What’s your worst nightmare? Here’s how to find out if your portfolio is ready for it

This article is by Bloomberg equities specialist Victor F. Leong. It appeared first in Bloomberg Markets Special Report | Family Offices.

Family Offices need to be strategic about asset allocation, because the right diversified approach can help mitigate losses in stressed markets. Investment managers and regulators are relying increasingly on scenario analysis as a means to expose potential risk.

Traditional tools to assess risk, such as value-at-risk, have shortcomings. VaR calculates the worst-case loss that won’t be exceeded with a given level of confidence. For instance, depending on the model employed, VaR assumes that asset returns are normally distributed. Additionally, it doesn’t quantify the potential magnitude of losses when a loss threshold is exceeded, nor does it take into account cross-asset correlations that likely break down in times of market stress. Scenario analysis, on the other hand, helps you gain a quantitative understanding on portfolio impact.

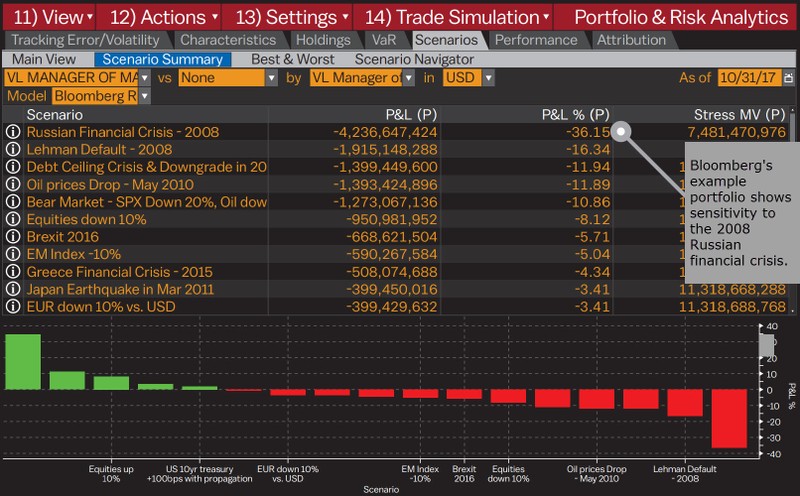

For example, what would happen to your portfolio with an upward shift of 100 basis points in U.S. interest rates or a 20 percent rise in oil prices? Or how would your current portfolio have fared in the depths of a 2008 subprime crisis? These types of tests can help uncover inordinate risk concentrations within a portfolio and flag a needed change to investment strategy.

Bloomberg’s scenario analysis tool in PORT can help determine a portfolio’s sensitivity to a single risk factor or understand a portfolio’s response to the effect of simultaneous moves in a group of risk factors. Importantly, the analysis spans across multiple asset classes, from traditional equity and fixed-income securities to more esoteric credit-default swaps, hedge funds, and private equity.

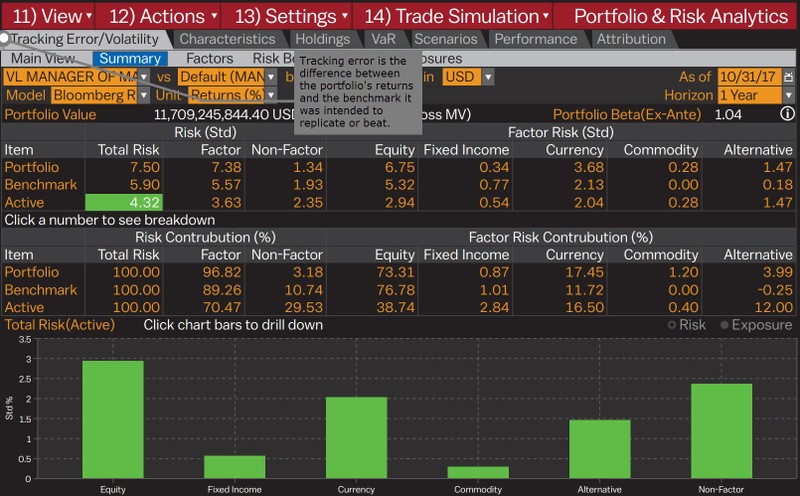

In a sample family office portfolio created by Bloomberg, not only are exposures captured, but the amount of risk sourced from those exposures is also quantified. For example, allocations to alternatives are generating 3.99 percent of the risk in the portfolio and represent 12 percent of the portfolio’s tracking error. Existing Terminal subscribers can find an exhaustive list of asset-class coverage can be found on the PORT Help page.

Additionally, PORT’s scenario analysis capabilities encompass both risk factor modeling and full-valuation methodologies. The former uses Bloomberg’s multi-asset risk factor models and incorporates the correlation of different asset classes to propagate moves in one factor to all other factors in the model for a given scenario. The latter, which is appropriate for instruments that can be priced using a model, shifts the instruments’ underlying curves and reprices the securities. Bloomberg’s example portfolio shows particular sensitivity to the 2008 Russian financial crisis and less to the 2008 Lehman Brothers Holdings Inc. subprime event. Users can also create their own draconian scenario to analyze.

Many times asset allocators will understand the risk/reward relationship of a single investment manager or asset class. The main advantage of PORT’s application is a holistic depiction of a portfolio’s dynamics, considering the amount allocated and correlation among all invested asset classes.