ARTICLE

What’s in a name? Equal weighting in broad equity indices

Bloomberg Professional Services

Although investors spend a great deal of time on stock selection, academic research has shown that aggregate characteristics of a diversified portfolio or index are often the primary drivers of risk and return. This is especially worth noting as many investors seek ways to improve diversification due to heightened level of concentration in traditional market cap indices.

For the past few years, the most echoed market observation has been the concentration in equity index makeup and return. This sentiment was echoed so much by investors that it was given a name: the Magnificent 7. The risk of this concentration was beaten like a drum for months, resulting in many equity investors seeking ways to diversify. Some kicked the tires on small caps, while others increased their exposure to international stocks. One of the more discussed approaches however was not adding new exposures, but instead evolving the weighting scheme. Equal weighting has experienced a revival, as approximately $29 billion have flowed into ETFs providing such exposure over the trailing 3-year period. This despite such strategies having underperformed a traditional market cap weighted approach over that period.

Intended and unintended characteristics of equal weighting

Market participants have pointed to several reasons why now might be the time for an equal weight approach: lofty Mega cap valuations, broadening earnings growth, more defensive positioning, fed rate cuts, and factor exposures relative to the market cap weighted index. Despite longer-term performance, there are early signs that the tide may be shifting, and many market prognosticators have taken notice. The Bloomberg US Large Cap Equal Weight Index (B500EQ) has recently begun to outperform its market cap weighted cousin (B500). While equal weighting is intuitive, some of the characteristics of such an approach may not be as evident as others.

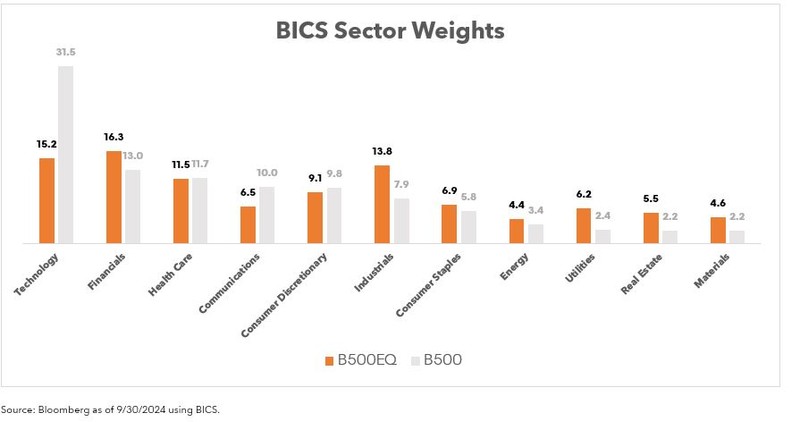

For starters, while the weighting scheme may differ, the companies making up the respective indices are the same. Nonetheless, while the top 10 names in the market cap weighted variant makeup a third of the total index, the top 10 names in the equal weight version in aggregate makeup only 2% at rebalance. And while constituent concentration is the typical motivation for an equal weight approach, sector diversification will also come along with it.

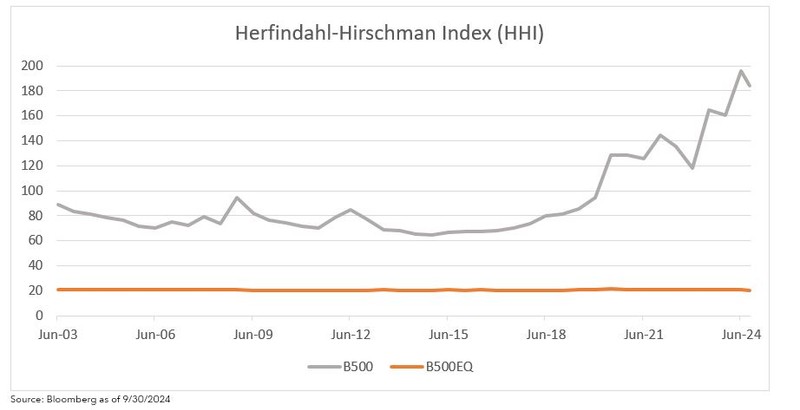

One popular analysis to illustrate diversification has been the Herfindahl-Hirschman Index (HHI). This index is calculated by squaring the market weight of each position, then summing the resulting numbers. While the HHI for the B500 is near an all-time high (as it is for all Large Cap US market weighted Indices), the HHI for an equal weight index will essentially remain constant, with its value based on the number of holdings.

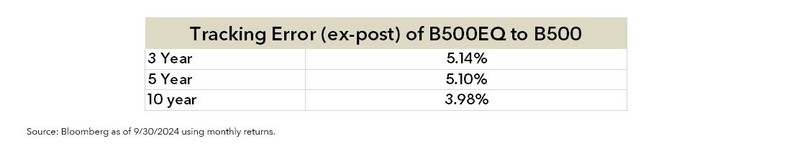

While these characteristics may be welcomed by investors who are looking to improve diversification, the change in weighting scheme will result in meaningful active risk relative to the market cap weighted version. The table below shows historical tracking error (standard deviation of excess returns) of the B500EQ when compared to that of the B500. Despite having essentially all names in common, the historical tracking error is on par with what investors expect to see from a highly active stock picking portfolio.

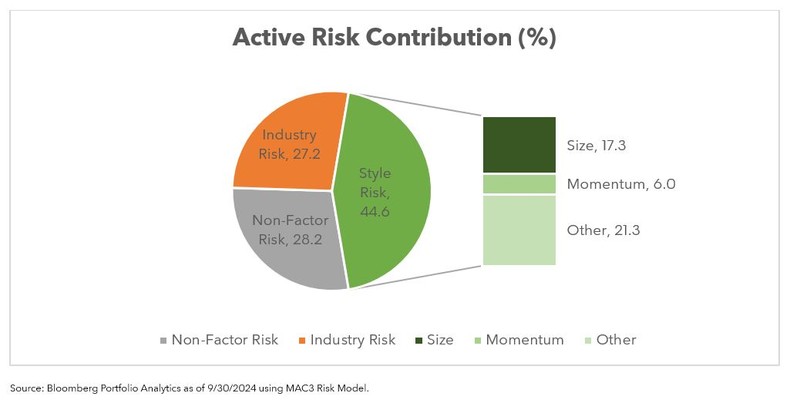

To better understand the drivers of this active risk, one can compare the two approaches using a risk model like those available via TLTS or PORT on the Bloomberg Terminal. Such analysis will highlight many observations investors might expect to see, as well as tilts or bets that are less intuitive. Although non-factor (i.e. idiosyncratic/stock specific) and Industry bets drive a large portion of active risk, factor bets drive nearly 44%. The largest factor contributor is to the size factor, which is to be expected as such an approach will underweight large companies to fund higher allocations to smaller ones, and while equal weighting also results in tilts to companies with lower valuations, it is an underweight to momentum that is the second largest style contributor to risk. This is not all that surprising, as we are again underweighting the Magnificent 7 names that have had positive price momentum. Additionally, the momentum factor is often thought of as the opposite side of the value coin, as momentum measures the numerator in traditional value metrics such as price-to-book. In other words, if holding all else equal, a stock with positive price momentum is getting more expensive in relation to fundamentals. All these tilts, whether intended or unintended, will result in different performance in different market scenarios.

How important is the starting universe?

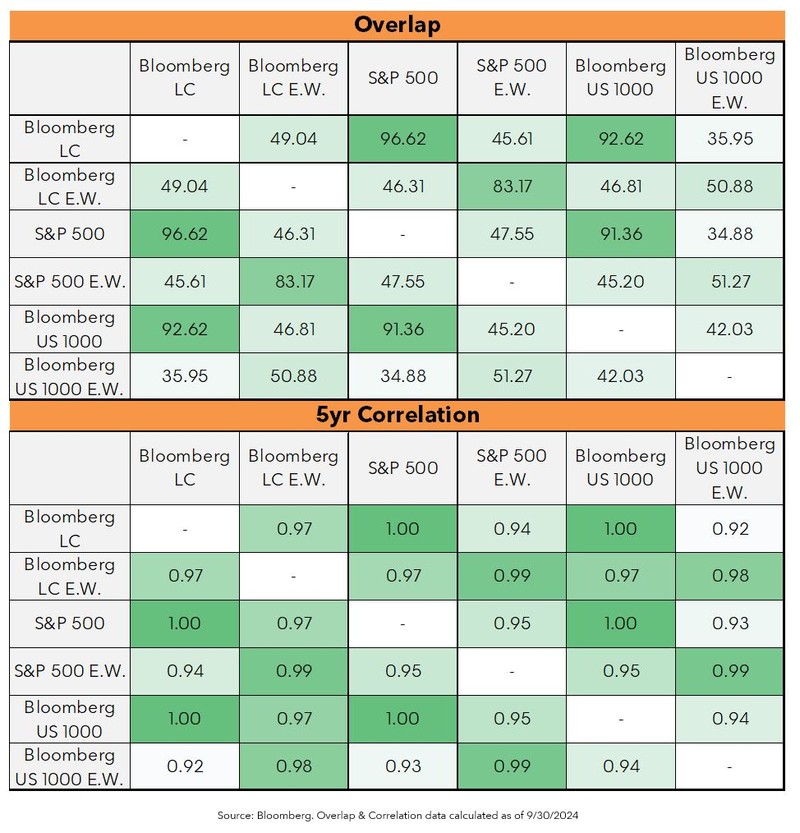

If equal weighting dramatically changes the makeup of an index, does the starting universe even matter? Not as much as some investors might think. Even though an equal and market weighted index hold the same names, they will have lower overlap and correlation than one might anticipate. While all the names of the Bloomberg Large Cap Equal Weight Index are found in the Bloomberg Large Cap Market Weight Index, the overlap (as measured by common holdings score) is only 49%. In fact, Large Cap Equal weight indices have higher overlap with one another than they do with their respective starting market cap weighted versions. We see a similar relationship with correlations as well, although market and equal weight indices of the same asset class will typically have high correlation regardless of weighting or selection scheme.

Investors continue to seek ways to improve portfolio diversification, and the Bloomberg equal weight indices provide a transparent, rules-based approach to help solve this challenge. Such a weighting scheme can improve diversification not just at the stock level, but also at a sector and factor level as well. While an intuitive weighting scheme, the resulting traits may not be as evident, and understanding the resulting tilts, whether intended or not, will lead to more efficient portfolio management and intentionality.