No matter what your investment strategy is, assessing available liquidity and trading feasibility are essential tasks. The challenge is that liquidity, or expected volume, is usually affected by a variety of factors.

Various volume figures exist in the market, including:

- Historical daily volume

- Intra-day historical volume

- Historical daily volume at special days

- Today’s volume ‘at time’ (from the market open until a certain point in time)

- Today’s volume by time bins (1-5-10 minutes).

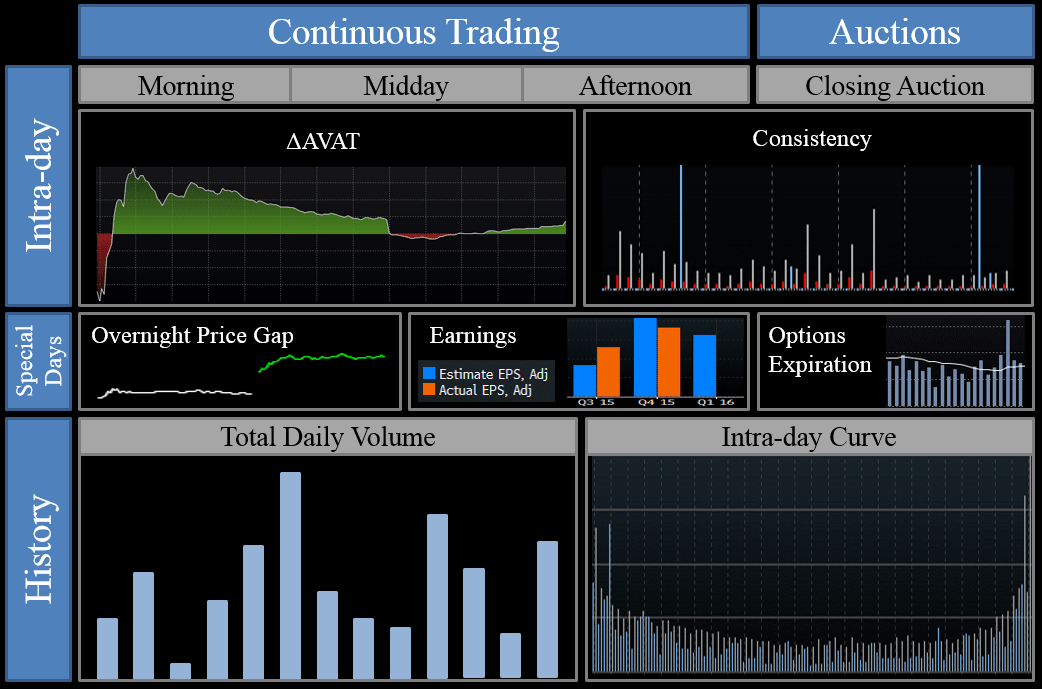

It is necessary to understand these market volume figures in order to estimate today’s remaining daily volume. With that in mind, below is a framework that attempts to capture the main factors and present them in a structured manner. One of the truisms of this framework is that it is better to underestimate expected volume than overestimate it (within reason, of course).

From left to right, this framework represents a trading day as a progression from morning through midday to the afternoon, while delineating closing auction separately. Research shows that auction dynamics could be different from the intra-day trading volume; this is true for open and mid-day auctions as well. We are showing only closing auctions to emphasize that it is the most important, in the sense that if you overestimate it, part of your order might be exposed to overnight risk. For the intra-day auctions, there is a chance to catch up on the missing volume later in the day.

From the bottom up, the framework looks at historical volume figures, overlaid with special-day information and topped with today’s intra-day volume observations.

History

It is not enough to simply take an average of the daily volumes over a certain number of recent days or months; it’s also important to consider how consistent these volume figures have been. More consistency results in higher predictability, and thus a higher estimate. (Please refer to the aforementioned principal of avoiding overestimation.)

Another aspect of historical volumes is an intra-day curve, which helps to assess volume distribution throughout the day.

Special Days

Over the historical averages layer, we add special days to take into account earnings days, options expirations and also unexpected events that result in an overnight gap well above normal overnight stock volatility. It is worth noting that special days might have different effects on various parts of the day. For instance, options expirations have a much stronger effect on the closing auction in comparison to the rest of the trading day.

The combination of historical figures and special days result in a stable base for the daily volume estimate before the market open.

Intra-Day

We start the daily volume estimate described above and incorporate today’s volume observations as the day progresses. As soon as the market opens, we observe today’s volume behavior and compare it with historical observations in similar time bins (e.g. every 5 or 10 minutes). If today’s observations are consistently pointing to the same volume (e.g. +20%), we will start believing today’s volume much more quickly and will subsequently give it a much higher weight in predicting remaining daily volume versus historical observations. If today’s figures are inconsistent (e.g. one bin is -50% versus history and the next one is +100%), we would consequently lean more heavily on historical predictions and less on today’s observations.

Closing auctions are more dependent on cumulative volume behavior through the day and less dependent on the consistency of bin-by-bin observations.

The volume estimation framework presented here allows for volume prediction in a structured and methodical manner, taking into account historical behavior, special days and today’s observations. We should also remember the importance of underestimation, rather than overestimation, when using this model. Finally, implementing this framework is easier said than done. The devil, and the angels, as often, are in the details.