This analysis is by Bloomberg Intelligence Senior ETF Analyst Eric Balchunas. It appeared first on the Bloomberg Terminal.

One ETF that doesn’t exist but may be in the works is an inverse Jim Cramer ETF, which would hold positions opposite to those promoted by the CNBC host. Recent calls on Netflix, AMC and ARKK show the strategy could perform well and has potential as a hedge if markets struggle. Existing trackers and a planned index for Cramer’s picks could be licensed for an ETF.

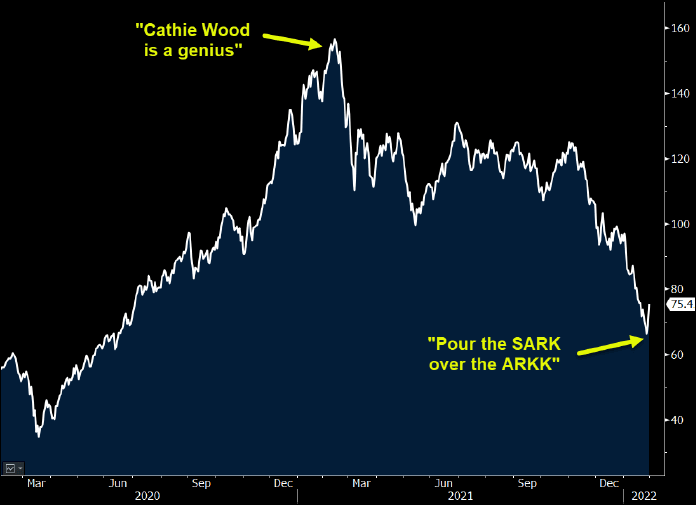

ARKK gets the call at top and bottom

An inverse ETF’s potential was recently highlighted by Cramer’s comment on the ARK Innovation ETF (ARKK), which he praised last year, going so far as to call Cathie Wood a “genius” — right before the high-flying ETF declined about 50%. On Jan. 27, Cramer suggested shorting ARKK would be a good idea, given the Federal Reserve’s plan to raise interest rates. Since then, ARKK is up 13.5%, including its fourth-best one-day return.

An Inverse Cramer ETF wouldn’t be without precedent: An inverse ARKK ETF shorts Wood’s picks, while other ETFs track the sentiment or holdings of high-profile investors and hedge funds.

Cramer’s sentiment can be contrarian indicator

Exploitable knack for being wrong in a big way

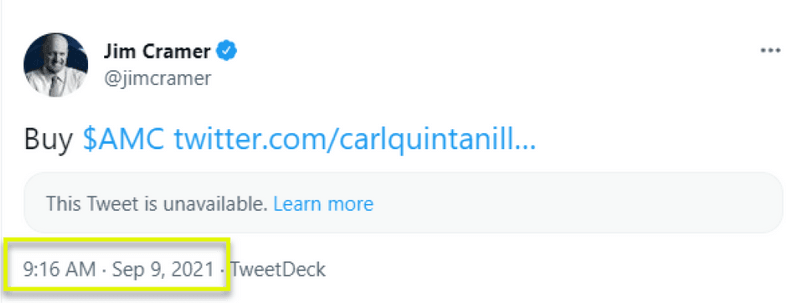

An inverse Cramer ETF might perform well by including spectacular bets that offset those that don’t work out or take a long time to unfold. For example, Cramer tweeted “Buy $AMC” in September. The stock has plunged 66% since then. He previously tweeted, “we like Coinbase to $475” on April 14; it still trades below $200. Netflix is down 32% since he recommended buying it in October. Perhaps his most famous call was the declaration that “Bear Stearns is fine!” in March 2008.

Though an inverse ETF wouldn’t be run by Cramer, he might benefit since the transparency would let viewers follow his picks, as with Cathie Wood’s Ark ETFs.

AMC down 66% since Cramer’s ‘buy’ tweet

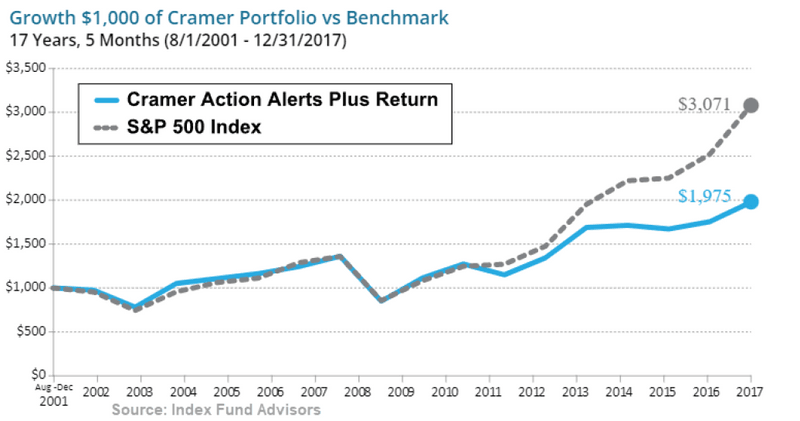

Underperforming S&P 500 by 3 points a year

A few studies have attempted to track Cramer’s performance. The Wharton School in 2018 found his Action Alerts PLUS portfolio returned 4% annually vs. 7% for the S&P 500 Index over a 17-year period. Most active managers underperform the benchmark over the long term, yet Cramer’s picks were still up, creating a dilemma for an ETF designer. A long/short hedge fund-type ETF, going long an S&P 500 ETF and then shorting his picks, would isolate the “Cramer factor” yet likely wouldn’t ever pop because of the offsetting positions.

An ETF also could seek to short Cramer’s buy recommendations that follow big run-ups in the stocks. A 100% short ETF might seek to take advantage of tougher market conditions.

Cramer’s picks trail S&P 500 Index

Cramer trackers lay groundwork for ETF

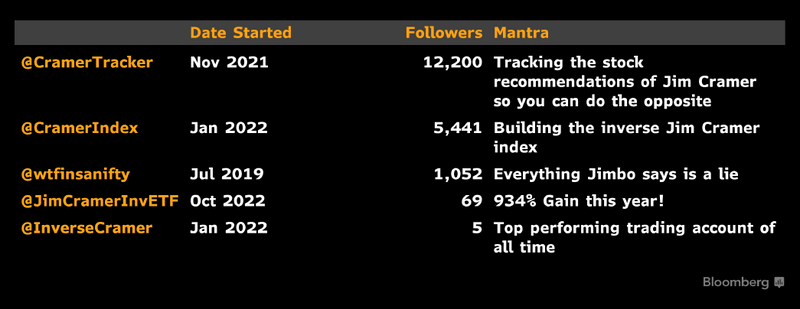

One sign that an ETF could be coming is that some Twitter handles have been set up specifically to track Cramer’s picks, including one that’s designing an index to be launched in February. These trackers and an index could do much of the legwork for an ETF issuer and might easily be licensed. A new account called @CramerTracker said on Jan. 16 that it would “be tracking EVERY stock recommendation made by Jim Cramer so you can do the opposite.” It has posted his buy and sell calls since Jan. 18.

We wouldn’t be surprised to see such an ETF from Tuttle, which put out the Short Innovation ETF (SARK).

Rise of the inverse Cramer trackers