This analysis is by Bloomberg Intelligence Chief Global Derivatives Strategist Tanvir Sandhu. It appeared first on the Bloomberg Terminal.

The current elevated volatility levels of risk assets is unsustainable over the long term given the mean-reversion property of volatility. For now, volatility is in clustering mode at high levels given the market stress highlighted through intraday swings. But the level and speed to which it resets is always a moving target and looks set to be higher this year, given the mix of macro uncertainty and liquidity issues.

Persistence of volatility

Elevated volatility has been clustering, with large changes in price followed by more large changes and exhibiting high auto-correlation. Vol will eventually mean revert but the speed to which it does and to what level varies in different scenarios. In recent years, vol has seen pronounced spikes followed by fast declines. We think these localized moves have been a function of falling market liquidity and algo market-makers stepping away as vol rises. The Fed put re-strike and lack of visibility on the Ukraine-Russia conflict may see vol reset to a higher level this year.

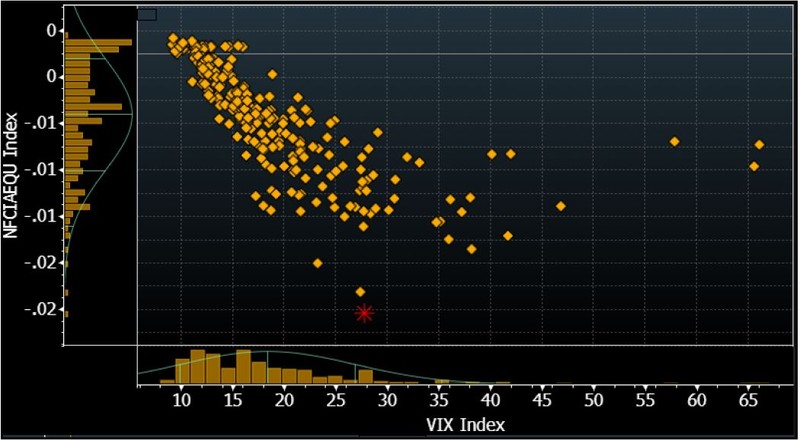

Chicago Fed e-mini market depth vs VIX

What is volatility pricing?

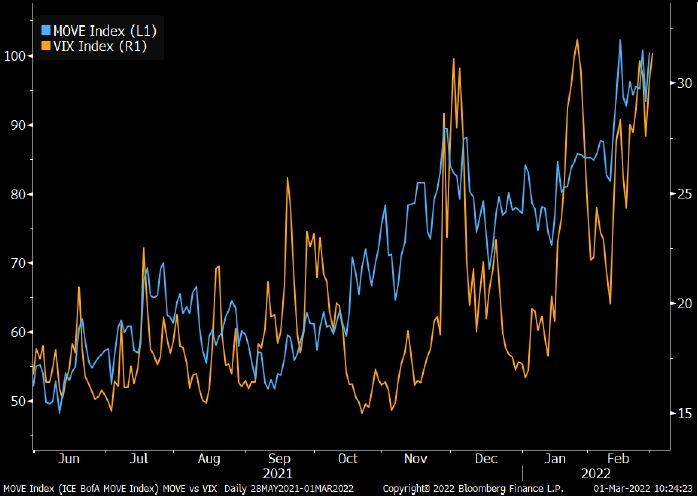

Short-term rates implied vol has only recently picked up after having been relatively limited compared with other asset classes in relation to the Ukraine-Russia conflict, given that it was already elevated. The 3m10y straddle with implied vol at 93 normals is pricing a wide terminal break-even range of 76 bps. The VIX at 31 means the market is pricing the S&P 500 to swing 6.3% in either direction over the next month (using mean deviation with SPX, a power law distribution). To note, this is less than the commonly seen method of taking the square root of time (VIX/√12), which gives 8.9%.

Rates vol vs SPX

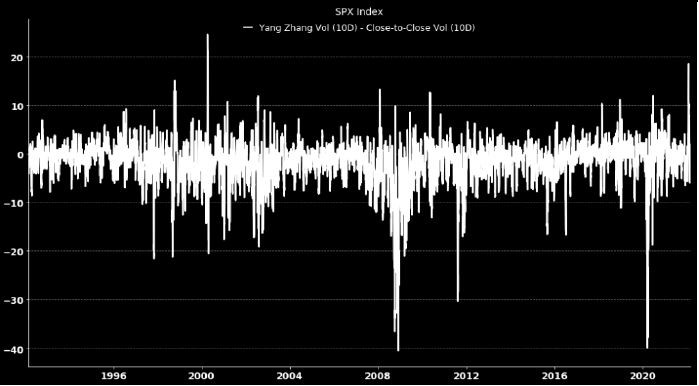

SPX intraday vol spread to close-to-close at multi-decade highs

SPX 10-day intraday and close-to-close vol spread

European index skews at extremes, SPX at average as monetized

Carry vs Implied vol (3m vol, 10y percentile)

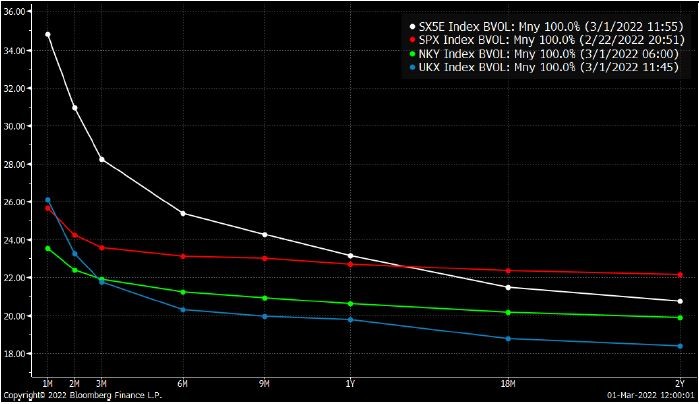

SX5E has most elevated skew and inverted vol term structure

Vol term structures (OVDV <GO>)