Solutions / Banks and Broker Dealers

Community Banks & Credit Unions

Make better decisions with critical market data

Bloomberg helps community banks and credit unions ensure they are investing in quality bonds at optimal prices with the highest return for a particular asset class.

Understand the forces behind market moves and potential risk exposure

We provide the news, data and analytics you need for pricing transparency, risk assessment and regulatory compliance.

Access application specialists

The Bloomberg analytics team is available 24/7 to help you access data and navigate analytical tools on the Bloomberg Terminal.

See what the rest of the market sees

Price transparency into market activity can help you better assess broker pricing for best execution and cost savings. Bloomberg users can make independent pricing assessments and see what other brokers offer with our suite of pricing tools.

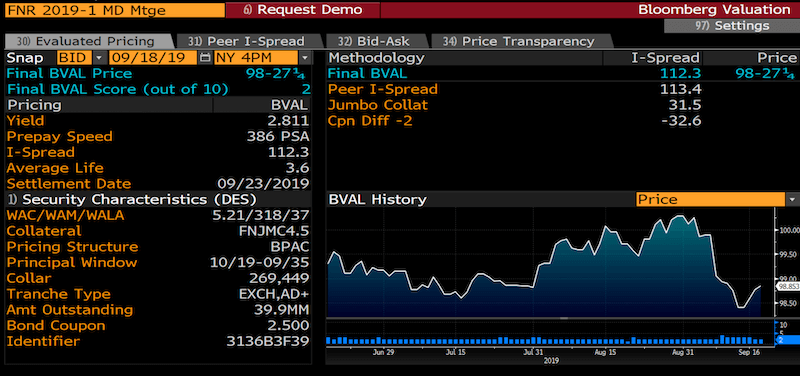

Fixed income price transparency

Bloomberg’s Evaluated Pricing Service (BVAL) provides transparent and highly defensible prices across the liquidity spectrum for a variety of fixed-income securities including government, supranational, agency and corporate (GSAC) sector bonds, mortgage backed securities, municipal bonds and over-the-counter derivatives.

The key to BVAL’s methodology is its real-time access to market observations from a wealth of contributed sources. BVAL assigns a score based on the amount and consistency of market data used in our models.

Pre-trade analysis and market & risk analytics

Making effective trading decisions requires having information before the trade

Tap into our comprehensive macroeconomic research and data that includes previews of major data releases and economic events, thematic insights and medium-term forecasts. Leverage the Terminal to monitor global rates markets, better understand regulations and analyze potential impacts on your firm.

Assess market conditions under different scenarios to position your trades

Easily find hidden risk before you trade, via detailed security description pages for an MBS deal and collateral composition data to understand the underlying collateral for mortgage, CLO and asset-backed securities. Capturing pre-trade data helps to ensure proper due diligence on investments to satisfy internal and external risk controls.

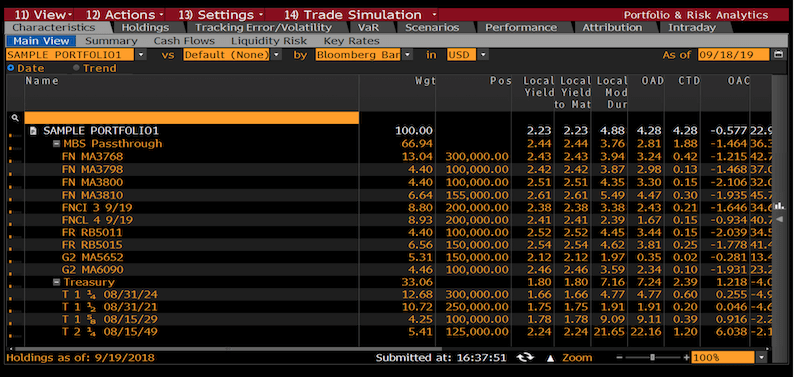

Portfolio management

Aggregate total portfolio risk, performance and characteristics to validate your portfolio decisions and satisfy regulatory compliance. Bloomberg’s Portfolio & Risk Analytics — PORT on the Bloomberg Terminal — provides a complete suite of pre-trade, execution and post-trade analytics for full portfolio analysis. See key rate risk across the yield curve and enhance the risk management, collateral surveillance, scenario analysis and portfolio reporting workflows and ensure your internal procedures are compliant.

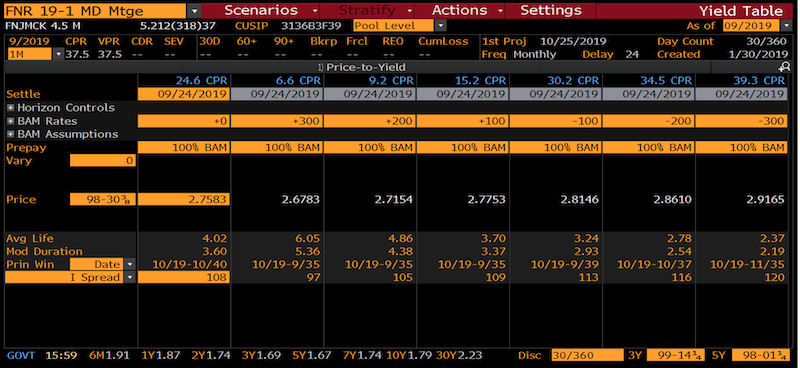

Access a collection of risk assessment tools to help analyze exposure in your portfolios. The Super Yield Table — SYT on the Bloomberg Terminal — provides a security’s yield and average life profile across a range of interest rate scenarios.

Our well-known Bloomberg Agency MBS Prepayment Model (BAM) provides a consistent framework when viewing the risk profile of a mortgage security. BAM helps investors ensure that MBS securities perform as expected, as well as raising red flags for securities that might be too volatile.

Hedge accounting

Bloomberg also provides verified SOC compliant hedge accounting tools that allow for in-house hedge effectiveness and decrease reliability on external sources.