Tilting it green: Treasury bond indices

This article study was written by Kate Onodi, EMEA Team Leader for Fixed Income Product Management at Bloomberg.

As the world becomes increasingly aware of the impact of climate change, there is a growing demand for investments that align with environmental sustainability. Green bonds are fixed-income securities designed to finance projects that have environmentally sustainable benefits, such as promoting renewable energy efficiency, sustainable agriculture, and other environmentally friendly initiatives.

In recent years, green bond issuance by government, corporate, and other issuers has grown significantly, with cumulative issuance surpassing $2.5 trillion globally. However, green bond issuance is still relatively small compared to issuance of non-green bonds. For example, the market value weight of green bonds is only 2.3% in the Bloomberg Euro Treasury 50bn Bond Index, despite the number of green bonds issued having grown nearly 3 times between December 2020 and May 2023.

Investors wanting to align their investments with their values and support the transition to a low-carbon economy may want to overweigh green bonds within a broader market, rather than choosing a standalone green bond index. This would provide a meaningful exposure to green bonds while retaining a larger and a more diversified index than one that contains only green bonds.

Overweighing of green bonds in a euro treasury index

With green bond issuance growing rapidly, but still being relatively small compared to overall debt issuance, investors can achieve a meaningful exposure to green bonds by overweighing those bonds within a broader benchmark index – e.g., overweighting green bonds to represent 30% of the Euro Treasury 50bn Bond Index’s market value rather than their natural weight of 2.3%. Changing this allocation, however, does introduce additional considerations.

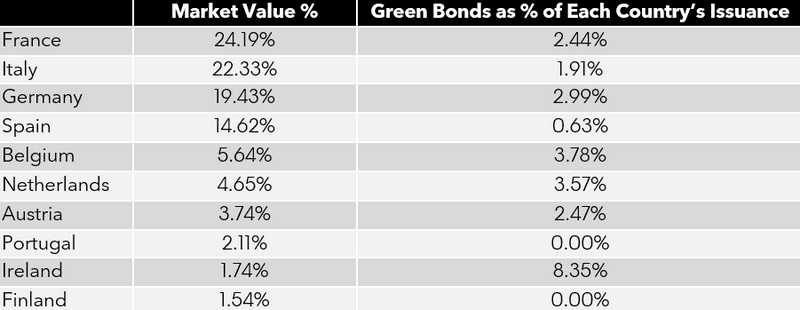

For example, as different countries issue green bonds in different proportions to their overall debt, a total 30% overweight in green bonds within an index can alter the country allocation mix. Some countries, such as Portugal and Finland, do not currently issue any green bonds, whereas other countries, such as Ireland, currently have more than 8% of their total debt issuance in green bonds. (Figure 1) These differences in green bond issuance patterns can lead to an increased allocation to countries that have a higher proportion of their debt in green bonds (e.g. Ireland, Belgium, Germany, etc), and a decreased allocation to countries with a lower proportion in green bonds (e.g. Portugal, Finland, Spain, Italy).

Figure 1: Weight of countries and proportion of their debt in green bonds in the Bloomberg euro treasury 50bn bond index

Similarly, an overweight of green bonds may affect other risk characteristics, like duration. Within the Euro Treasury 50bn Bond Index, the market-value weighted average duration of green bonds is approximately 12.0 years, whereas non-green bonds have a weighted average duration of 7.2 years. This would imply that an overweight in green bonds in this index from 2.3% to 30% would increase the overall index duration from 7.4 to 8.7 years.

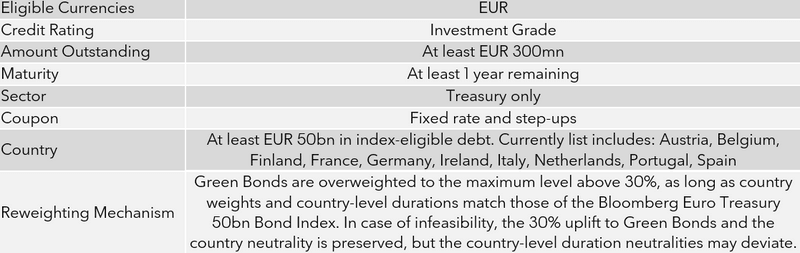

For an investor who prefers to avoid these changes from the broad benchmark, one approach is to introduce controls within the index methodology for these characteristics. The Bloomberg Euro Treasury Green Bond Tilted Index uplifts green bonds such that they are at least 30% market value weight of the index, while also maintaining the same country weights as the Bloomberg Euro Treasury 50bn Bond Index. In addition, the Bloomberg Euro Treasury Green Bond Tilted Index also aims to be duration-neutral on a country-level to the Euro Treasury 50bn Bond Index, as long as the minimum 30% green bond uplift is met. As such, this index not only seeks a meaningful allocation to the green bond market, but also controls for characteristics that may alter the index performance and risk characteristics compared to the broadly diversified Bloomberg Euro Treasury 50bn Bond Index. Figure 2 below summarizes the main index rules of the Bloomberg Euro Treasury Green Bond Tilted Index.

Figure 2: Main index features and rules of the Bloomberg euro treasury green bond tilted index

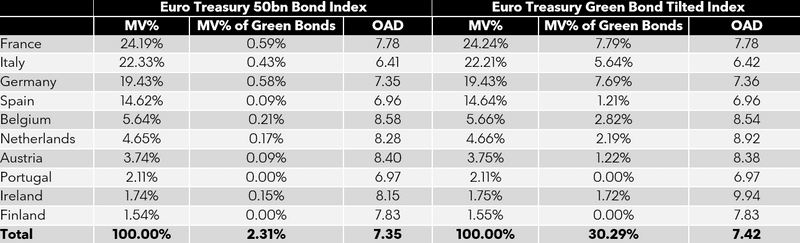

Figures 3 below compares the country weights, percentage of green bonds issued by each country, and country-level durations between the Euro Treasury 50bn Bond Index and the Euro Treasury Green Bond Tilted Index as of May 31, 2023. From this table we can see that country weights are very similar, green bonds get uplifted from 2.31% to 30.29% in the Euro Treasury Green Bond Tilted Index, and OAD is very similar overall but does diverge for Netherlands and Ireland. This is because the green bonds of both of these countries are quite large and have longer durations, whereas all of their non-green bonds are much smaller and have much shorter durations, limiting the ability to neutralize the increase in duration from the green bond uplift with non-green bonds.

Figure 3: Country-level weight of all index-eligible and green bonds and duration in Euro Treasury 50bn and Euro Treasury Green Bond Tilted Indices as of May 31, 2023

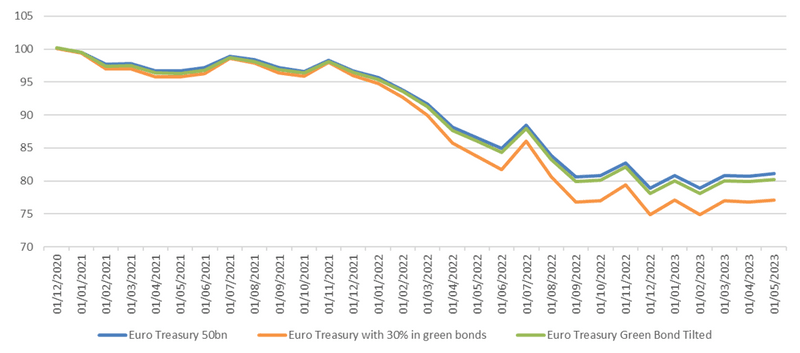

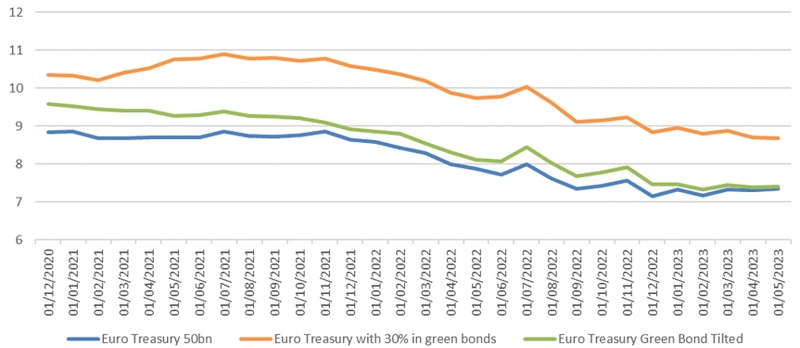

Figures 4 and 5 below show the cumulative performance as well as the option-adjusted duration for the Bloomberg Euro Treasury Green Bond Tilted Index (in green), compared to both the Euro Treasury 50bn Bond Index (in blue), as well as to an index that allocates 30% to green bonds without controlling for country and duration exposures (in orange).

Figure 4: Cumulative returns comparison

Figure 5: Option-adjusted duration comparison

From these figures, we can see that the Bloomberg Euro Treasury Green Bond Tilted Index tracks the Bloomberg Euro Treasury 50bn Bond Index much closer, both in terms of duration and returns, compared to the Euro Treasury index which has a 30% overweight in green bonds but doesn’t control for country and duration characteristics. Hence, investors seeking a similar performance and risk exposures as the Euro Treasury 50bn Bond Index, but wishing to overweight green bonds, may find that the Bloomberg Euro Treasury Green Bond Tilted Index is closer aligned with their objectives.

Investment in green bonds is a way for investors to align their investments with additional climate and environmental objectives. Further, increasing investment in green bonds can help to promote sustainable investing more broadly by signaling to companies and governments that there is a demand for these bonds, which can encourage more issuance. Indices, such as the Bloomberg Euro Treasury Green Bond Tilted Index, showcase how investors can increase their allocations to the rapidly growing green bond segment, while keeping risk exposures and performance characteristics in line with that of the broader market.

Visit I<GO> on the Terminal or browse our website to find out more about Bloomberg’s indices and request a consultation with an index specialist.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.