A new spotlight on FX “fixings”

This article was written by Michael Briody, Corporate Treasury Markets Specialist at Bloomberg.

The FX fixing rate is the precise currency rate at a very specific time of day. The currency and time are agreed upon between price maker and taker prior to a trade. Once that time hits, the trade is executed wherever the currency pair is trading. The traditional benefit of trading with an FX fixing rate is complete price transparency.

Several years ago, however, the 4pm London FX fixing was discovered to be being subject to price manipulation by market makers — resulting in unnecessary volatility and sudden price spikes at that precise time of the day. Since then, new codes of conduct for the FX markets have been suggested and followed by market participants, which has decreased the wild price swings at this particular fixing time.

To keep the markets running smoothly, market surveillance companies are once again flagging the same type of price action at the same 4pm London fixing time. The exact reason why this is happening again is unknown, but many believe that computer-driven hedge funds could be responsible for this pattern of activity.

Does this new data suggest institutions should not trade using fixings? Absolutely not. In fact, it can still be quite beneficial for corporations to trade with fixings, especially at a time when many institutions are trading remotely.

For corporations and other institutions that need to execute currency trades, tight market pricing and low volatility represent an environment where they can trade comfortably and fairly. In times like these; with potentially unnecessary market volatility, a practice many corporate treasurers can use to ensure consistent spreads with no price slippage is to execute at “fixing times” other than the London 4pm rate.

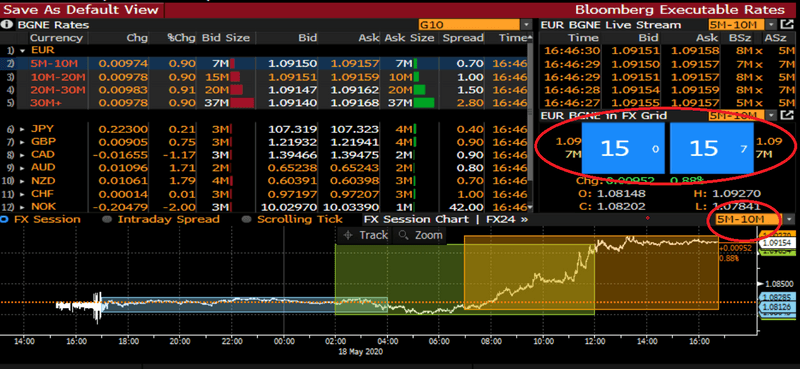

In these times filled with technology and fast price action, tools and data are available to help navigate the best FX prices and the times of day offering optimal liquidity for trade execution.

Analytics can help treasurers or traders see when the largest number of banks are providing foreign exchange prices. This helps formulate when the deepest amount of liquidity is available and, in turn, would offer the tightest spread between bid-offer pricing.

An example of these analytics can be seen in the graph below, which indicates that in USD/JPY there is a lack of pricing at 5pm ET, suggesting wider spreads at this time. This type of data can indicate to institutions that they should avoid execution at that time of day.

Although FX fixings are making headlines once again, this is still a potential beneficial option for corporations and others to trade currencies, since it allows them to easily go back to see historically where a currency was trading at the top or bottom of every hour — thus offering complete transparency to any internal process or outside auditor.

To learn more about some of these tools and best practices, sign up to speak with a Bloomberg treasury workflow specialist.