Private Wealth Management

Foresight. Insight. Oversight.

The complete perspective for modern private wealth

Where it all comes together

Managing wealth often means navigating complexity across portfolios, insights, and tools. Bloomberg brings it all into one suite of solutions. Data, news, analytics, execution — connected seamlessly — so you see the full picture, act faster, and advise with confidence.

Market intelligence

Harness intelligence that spans the full spectrum of asset classes and information sources.

Advisory confidence

Empower your teams to shape sophisticated data-driven conversations that set you apart.

Portfolio mastery

Turn portfolio complexity into clarity with comprehensive insight across every holding.

Workflow integration

Create workflows where everything connects naturally, so you can focus on value creation.

Explore our solutions

Elevate decision-making with deep insight

Bloomberg transforms fragmented data into coherent views and connected insights. Harness the full spectrum of market intelligence through complete integration across asset classes and information sources, with private and real-time public data, macro signals, proprietary news and more.

- 100B+ data points published daily across 70M+ instruments

- 8,000+ integrated datasets and 40,000 data fields

- 55,000 indices calculated daily covering 99% of global market cap

- 350+ research professionals supporting client insight

How we help our clients

Stand out with truly differentiated advisory

Shape sophisticated conversations with speed and confidence. Translate complexity into clear, actionable perspectives derived from data that spans asset classes and public and private markets. Design, price and manage strategies with transparency and precision, with structured product solutions that support the full investment lifecycle.

How we help our clients

Sharpen your perspective across portfolios

Turn complexity into clarity with comprehensive portfolio oversight that spans every holding. With Bloomberg, you have access to powerful portfolio analytics tools that support performance attribution, scenario modeling and risk management — all in one place.

How we help our clients

Unify workflows for greater efficiency

Strengthen established processes by uniting proprietary data, spreadsheets and external systems with Bloomberg, creating workflows where everything connects naturally — from analysis to execution — so your teams can focus on value creation and strategy.

How we help our clients

Featured insights

Article

The integration gap: Can your tech keep up with Asia’s private wealth boom?

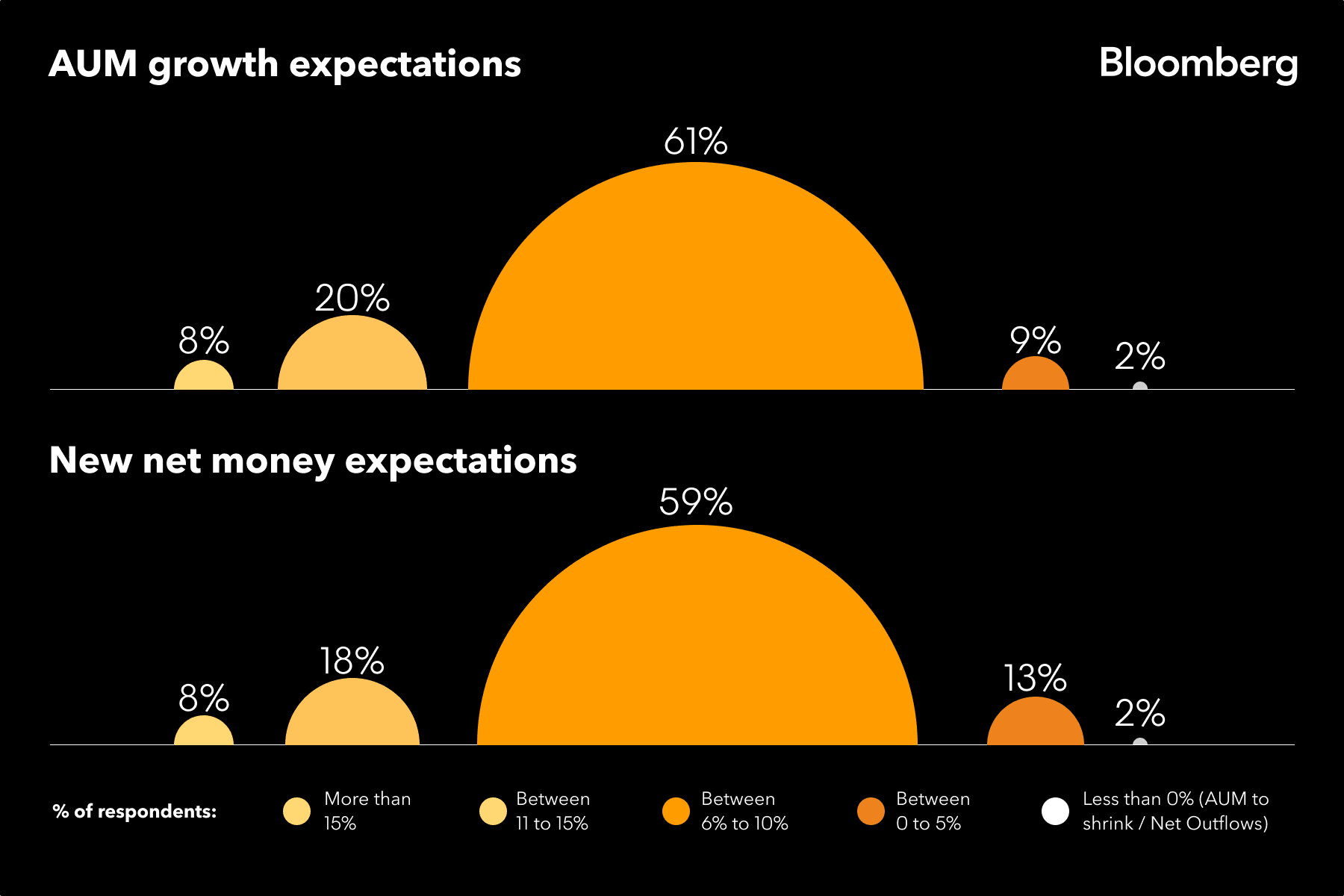

The 2025 Asia Private Wealth Survey results reveal an unambiguously bullish outlook. 61% of respondents expect AUM to grow 6–10% annually, while 85% expect net new money to rise 6% or more each year. Despite the massive growth opportunity ahead, most private banks and family offices aren’t structurally ready to capture it — only 23% of surveyed firms say they are fully integrated across front, middle and back offices.

Article

Building the next APAC portfolio

Asia’s private-wealth allocators are shifting their mix as risk appetite rises. Half of the respondents say client risk appetite is higher than a year ago, and over two-thirds plan to increase allocations to equities, private equity and digital assets over the next 12 months. Discover how portfolio managers can keep up with a fast-changing, cross-asset landscape using integrated data and analytics.

Community in Action

At Bloomberg, we bring the private wealth community together — through data and insights, and through shared values and meaningful experiences. From exclusive events to corporate philanthropy, stay informed, inspired, and plugged into a global network of peers, ideas and opportunities.