The truth about toxicity analysis

We spoke with Jingle Liu,Quantitative Analyst for Algorithmic Trading at Bloomberg Tradebook in New York about some of the work he has been doing in the area of toxicity analysis.

What is the value of a toxicity analysis?

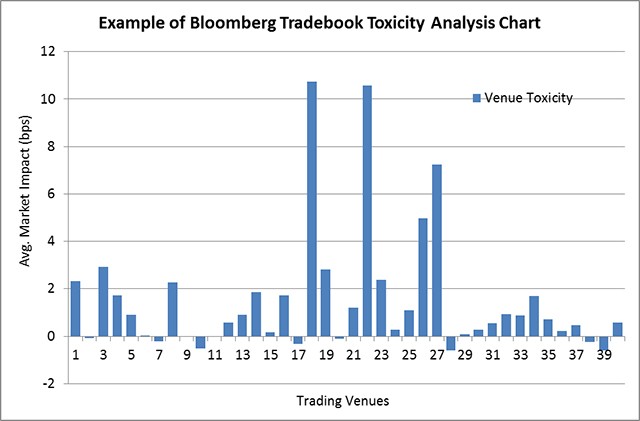

Toxicity analysis systematically measures the degree of market impact or adverse selection of the trade per each venue, security name and order size. It brings transparency to our clients regarding how brokers interact with lit exchanges and dark pools. It also offers valuable information on execution optimization, reducing explicit/implicit costs by minimizing your footprint and protecting against general information leakage so the market can react appropriately.

It’s important to understand however that toxicity reports should not be used to systematically turn off dark pools, solely based on the numbers. The idea is to help our clients be more transparent and build intelligence so they can incorporate this logic in their smart order routing decisions.

What are the key trends that are worth noting related to this type of analysis?

Venue toxicity has become more valuable for sophisticated buy side clients as investors are becoming more concerned about the impact HFT (High Frequency Trading) brings to the market.

What is the most important point that this type of analysis makes?

The analysis provides a multi dimensional trading venue heat map for smart order routing. It statistically measures the market impact of our order flow and incorporates these results into a broker’s smart order routing. We feel this will greatly benefit our client’s orders (especially large orders) which can be adversely affected by information leakage in a toxic venue.

What are the main conclusions we can draw regarding the dark pools in this type of study?

By looking at the toxicity levels (scores), we can easily identify the potential impact of the trades if we were to send orders to specific venues. We need to carefully evaluate sending orders to venues exhibiting higher toxicity levels and reasonably estimate the impact if we take liquidity from there.

Some dark pools exhibit very high toxicities because of their nature of IOI (Indication Of Interest),

so it’s important to understand that you should not automatically shut off a dark pool if the toxicity levels are high. It’s important that you dig a little deeper into the exchange and compare the results to your investment goals. Toxicity is just a starting point.

Could this type of study be called a “risk management package” for dark pools?

We can definitely use these results for risk management related to order execution. It can be used to estimate the risk of trading your order in one venue or the other.

Jingle Liu has been with Bloomberg since 2011. As a quantitative analyst in algorithmic trading group of Bloomberg Tradebook, his work focuses on trading strategy design, statistical and econometrics modeling, large scale data analysis, market microstructure and trading. In 2010, he completed his PhD degree in Physics with 3 patents and 50 publications on Nature Photonics, Physical Review Letter and et al.