Untangling tech supply chain: Relocation plans

This analysis is by Bloomberg Intelligence Technology Analyst Charles Shum. It appeared first on the Bloomberg Terminal.

Apple, AMD’s Taiwan exposure may still stay above 40% by 2030

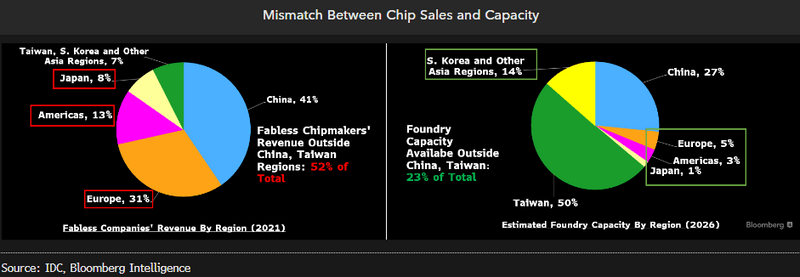

Apple, Advanced Micro Devices and other chipmakers that don’t own foundries may only be able to reduce their exposure to China and Taiwan to about 40% by 2030, according to our calculations. Taiwan will still hold the largest share of advanced-node semiconductor manufacturing capacity, while mainland China will dominate mature-node capacity. Apple, which is fabless, depends 100% on Taiwan’s TSMC to make its custom processors.

Taiwan still the largest chip manufacturing hub in 2030

By 2030, Apple, AMD and other large advanced-chip designers may still have at least 40% of their own-designed chips manufactured in Taiwan and China, we estimate, despite increasing US and European government efforts to bring more such capacity on shore. Based on what TSMC, Samsung and other chipmakers have announced by the end of June, the total percentage of capacity of the leading 10 nanometer and smaller nodes — which advanced logic chips manufacturing relies on — in Taiwan will still be 41%, the largest share among countries.

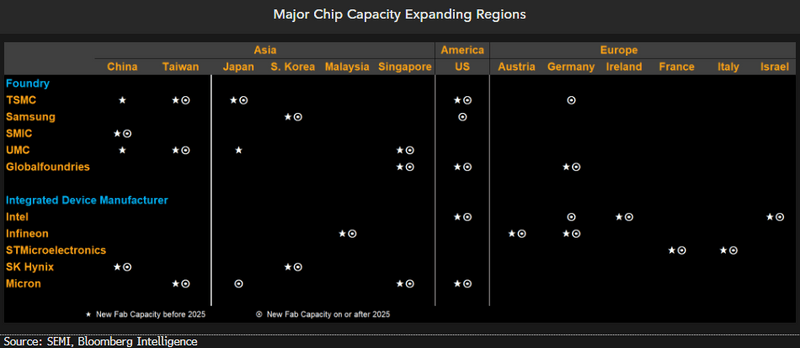

Over the next eight years, the US may take the lead in capacity expansion with a jump of 2.6x. Taiwan will likely follow with expansion of 1.6x as the nation’s foundries, led by TSMC, aggressively expand capacity in their home market.

A challenging plan for advanced chip diversity

Hurdles to moving manufacturing capacity of advanced chips outside of Asia include high requirements for utility infrastructure, slow deliveries of extreme ultraviolet lithography systems and the lack of local supply-chain support from photomasks and wafer materials to experienced engineers. The mismatch of downstream market demand is also a key issue. PCs and handsets, the two largest end-markets for chips, are still largely produced in China and Southeast Asia.

Instead of governments, Apple and other chipmakers that don’t have their own foundries may have to consider offering more incentives to push faster expansion outside Asia. In addition to direct financial subsidies and partial shareholdings, multiple-year supply agreements can also be good measures for fabless chipmakers to consider.

Mature node chip supply also needs to be diversified

To accommodate unexpected supply disruption from issues such as pandemics and geopolitical conflicts, automotive and electronics manufacturers will also have to diversify their sourcing of chips made by older manufacturing processes — not just the leading-edge nodes run by TSMC, Samsung and Intel. Globally, mainland China will control the largest share of foundation capacity — 31% — for mature-node, non-memory semiconductors by the end of 2025. Taiwan will follow with 18%, based on our estimation.

Automotive-grade semiconductors have to operate in a high-voltage and high-temperature environment. That means about 75% will still have to be produced by matured nodes processes that are 28 nanometers or larger in the coming decade, we believe.

Four ideal non-US locations for new fabs

Over the next 10 years, South Korea, Japan, Malaysia and Singapore may be the preferred regions for TSMC, UMC and other foundries to diversify their supply chain outside mainland China and Taiwan. Setting up integrated circuit fabs will fulfill the three core prerequisites for business sustainability. First, proximity to Apple, Samsung and other original equipment manufacturers’ production hubs, which will still be mostly distributed across Asia. Second, support from a well-established supply ecosystem of materials and talent. Last, access to robust energy and logistic infrastructures and trade relationships with other countries.

Germany may also be another key region for capacity growth, given its proximity to automotive production. But, its cost of electricity — Europe’s second-highest — will be a hurdle.