This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Sean Savage. It appeared first on the Bloomberg Terminal.

Trading in Secured Overnight Financing Rate (SOFR) futures continues to benefit from elevated uncertainty about inflation and as the Federal Reserve prepares to hike interest rates further. A rising geopolitical risk premium provides another source of demand as the mid-2023″drop-dead” date for LIBOR looms.

SOFR futures have room to run; Fed posture helps

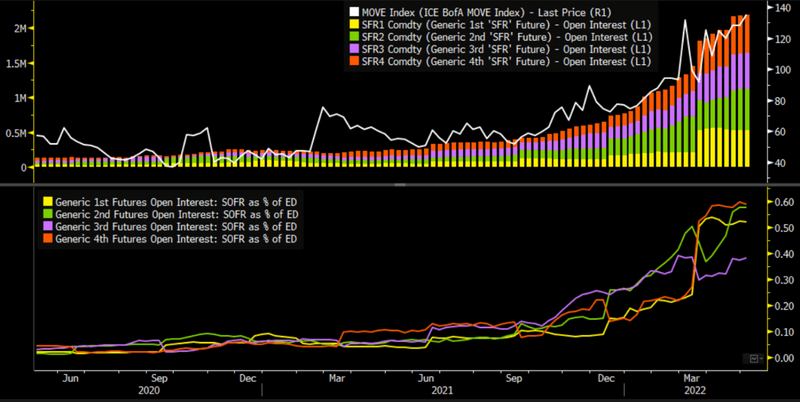

Rising market volatility continues to boost the development of the SOFR futures market, as expectations for aggressive rate hikes and balance-sheet runoff by the Fed spur more speculation and hedging. Open interest relative to that in euro dollar futures has risen significantly in recent months. Near- and further-dated contracts have ramped up the most, with all having held onto relative gains seen following the higher-than-expected CPI data in March (bottom panel). With the LIBOR transition “drop-dead” date over a year away, we expect SOFR futures to continue to scale up, particularly during periods of higher volatility.

SOFR vs. ED futures open interest

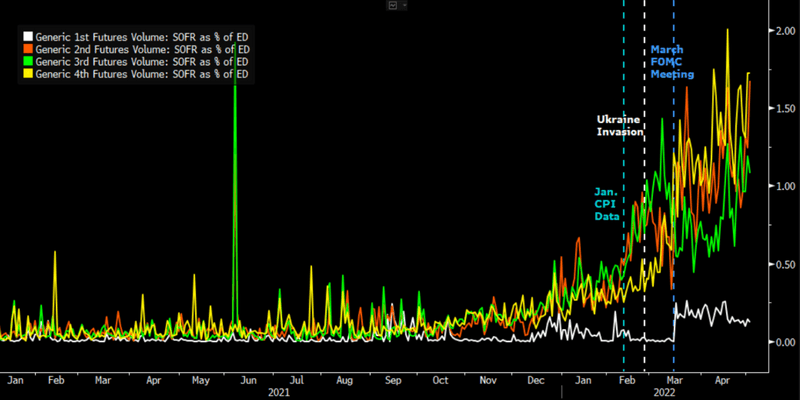

Uncertainty on all fronts boosts SOFR futures

SOFR futures trading volume was going to catch and eventually surpass volume in eurodollars futures — likely in 2H of this year, we believed — due to the mid-2023 Libor drop-dead date, yet this transition appears to be occurring on a faster timeline. Trading in SOFR futures has benefited from rising uncertainty across multiple fronts, most importantly the inflation outlook, geopolitical risks and how aggressively the Fed will tighten policy. Of note, volume and open interest in mid-curves has risen significantly relative to early-2022 levels (not shown).

Given the Chicago Mercantile Exchange is heavily focused on the transition, we expect future bouts of volatility — whatever their source — to keep boosting trading volume in SOFR futures.

SOFR vs. Eurodollar futures volume

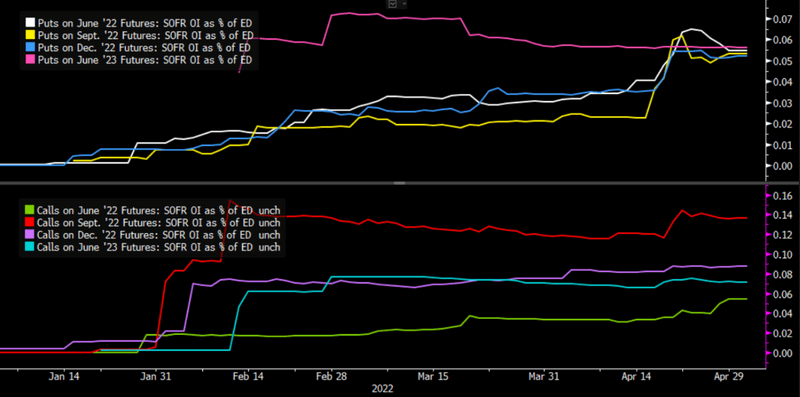

Options liquidity lags: ‘Chicken vs. Egg’ problem

Liquidity in SOFR futures options remains the final piece of the puzzle with respect to the contracts fully realizing the role played by eurodollar futures. Open interest in options on SOFR futures is a fraction of that in eurodollars, which we believe creates a “chicken vs. egg” challenge. Investors need to see substantial interest to feel comfortable using options on SOFR, but such interest only comes when most of the buyside adopts them as key tools in their portfolio and risk management.

We expect regulators to continue to try to jawbone and cajole wider adoption and use of SOFR options in the marketplace. The rise in futures trading helps in this regard, as does the rapidly evolving outlook for the degree and pace of policy tightening by the Fed.

Options on SOFR futures