Given the evolving inflation outlook and an active Federal Reserve Bank, most expect rate markets to remain volatile over the next 12 to 18 months. Understanding forward interest rates and changing market expectations is critical for managing interest rate exposure and forecasting expenses. With access to the right data and analytical tools, treasurers and risk managers can make more informed decisions.

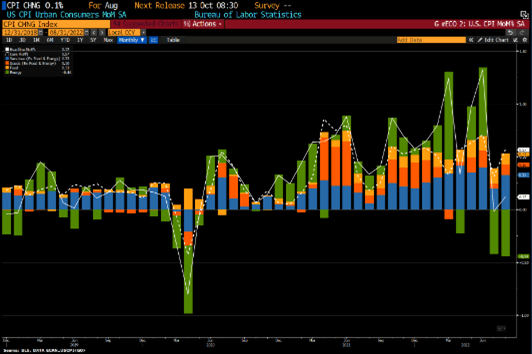

The August release of U.S. core inflation of +0.57% (MoM SA) surprised to the upside. Despite a significant monthly drop in energy prices, inflationary pressure is building in core goods and services. The shelter sub-component of the core rate was up 0.69%, which contributed 0.22% to the month over month increase.

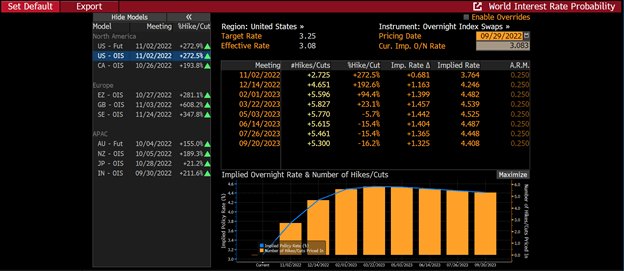

Based on the recent inflation data, the Fed tightened by 75 bps on September 14th and the market is now pricing a good chance of an additional 75 bp hike in early November. Implied forward rates derived from quoted swap markets suggest a terminal Fed funds rate of 4.54% by March 2023.

Terminal® users can track implied rates corresponding to Fed meeting dates by typing WIRP <GO>.

The significant upward movement in rates this past year and uncertainty around Fed policy presents challenges for corporate profitability and forecasting interest expense. Additionally, the migration from Libor to the ARRC chosen successor rate of SOFR has added operational complexity that treasury departments need to address over the next 6 to 9 months.

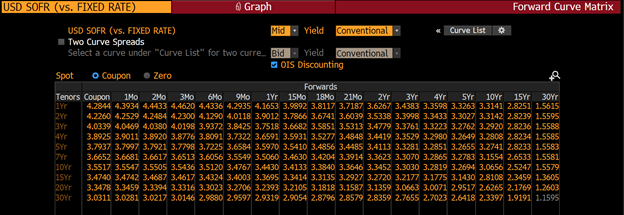

To help corporations forecast interest expense, Bloomberg models forward rates by bootstrapping quoted interest rate swaps. These modeled forward projections are available by typing FWCV <GO> on the Terminal. This tool will support calculations for Libor rates and all of the new risk-free rates globally. In the upper left box, users can type SOFR <GO> and toggle to the “Implied Forwards” tab. The “spot” column is derived annualized zero rates and the “projection” column is modeled forward rates. In the case of SOFR and other overnight risk-free rates, the projected rates represent the annualized daily compounded overnight rate for the chosen tenor.

For clients forecasting CME term SOFR rates, the standard SOFR swap curve (S490) should provide a very close projection. CME term fixings are derived from executed transactions in futures contracts indexed to the published daily SOFR rate. And unlike LIBOR projections, no separate swap curves are needed to project rates for different tenors. All payment tenors and CME term fixings represent the compounded overnight rate for the accrual period.

A parallel function to FWCV <GO>, FWCM <GO> presents derived medium-term swap rate levels rather than forward rate projections for short tenors. Corporate treasurers can utilize FWCM to monitor forward SOFR interest rate swaps for both hedging and issuance requirements. In the image below, the SOFR swap curve is displayed in columns, and each column represents a forward point in time (1Mo, 2Mo, 3Mo, etc.). Given the current inverted SOFR swap yield curve, a 6m forward-10y swap rate was actually 4 bps lower than the quoted 10y swap in the image from September 14, 2022.