Trading in the pre and post-market sessions part I: Liquidity profile

This is the first post in a three part series where the Tradebook Quantitative Research team examines the after-hours trading environment and the opportunities these sessions offer institutional traders.

For U.S.-listed stocks, a significant percentage of the day’s volume trades are done in the pre-open and post-close sessions during earnings releases and other high-profile events. Below, we present some statistics that demonstrate that such events are not only associated with higher-than-average volume but also have significant price moves associated with them. These price moves are indicative of market-moving information and that the trading that transpires before the market open on the next day goes toward capturing a significant part of this move. We also believe that traders should not miss out on this volume and should employ tactical algorithms to trade intelligently in the post-close and pre-open time frame.

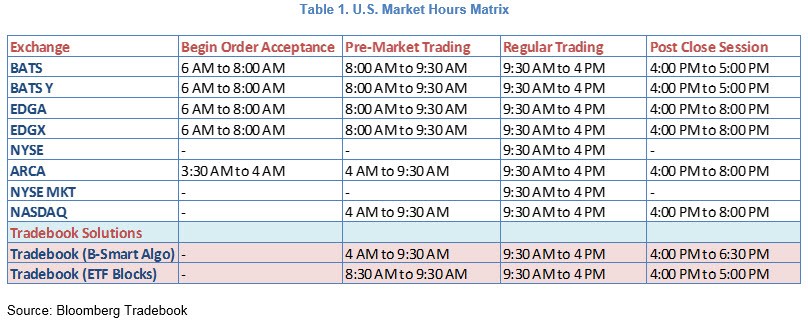

Pre- and Post-Market Trading Times

For U.S. equities, the time frame of 4 AM to 9:30 AM before the market officially opens (Continuous Trading) is considered pre-open and the 4 PM to 8 PM time frame is considered post-close. Tradebook offers a set of solutions available for pre- and post-market sessions.

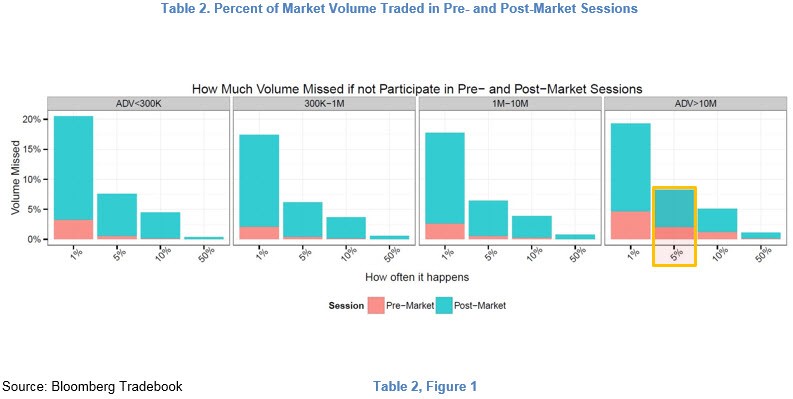

Pre- and Post-Market Volume Statistics

To summarize the characteristics of trading in these sessions, we sampled 500 tickers from the Russell 3000 with equal representation across the market capitalization spectrum. We compute pre-open and post-close market share as a percent of daily volume and group stocks using an average 30-day daily volume number. In Table 2, we show data for selected percentile groups for ease of display. For example, a highlighted column in Table 2, Figure 1 shows that for Average Daily Volume (ADV) greater than 10M shares, pre- and post-market volume account for about 8% of the daily volume. And this happens on 5% of the days in the year—or about once a month. This represents significant trading volume and is not just an earnings-day release characteristic.

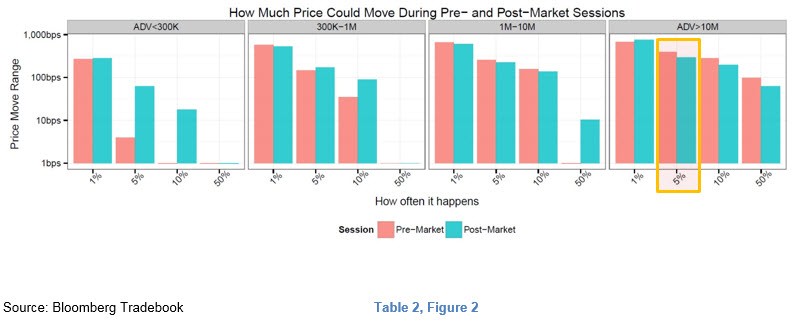

In Table 2, Figure 2, we display price moves associated with these volumes; in the smallest of volume events, significant (in the order of multiples of 100bps) price moves are observed.

Figure 3 shows an example of pre-open and post-close trading on a intraday price chart using the Bloomberg Professional® service. For this ticker, JC Penney, we observe a 17% jump in after-hours trading associated with about 64% of the Average Daily Volume (7.1M shares in the post-close session and 6.34M shares in the next day pre-open session). Although some might point to this trading being conducted in the upstairs market, only 17.4% of this activity was indicated on the TRFs, with the other 82.6% taking place on the exchanges, with NYSE ARCA trading 6.49MM shares before next day’s official market open. Traders could have participated with this volume using tactical algorithms such as Bloomberg Tradebook’s B-Smart algorithm.

In the next part of this series we will discuss the value of price discovery during the pre and post-market trading sessions.