This article originally appeared on the Bloomberg Professional Service.

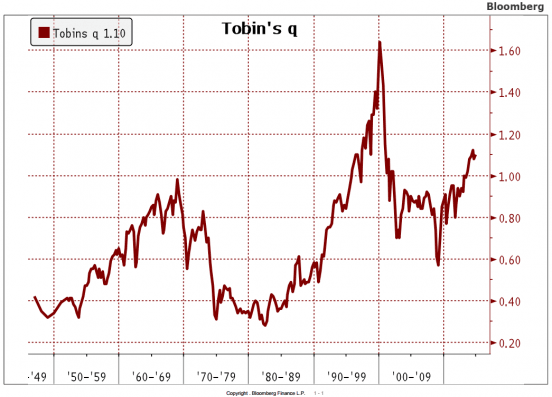

During the fourth quarter of 2014 — the most recently available data — the ratio of non-farm non-financial corporate business equities to business net worth (market value) was 1.10, essentially the same as the revised 1.08 registered during the third quarter of 2014.

This implies that the stock market is overvalued with respect to the value of assets of the underlying issuers. Since 1946, the average quarterly estimate of Tobin’s q has been roughly 0.71.

The Tobin q compares the total value of the prices of stocks with the cost of replacing the underlying assets of those same stocks, or corporate net worth. It is argued that when the stock market trades at a discount to the replacement cost of its assets, the market is relatively inexpensive.

Conversely, when the market trades at a premium to its replacement cost, it is considered expensive. When the ratio is 1.0, the stock market is valued the same as the asset’s value.