Multi-Asset Class Factor Risk Modeling (MAC3)

Redefining risk modeling for a new era of investing

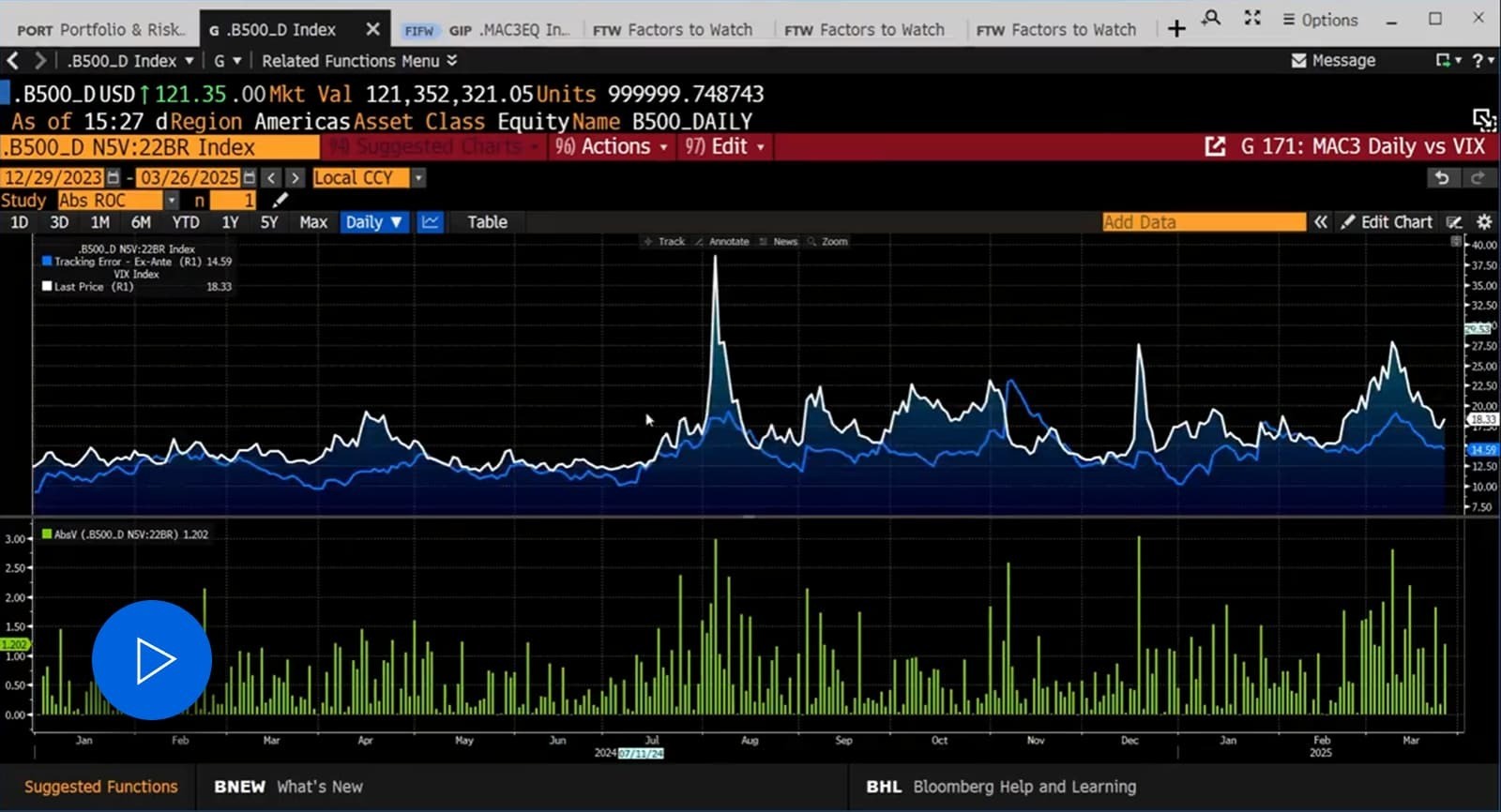

Powered by advanced factor research and daily refreshed data, Bloomberg’s MAC3 Risk Model transforms how investors see and manage risk in a multi-asset world.

Bloomberg MAC3 gives investors a unified and transparent view of portfolio risk across equities, fixed income, commodities and alternative assets. Built on Bloomberg’s unparalleled market data, analytics and factor research, it enables investors to measure, decompose and forecast risk across multiple dimensions, as well as to construct and optimize portfolios with a consistent, data-driven framework for achieving the best risk-adjusted outcomes.

Uncover the sources of portfolio risk

Expose the drivers of systematic risk across equity, fixed income and multi-asset portfolios.

Identify unintended risk bets

Detect unintended exposures to style, industry, and country factors before they impact portfolio performance.

Construct efficient portfolios

Build more resilient portfolios by revealing how risk and return interact across asset classes.

MAC3’s advantages

Smarter factor design

Country and industry betas replace dummy variables for deeper, more accurate risk insight.

Sharper signal quality

Inverse residual variance (IRV) regression weighting reduces noise and improves precision of factor returns estimates.

Term structure of risk

Six expanded model horizons allow users to align risk forecasting with the prediction horizon.

True risk separation

Finite Sample Adjustment (FSA) isolates factor risk and prevents double counting of idiosyncratic risk.

Adaptive volatility

Cross-sectional volatility adjustment (CSV) responds dynamically to market shifts.

Stable correlations

PCA shrinkage delivers robust, reliable correlation matrices for portfolio optimization.

Applying MAC3 to your workflow

Use Bloomberg’s MAC3 risk models to uncover factor-driven opportunities that enhance systematic strategies and strengthen alpha generation.

Use Bloomberg’s integrated optimization framework to design portfolios that align exposures, balance risk and target superior risk-adjusted returns.

Gain a deeper understanding of key portfolio risk drivers using Bloomberg’s MAC3 multi-asset risk factor framework, which decomposes risk into asset-class specific factors (such as style, industry, curve, and spread) for highly informed decision-making.

Spot hidden exposures and unintended concentrations early using Bloomberg’s transparent factor-based analytics.

Assess how your portfolio performs under shifting market conditions and design targeted hedges using Bloomberg’s multi-asset factor framework.

Access 3,000+ factors across asset classes

KEY STATS

Equity factors

Fixed income factors

Commodity factors

Private equity factors

Currency factors

Insights across every major asset class

Gain actionable insights and analytics across all major asset classes to help you understand and manage risk.

Equities

Global coverage across developed and emerging markets with country and regional models and detailed style factors.

Fixed Income

Sovereign, corporate and securitized exposures with advanced term structure and spread analytics, including coverage for inflation-linked bonds, municipal bonds and leveraged loans.

Commodities

Constant maturity curves and volatility-aware factor structures.

Alternatives

Private equity, funds and hedge funds integrated within one consistent framework.

Explore our risk solutions

MAC3 RISK MODEL FILES

Access and act on the data behind the model

Bloomberg’s MAC3 Risk Model Files service provides access to the model data in a machine-readable format to empower quantitative processes such as factor decomposition, backtesting investment strategies and portfolio construction.

Gain additional insight with Risk Model Files data in CSV format or via API:

- Variance Co-Variance (VCV) Matrix

- Risk Factor Exposures

- Factor Returns

Factor returns shown in the API Factor Explorer Dashboard

Jose Menchero, Head of Portfolio Analytics Research, Bloomberg

FEATURED WEBINAR

Factor Misalignment and Portfolio Construction

This focused session discusses factor misalignment in portfolios construction, specifically around how it occurs when mean-variance optimization is performed on an alpha factor that is not contained within the set of risk model factors.

Speaker: Jose Menchero, Head of Portfolio Analytics Research, Bloomberg.