Solutions / Government

Central Banks

Overview

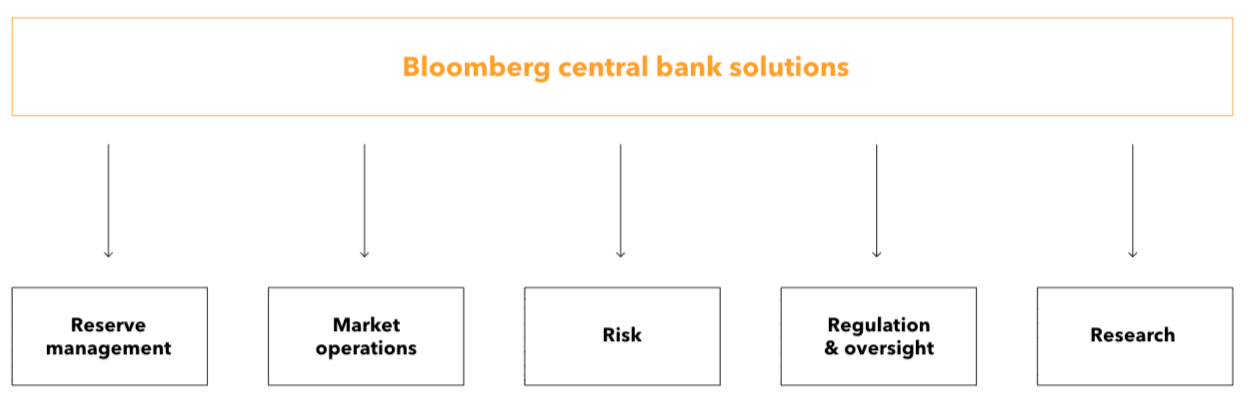

Central banks are playing an increasingly vital role in global economies, having implemented unprecedented monetary policy and been tasked with sustaining financial stability. As the role of central banks has evolved, so too has Bloomberg.

Long the go-to technology provider for reserve management, Bloomberg now offers an integrated end-to-end workflow solution that covers most central bank activities.

Bloomberg’s enterprise solution enable central banks to act quickly and decisively to conduct open market operations, control risk, oversee markets and manage foreign reserves. Our tools adapt to clients’ needs at the speed of the markets.

How we help our clients

Reserve management

Central banks have built up substantial reserves, making investment management more complex – especially for those banks moving into riskier assets. This has necessitated the use of adaptive, global, multi-asset solutions for portfolio management, trading, compliance and operations.

Bloomberg delivers just such a solution, combined with a complete suite of benchmarking, risk management and return attribution tools, including the ability to measure the liquidity in an individual position.

Market operations

Liquidity and market stability are paramount. Bloomberg helps seamlessly conduct domestic and international market operations from issuing debt to auctioning bills, repos and FX.

Bloomberg can streamline the debt issuance cycle from registration to auction to settlement. Bloomberg’s debt management system not only digitalizes internal processes, it provides real-time access at an individual or enterprise level to Bloomberg’s universe of market data.

Risk

Identifying risk is a vital part of central banking. From managing portfolio risk to evaluating systematic risk and mitigating operational risks, Bloomberg’s data and analytics can help.

Bloomberg provides supervision and surveillance tools, cutting-edge investigative functionality, advanced reporting and immutable storage for record-keeping requirements that keep pace with changing regulatory requirements, new communication platforms, and rapidly growing data volumes.

Regulation & oversight

Bloomberg helps central bankers fulfill their oversight and regulatory responsibilities, including monitoring FX, fixed income and OTC markets in real time, and efficiently and securely collect documents from outside firms to conduct KYC and AML due diligence.

Bloomberg offers a real-time, event-driven news feed.

Research

A steady research flow is critical to properly conducting monetary policy and understanding how markets react.

Along with a vast array of analytics and real-time data, Bloomberg provides the ability to publish research directly to market participants in the same way they digest sell-side research.

Tagged to the appropriate topics codes, publications feed alerts and become easily searchable across the global financial community via the Bloomberg Terminal.