This article was written by Hugo Rodriguez Bautista, Global Product Manager, Risk and Investment Analytics and Bradley Foster, Global Head of Content (Enterprise) at Bloomberg.

COVID-19 has introduced a new period of stress and uncertainty in global credit markets, unlike any other stress in recent times. In contrast, with the Global Financial Crisis, the market witnessed a slow deterioration of credit in the financial sector that eventually crept into other sectors. The current crisis introduced rapid and drastic credit quality concerns across many sectors. In just a matter of days, a relatively positive outlook for the transportation, retail, and energy sectors transformed into a series of red flags predicting a wave of defaults in the coming months. This rapid series of events affected not only credit ratings and defaults but also underlying investments.

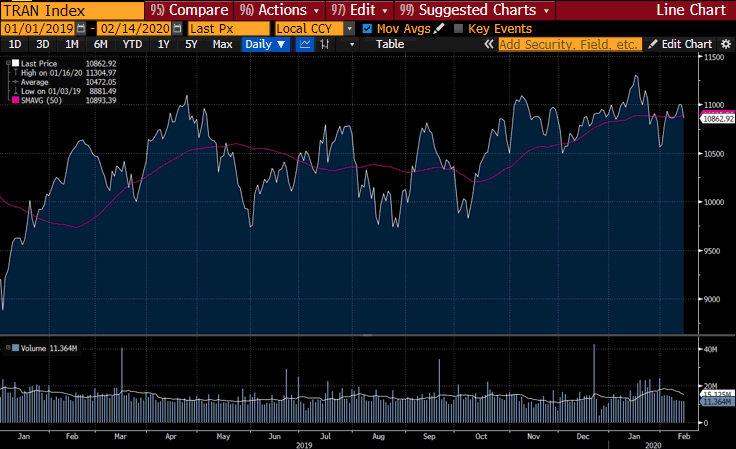

During the first few weeks of 2020, the transportation sector seemed like a safe place to invest, in fact, the airline industry was one of the strongest sectors with low implied volatility, few rating downgrades, and equity prices consistently trending upward (figure 1).

Then COVID-19 started to spread globally.

Figure 1: Dow Jones Transportation Average Index performance Jan 2019 – Feb 2020

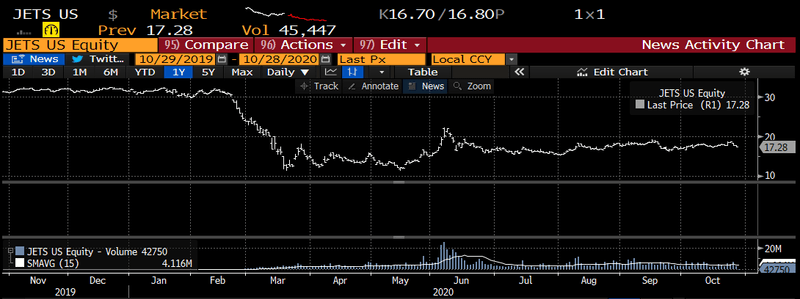

While company fundamentals and balance sheets in the airline industry did not change overnight, the market’s perception did. Traders experienced first-hand the vast move from offices to work from home along with a series of global travel bans, and they instantly understood the ramifications for the travel industry. Indicators such as fuel cost, and company financials/liabilities continued to paint a rosier picture of credit quality due to optimized balance sheets, and proper P/L ratios. However, bond prices quickly reacted to the widely reported drop in demand for global travel, which suggested a high level of stress and potential liquidity issues. This market data is extremely valuable because it can quickly quantify the market’s perception of creditworthiness long before a credit rating downgrade occurs. We leverage this data at Bloomberg to calculate a Market Implied Probability of Default (MIPD) that closely follows market-impacting events as they unfold to identify similar issues for a wide range of companies and sectors.

Figure 2: The performance of the US Global Jets ETF shows how bond pricing quickly reacted to the global pandemic. In some cases, the underlying market data predicted a rating downgrades up to 45 days prior to the credit event.

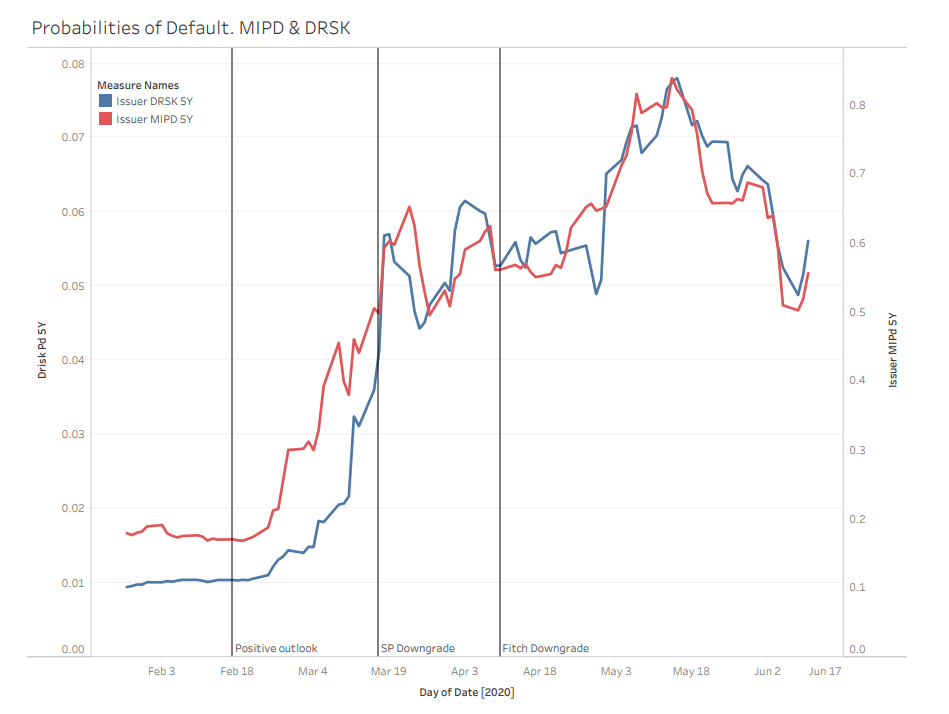

When analyzing the data historically, especially during high stress periods like March 2020, there is a consistent lag between market events and changes in credit ratings. For example, multiple rating agencies confirmed the credit rating and reassured a positive outlook for United Airlines in February shortly before the COVID-19 outbreak, but did not announce rating downgrades until late March, and in some cases early April when the risks were already well known. This represents a 30-45 day delay compared to metrics produced by MIPD (figure 3). While traditional credit ratings continue to play a major role in financial risk management, the global pandemic has highlighted the increasing need for market data-driven credit metrics to supplement ratings data, and provide a holistic approach to managing and forecasting credit risk.

In addition to MIPD, Bloomberg also calculates issuer-level default probabilities based on a combination of capital structure data, company financials, and equity pricing in a data solution called DRSK. The charts in figure 3 illustrate how MIPD, DRSK, and credit ratings reacted to the events of March 2020 for United Airlines. MIPD and DRSK both provided clear early warning indicators of the impending credit rating downgrades, as well as, related equity price changes. In a distressed and dislocated market, risk levels can change at a moment’s notice, therefore, it is essential to incorporate these types of market-driven credit risk metrics into your analysis to capture daily changes in market sentiment.

Figure 3: A comparison of the MIPD, DRSK and credit ratings for United Airlines during the market volatility triggered by COVID-19

However, this type of analysis is not just theoretical. Based on a survey of around 500 Bloomberg clients who attended proprietary events in 2020 , we found that there were a wide range of workflows where clients incorporated market implied creditworthiness indicators:

- Creating early signals by identifying mismatches between CDS, company fundamentals data, and implied data, discrepancies could suggest opportunities of investment

- Understanding how your portfolio or investments are positioned based on the current market conditions, by adding the implied probability of default to your metrics

- Enriching your default models, forecasted losses, and stress scenarios, by inputting the implied data into your models

- Creating a strong credit and counterparty risk management monitoring framework to set up limits around portfolios, with a higher return and a lower risk.

In general, a market implied probability of default can enhance traditional risk analysis that is based on a company’s fundamentals. In particular, these market implied metrics help proactively manage credit and counterparty risks, especially during a crisis where even one day can make a huge difference in terms of financial loss. Due to the lagging nature of traditional credit ratings based analysis, proactive management of exposures requires a market implied perspective.