This analysis is by Bloomberg Intelligence Director of ESG Research EMEA & APAC Adeline Diab and Bloomberg Intelligence ESG Analyst Rahul Mahtani. It appeared first on the Bloomberg Terminal.

After the recent tumult in reclassification that stripped Europe’s top ESG designation from many funds, our analysis identifies two distinct characteristics of the darling holdings among the largest Article 9 funds we track. The stocks most broadly owned by 191 of such funds with over $500 million in assets under management — including Vestas, Schneider and ASML — are generally larger and showcase strong fundamentals and attractive valuations. And the stocks with more than 5% of their market cap held by these funds — including Signify Lighting and Sunnova — are much smaller and face both greater performance risks and weaker quality.

The new BI SFDR Barometer dataset covers 23,000 funds worth $11 trillion under the EU’s Sustainable Finance Disclosure Regulation.

SFDR reclassification tumult to intensify amid the EU revision

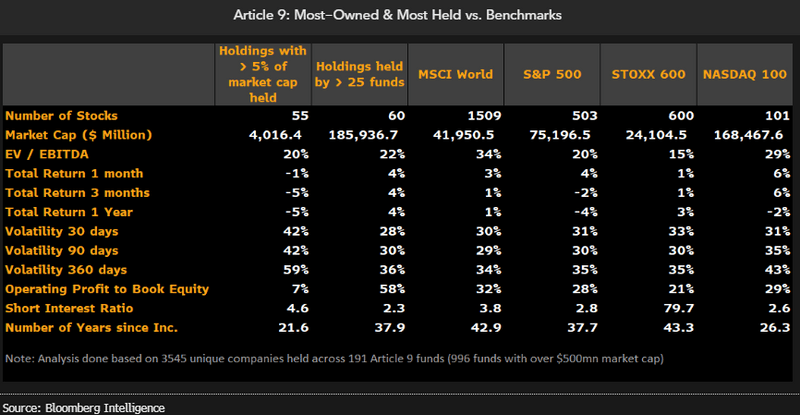

Companies found in the largest number of Article 9 funds are well positioned to capture investor attention. They are larger and higher quality — with 58% profitability exceeding the MSCI World and S&P 500 averages by 25-30%. Their volatility and valuations are comparable to the benchmarks, enhancing the appeal. In contrast, the most-held companies in terms of market cap show a small-cap bias. They appear more risky with higher short interest, weaker profitability and increased volatility and lower returns vs. the benchmarks.

METHODOLOGY: The BI SFDR Barometer covers 23,000 funds worth $11 trillion. Our Article 9 analysis considers: 3,545 unique holdings across 191 funds with over $500 million in market cap; the most-owned companies (owned by more than 25 funds); and the most-held stocks (more than 5% of their market cap).

Most-owned by article 9 funds: Attractive features

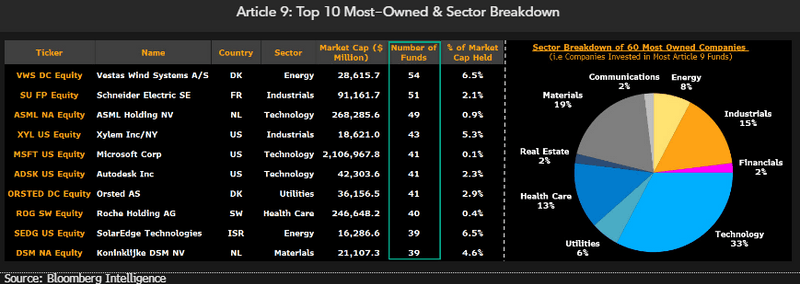

Vestas and Schneider are the most-owned companies across Article 9 funds, included in more than 50 funds and attesting to their green credentials in wind power and energy management. They also stand out compared to the 60 companies held among those funds, which are mostly in the technology (28%), materials (17%) and industrials (13%) sectors. The dominance of technology may be more linked to strong quality metrics than environmental activities, as ASML, Microsoft and Autodesk show 45-86% return on equity. From a geographical perspective, the US makes up half of the most-owned, followed by France (10%) and Denmark (8%).

The 60 most-owned companies are in more than 25% of Article 9 funds we track (191 funds with over $500 million market cap). Among the 3,545 unique holdings, most appear in three or fewer funds.

Most-held by article 9 Funds: Smaller and mighty volatile

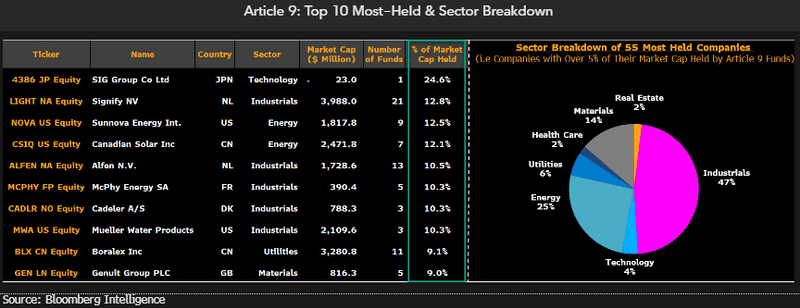

The 55 most-held companies have 5% or more of their market cap held in Article 9 funds. With such levels of concentration, they tend to be smaller and more volatile than global benchmarks. Their average market cap of $4 billion is just 5% vs. $75 billion for the S&P 500, while their 60% annual volatility is 70% higher than the index. Industrials represent 44% of the companies with Signify lighting solutions, Alfen energy equipment, as well as Cadeler and Mueller in water transportation and infrastructure. Energy and materials account for 24% and 13%, respectively, of the most-held companies with solar players like Sunnova and Canadian Solar, as well as Genuit Group, which provides water, climate and ventilation solutions.

The US, France and the UK make up 35%, 16% and 9% of the most-held companies, respectively.

SFDR: What are articles 6, 8 and 9?

SFDR provides a standardized approach to ESG Fund disclosure as part of the EU Sustainable Finance package.

Article 9 comprises EU “dark green” funds with sustainable investment as a core-measurable objective. Article 8 is for “light green” funds taking account of sustainable characteristics along with non-ESG traits — though such a strategy doesn’t pursue sustainability as its core objective, it’s part of the investment process. Article 6 funds don’t have an ESG focus, yet those offering them may still elect to publish a Principle Adverse Impact Statement capturing their carbon footprint and adherence to global ESG standards.