Economics

Stay ahead of markets with expert economic analysis and leading-edge tools

Bloomberg offers the most reliable and timely information, empowering informed decisions in an ever-changing economic landscape.

The Bloomberg Terminal and our data solutions deliver real-time, market-moving data, comprehensive research and interactive tools.

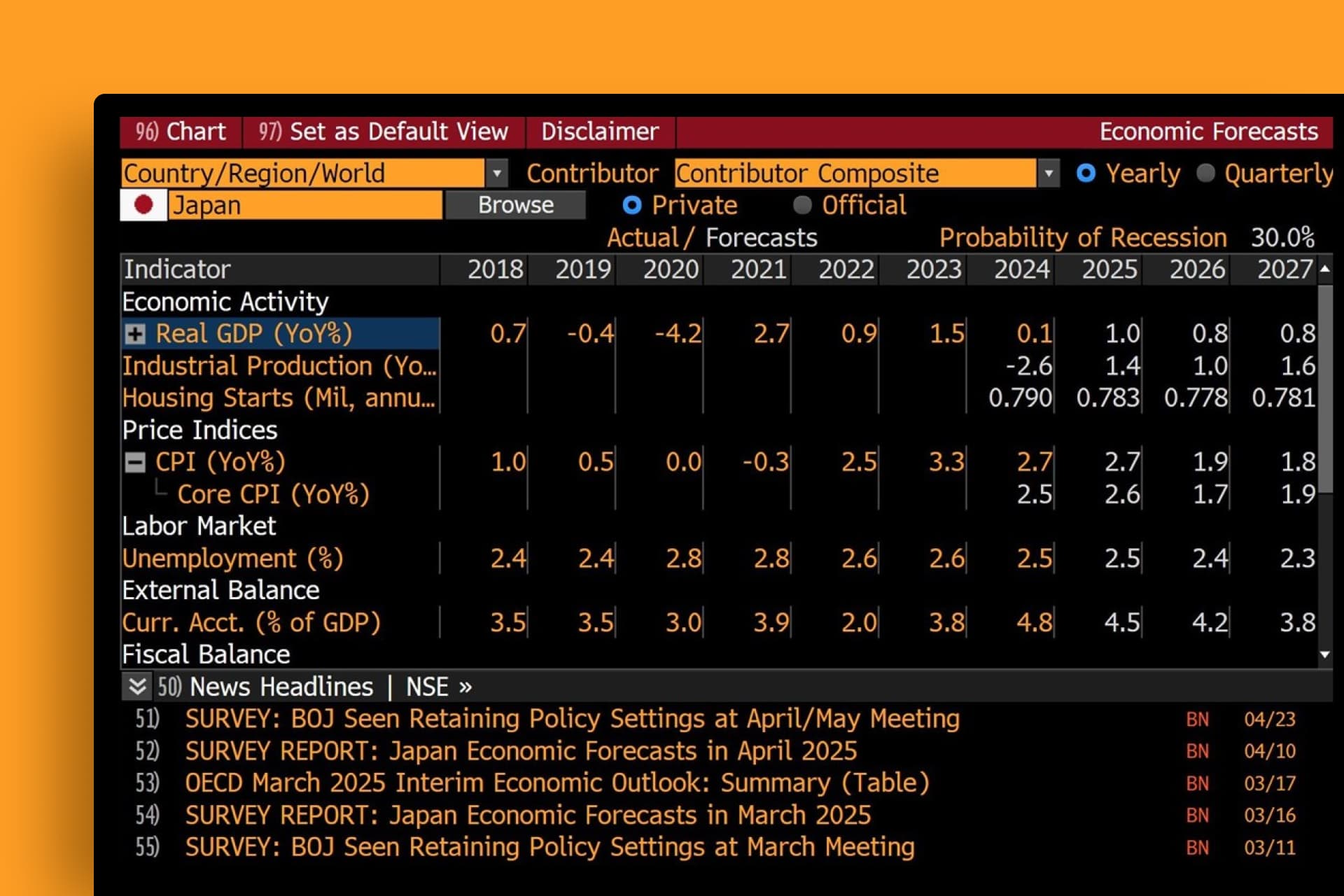

Best-in-class forecasts and analytical tools

Access robust economic forecasts for both upcoming and long-term releases. Our analytical tools enable you to estimate future trends, compare regional forecasts and identify global economic patterns with data from both private sector economists and official institutions like central banks and the IMF.

Real-time delivery of market-moving economic data

Instantly access critical information from over 1.5M time series, including a vast series of 4,000+ tickers spanning 120+ countries, ensuring you make timely and informed decisions in dynamic financial markets.

Comprehensive news and research content

Bloomberg News and third-party sources like the Wall Street Journal track developments across major economies, drawing on data from 1000+ sources. With more than 50 economists and analysts, Bloomberg Economics offers in-depth research on data releases, policy and global market events, with specialized teams covering trade, geoeconomics and macro modeling.

Explore our innovative product features

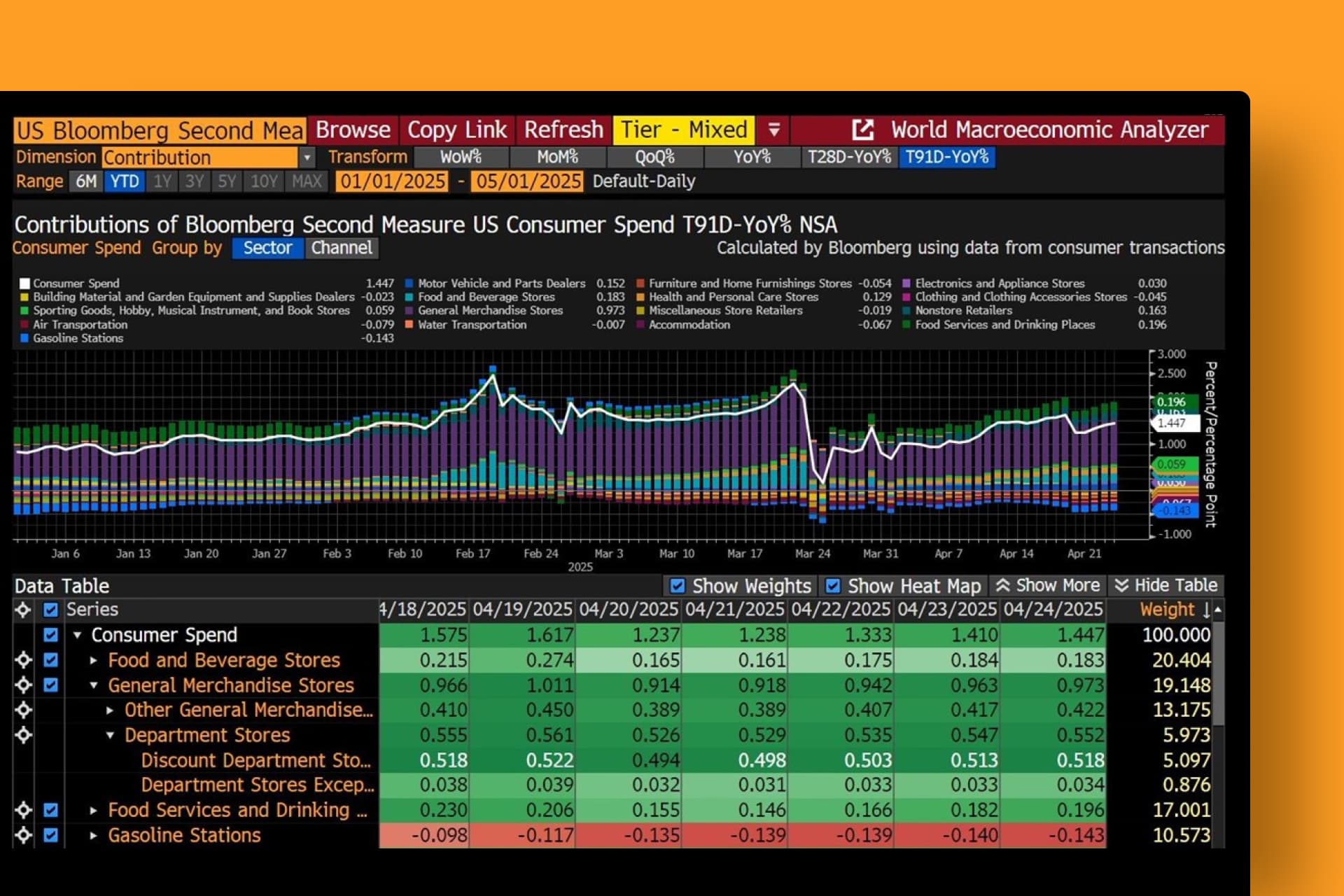

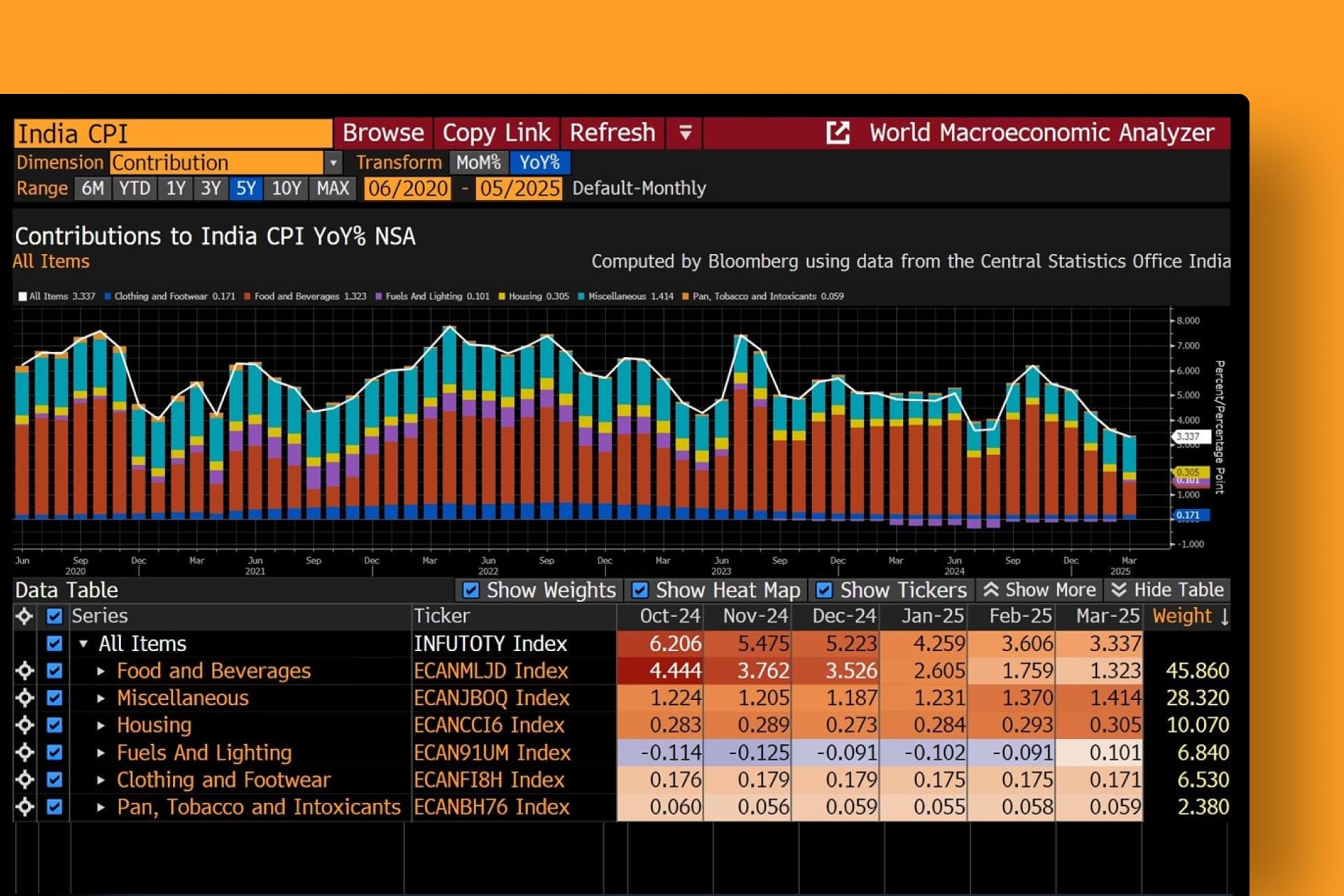

Interactive economic analyzers

Flexible tools provide access to vast amounts of current and historical data for major economic reports broken down by contributions. You can pinpoint the factors driving current and historical values, and analyze market reactions to data releases, a sector’s real-time estimates, and both actual and historical surprise release details.

Research powered by Bloomberg Economics’ analysts and models

Make informed decisions with previews, reacts, insights, short- to long-term forecasts and proprietary indicators from Bloomberg Economics. Or go deeper by exploring the interactive models behind our research, from our NLP tracker of Fed sentiment to tools for analyzing trade flows and economic shocks.

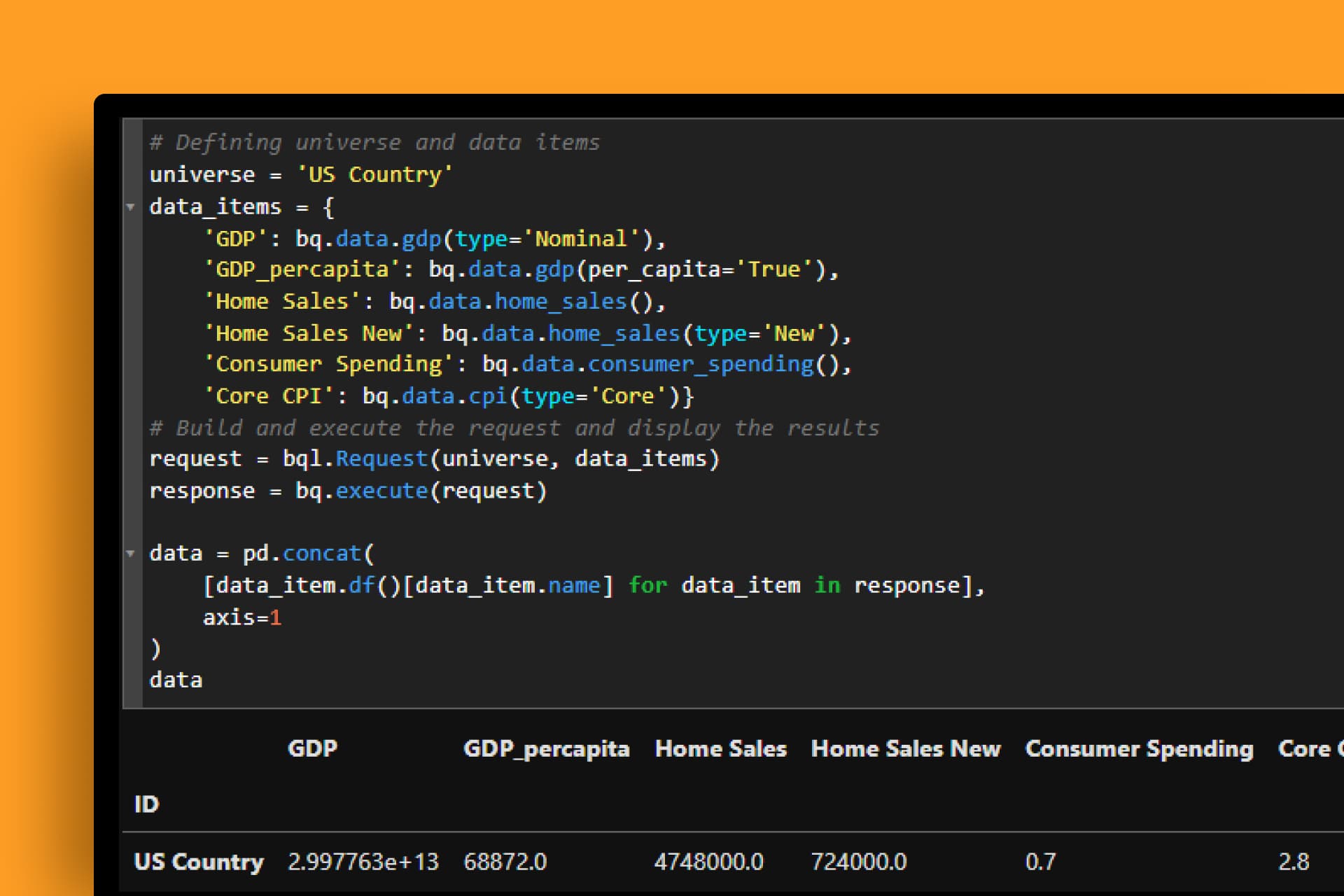

Programmatic access

Keep an eye out for market surprises by using a simple Bloomberg Query Language (BQL) formula to easily and dynamically retrieve data time series metadata in your Microsoft® Excel spreadsheet, or through BQuant. There, you can further refine the formula or incorporate it into your own custom analytics.

Advanced access to University of Michigan data

Access more than 12,500 time series from the University of Michigan. The underlying granular data is published on the Bloomberg Terminal before anywhere else.