Under the hood of ESG ETFs

This was written by Bloomberg Intelligence analysts Eric Balchunas and James Seyffart. It first appeared on the Bloomberg Terminal.

Exchange-traded funds that screen for environmental, social and governance (ESG) factors may align with certain investors’ values, but the caliber of companies excluded, such as Berkshire Hathaway, Netflix and Amazon.com, has sometimes led to underperformance. A hypothetical ETF made up of stocks that fell short of ESG metrics would have beaten both the S&P 500 Index and ESG peers over the past seven years, based on a backtest. Advisers might consider giving an investor interested in ESG an “Amazon test,” showing a list of top-returning stocks excluded from such funds, then asking whether the client plans to shun products from the excluded companies. A “yes” to both could identify a good candidate for ESG investing.

ESG ETFs should come with ‘Amazon Test’ to weed out slacktivists

Investing in an ESG exchange-traded fund may mean missing out on the next Amazon.com, as happened with the iShares MSCI USA ESG Select Social Index Fund. Asking clients whether they’re willing to take that risk might help advisers determine which ones have the level of commitment need to stick with the potentially underperforming strategies.

SUSA’s lag shows why ‘Amazon Test’ is needed

A real-world example of ESG filters’ potentially negative impact on returns is the $1.1 billion iShares MSCI USA ESG Select Social Index Fund (SUSA). The ETF is almost 15 years old and excludes obvious holdings, such as Exxon Mobil and defense contractors, but also less-obvious ones, including Amazon and Mastercard. Both are up more than 1,000% in the past 10 years, while SUSA has trailed the S&P 500 Index—a cautionary tale for potential ESG ETF investors. To avoid such surprises, we think potential ESG investors should be given “The

Amazon Test”—shown a list of excluded stocks and their past returns to ensure they’re comfortable with missing out on potential gains.

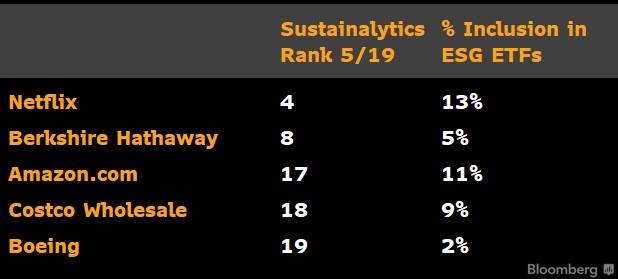

Hotshot stocks not included in SUSA

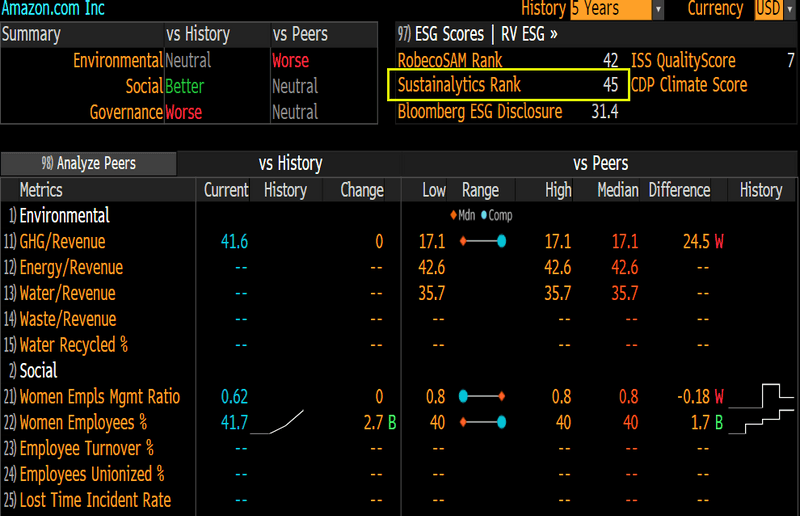

Close to Exxon under ESG fund screens

Amazon is included in only 37 of the world’s 327 ESG ETFs—almost as few as Exxon Mobil. Amazon tends to be excluded due to working conditions that put it on a worker-rights group’s “Dirty Dozen” list of the most dangerous employers in the U.S. Also, the online retailer’s Sustainalytics rating is even lower than Exxon’s. This creates a dilemma for ESG issuers and investors, since the presence or absence of a high-flying stock like Amazon can significantly affect an ETF’s performance against broader benchmarks.

ESG ETF investing may take more due diligence than most other areas and should probably come with a test of investors’ willingness to stick with the strategy.

Amazon ranks low on ESG

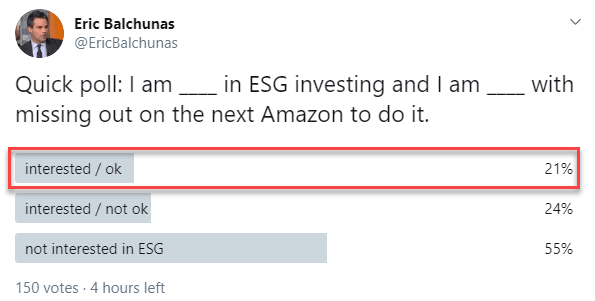

Just 21% OK with excluding Amazon

Investing in ESG may require a willingness to forgo returns from high-flying stocks such as Amazon. In an informal Twitter poll, fewer than half of respondents expressed interest in ESG investing, and fewer than half of those people—or only 21% overall—approved of excluding a company with Amazon’s performance. Such an Amazon test could separate investors who might prefer a broad index ETF from those willing to stick with ESG strategies, even if they trail the broader market. Amazon isn’t alone—many stocks get excluded beyond the obvious ones, and some have been top performers.

Poll finds 21% can handle ESG ETF investing

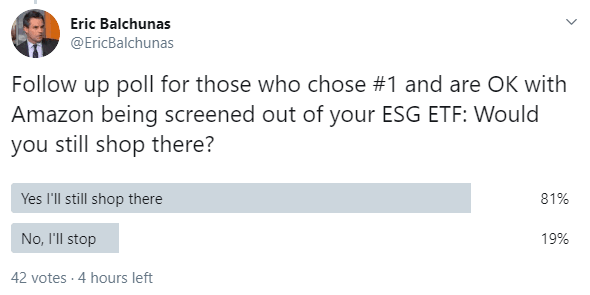

Not shopping at Amazon to send a message

Another potential question for possible ESG ETF investors is whether they’re committed to stop consuming products or services from excluded companies. Amazon and Exxon Mobil, for example, have broad reach and are inconvenient to give up. For such companies, consumers are arguably more powerful than retail investors. In an informal poll, however, four of five respondents who wanted Amazon screened out of their ESG ETF would still shop with the online retailer. That might prompt an adviser to ask why a client doesn’t want to invest in a company after helping to increase its revenue.

Won’t invest in Amazon but will still shop there?

How ESG ETFs can miss the boat on Berkshire-type returns

An investor using an ESG ETF is almost guaranteed to miss out on exposure to Warren Buffett, with Berkshire Hathaway excluded from more of the funds than Exxon Mobil due to poor governance metrics, as well as an overall lack of reporting. While ESG ETFs have their merits, this illustrates the importance of due diligence before investing.

Berkshire ranks near the bottom in ESG

Warren Buffett’s Berkshire Hathaway only makes it into 5% of the world’s 328 ESG and sustainability ETFs—fewer than oil producer Exxon Mobil. Berkshire also has the second-worst Sustainalytics Rank of S&P 100 companies, ahead of only Netflix. Part of the issue is Berkshire’s lack of environmental and social data. That leaves the G for governance, where Berkshire gets penalized for a board that’s only 57% independent—well below the 85% average. Berkshire also has investments in utilities and power producers that get 41% of net generation from coal. The company’s example drives home the need to do extra due diligence about any ESG ETF, given the potential for surprising exclusions.

Despite ESG ETFs’ rejection of his company, Buffett is one of the biggest philanthropists of all time.

Five lowest ESG scores in S&P 100

Berkshire’s in fewer ESG ETFs than Exxon

ESG ETFs’ rigid metrics can lead to surprising exclusions, as with Berkshire Hathaway, which is in almost none of the funds. The company gets dinged for having a less independent board, as well as a lack of reporting. But Chairman Warren Buffett has signaled no intention of changing the company’s business practices. He implied the independent board is a poor metric, saying many such boards he’s sat on are independent on paper only, with many directors just looking for a payday and typically following the CEO’s lead. Buffett also has said he doesn’t want to harness subsidiary companies with unnecessary rules and costs. Potential ESG ETF investors need to decide which argument is stronger: Buffett’s or ESG. There are many cases similar to Berkshire’s.

“We’re not going to spend the time of the people at Berkshire Hathaway Energy responding to questionnaires or trying to score better with somebody that is working on that. It’s just, we trust our managers and I think the performance is at least decent and we keep expenses and needless reporting down to a minimum at Berkshire,” said Warren Buffet at the Berkshire Hathway annual shareholder meeting in June 2019.

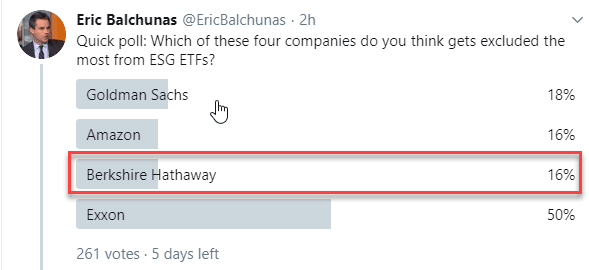

Little known that Buffett’s company is un-ESG

Beyond the debate over whether Berkshire Hathaway should be rejected by ESG criteria is a broader point—most investors likely don’t know how widely the company is excluded. An informal Twitter poll found that most respondents believed Berkshire was present in more ESG ETFs than Exxon Mobil. It isn’t, and the gap between perception and reality shines a light on the lack of education about ESG metrics and why certain companies make the cut and others don’t. We believe potential investors in any ESG ETF should be shown upfront a list of

companies that are included and excluded.

People don’t know Berkshire is excluded

Amazon and Netflix lead group of outperforming ESG outsiders

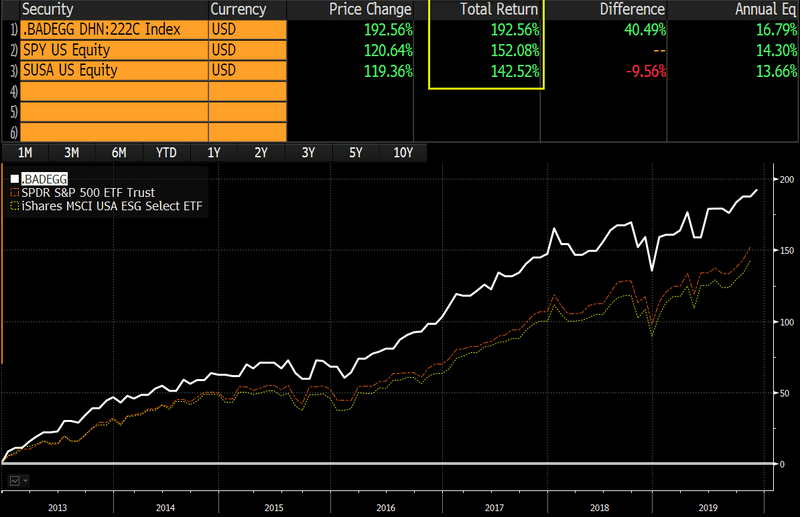

A hypothetical exchange-traded fund comprising the lowest-ranked stocks by environmental, social and governance metrics would have included some of the best overall performers during the past several years, such as Amazon.com, Netflix and Berkshire Hathaway. An equal-weighted basket of these stocks beat the S&P 500 Index, as well as ESG ETFs, in a backtest.

ESG outsiders include Netflix, Berkshire

While ESG investing promises peace of mind and, in some cases, reduced volatility, it can lead to lower returns due to the number and caliber of stocks often excluded by ESG ETFs, such as Amazon, Netflix and Berkshire Hathaway. This is illustrated by a backtest of the 20 members of the S&P 100 Index with the lowest Sustainalytics rankings. Obvious stocks such as Chevron and Boeing are on the list, joined by more surprising choices such Berkshire Hathaway and Netflix, which are penalized for governance issues and lack of reporting. This mock index didn’t just beat most ESG ETFs, it topped the market by about 40 percentage points over seven years.

20 stocks with lowest sustainalytics ranks

Outperforming market, ESG ETF over long term

An equal-weighted basket of the 20 stocks with the lowest Sustainalytics Rank among the S&P 100 would have returned 192% over the past seven years—easily beating the S&P 100 and S&P 500. Further, 192% tops the iShares MSCI USA ESG Select Social Index Fund (SUSA) by 50 percentage points, helped by Amazon and Netflix. Our hypothetical non-ESG index also posted a slightly lower standard deviation than the S&P 500 and SUSA, which has been around for almost 15 years and has more than $1 billion in assets. The gap demonstrates the importance of due diligence in ESG investing.

Non-ESG index easily beats SPY, SUSA

Exclusions ETF could capture inefficiencies

An ETF holding only stocks that are largely excluded from ESG ETFs could have periods of solid returns, while potentially attracting investors from both sides of the ESG debate. The small but vocal contingent that’s anti-ESG might buy such an ETF just to make a statement. Pro-ESG investors, on the other hand, could be encouraged to own the worst offenders to gain a voice in voting and possibly play a role in changing policies that conflict with ESG goals. ESG’s growth also may generate inefficiencies that could be captured by such an ETF.

“Searching for companies with weak ESG records might sound counterintuitive. But in fact, identifying companies that are on track to materially improve their ESG performance can yield positive outcomes for both investors and society. Investors play an important role in motivating these companies to change, through active engagement, proxy voting and other tools available to active managers,” said Valerie Grant.

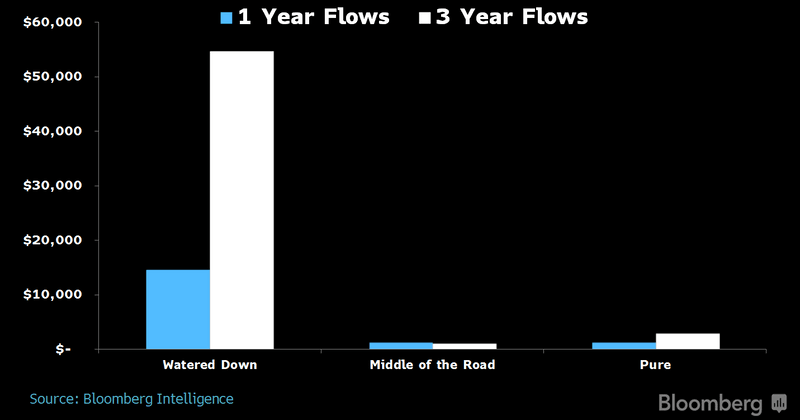

Hardcore ESG ETFs to play second fiddle to watered-down rivals

As with factor or smart-beta exchange-traded funds, we expect watered-down ESG ETFs to garner more inflows than purer peers in coming years. The strictest ESG screens can exclude high-returning stocks, leading to significant long-term underperformance.

Complex strategy for ‘don’t rock the boat’

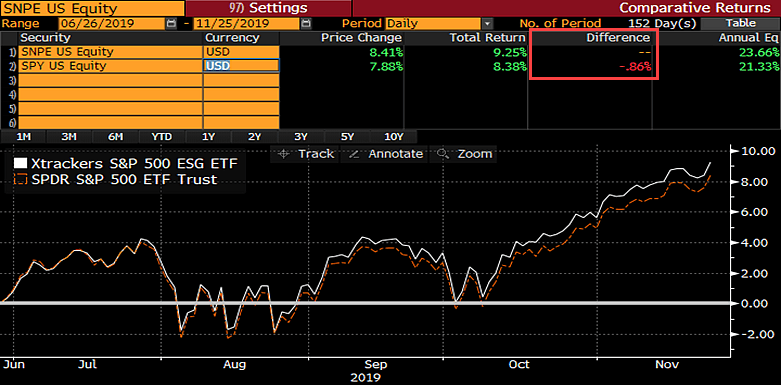

The complex rules behind DWS’ Xtrackers S&P 500 ESG ETF (SNPE) and the index it follows have a simple goal: don’t rock the boat. The ETF seeks to minimize tracking error to the market, exclude major risks associated with ESG criteria and give a good story for advisers to sell. All of this can be achieved while offering the potential for incremental outperformance by excluding companies with poorly ranked environment, social or governance practices.

Giving advisers a salable ESG strategy without deviating too far from the market has succeeded in garnering ETF assets in recent years, particularly from institutions directed to follow an ESG mandate.

“The methodology of the S&P 500 ESG Index was constructed with TWO objectives: (1) To provide a similar risk/return profile to the S&P 500; and (2) To avoid companies that are not managing their businesses in line with ESG principles, while including companies that are,” said Reid Steadman, managing director of S&P Dow Jones Indices.

Factor ETFs watered down for broad appeal

Purity in factor ETFs is enemy of assets & flows

ESG gains importance in risk assessment

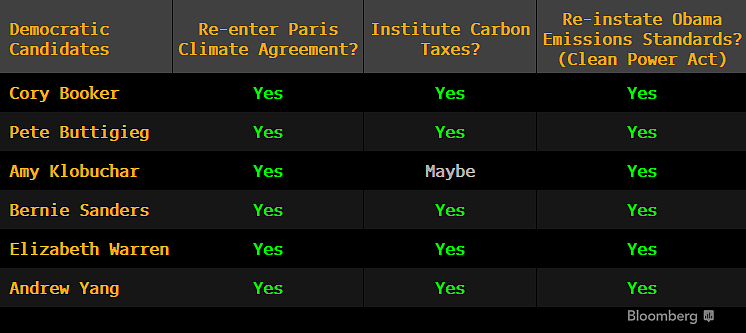

Moving forward on environmental and social issues will likely become more salient to companies, given political shifts as climate-change risks become more understood. A Democratic victory in the 2020 U.S. election could provide a catalyst, based on the candidates’ proposed policies, including broader adherence to international agreements and a return to stricter emissions standards. Excluding stocks with the lowest ESG scores within each sector is one way to minimize risks. This contrasts with pure ESG strategies, which try to select the best actors, based on restrictive scores. Being more restrictive, however, may cause investors to miss out on winning stocks.

Democrats may enact stronger environmental measures

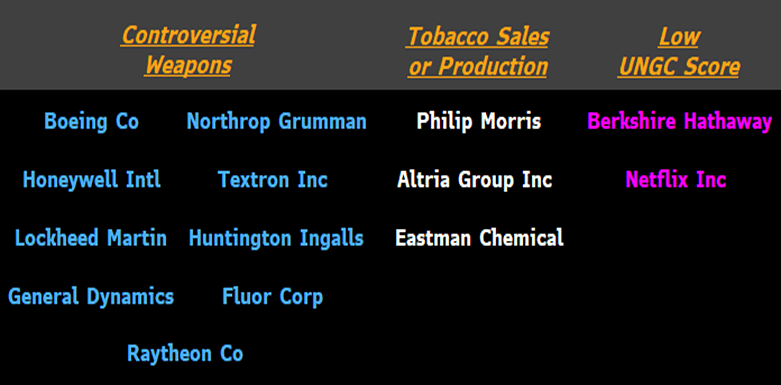

Flexible, but with hard stops for exclusion

The S&P 500 ESG Index isn’t as strict or exclusionary as purer ESG ETFs but it has clear lines that it won’t cross. Initial exclusions are controversial weapons, tobacco-related businesses and low United Nations Global Compact scores—amounting to 15 stocks and a 5.7% weighting in the S&P 500. Next to be filtered are the bottom 25% of companies from each industry group, based on a composite ESG score. The end goal is exposure to 75% of the market cap for each industry group in the S&P 500. In total, about 154 stocks are excluded, or 23% of the broader index’s market cap.

Berkshire Hathaway and Netflix are excluded for governance reasons.

S&P 500 ESG-excluded stocks

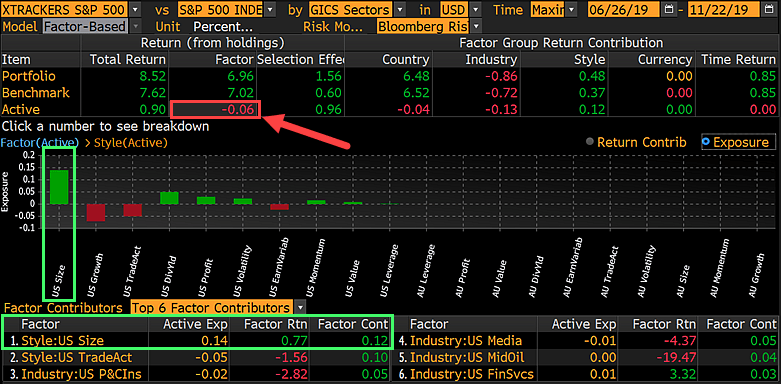

Test says size factor is in the driver’s seat

SNPE leans more toward the size factor than the S&P 500 Index, with overweight positions in Microsoft, Apple and Amazon.com. Among companies with more than $200 billion in market capitalization, SNPE has a 44% weighting vs. SPX’s 39%. The next-strongest contributor to SNPE’s return was an underweight position in stocks that trade the most, which performed poorly over the time period.

The largest negative contributors to SNPE’s return vs. the S&P 500 include underweight allocations to the growth factor and the defense sector, which performed well in the period.

SNPE PORT<GO> attribution summary

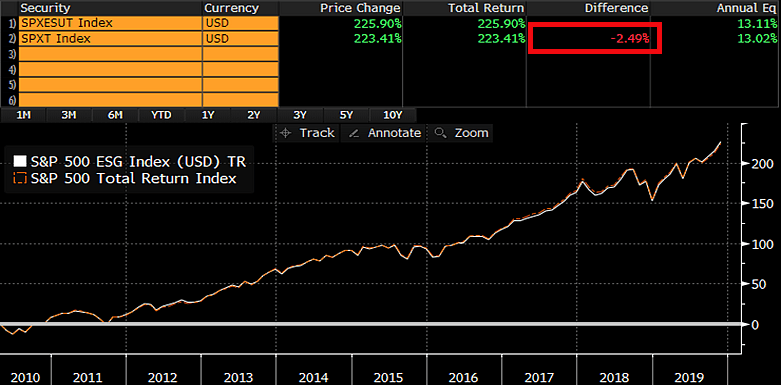

Benchmark is beating S&P 500 since inception

The S&P 500 ESG Index tracked by SNPE has outperformed the S&P 500 Index by 2.5 percentage points since the former’s inception in April 2010. An index that can keep pace with—or even outperform—the S&P 500 with a similar risk/return profile, while offering ESG exposure, could resonate with advisers and investors.

SNPE benchmark outpaces S&P since 2010

SNPE beating S&P 500 in first five months

SNPE vs. SPY