Abdessamad Khaled, Bloomberg’s Head of Structured Products, and Gaurav Kapoor, Bloomberg’s APAC Head, Sell-Side Risk and Valuations, discuss how structured products have performed during the pandemic in the APAC region, the role automation played in maintaining stability, and how the market will evolve post-pandemic.

Q: Looking back on 2020, what happened to the structured products market during those initial spikes of COVID-19-related volatility?

A: Crises in emerging markets typically follow the same pattern: bad news in the market accompanied by volatility spikes, followed by a drying up of the primary market for structured products. A general nervousness also increases volume in the secondary market, as rattled investors look to unwind their positions. However, this cycle hasn’t occurred in the structured products market during the pandemic. Primary market volumes have thus far remained reasonably strong as structured products continue to perform well. The extra liquidity provided by central banks has overcome the temptation to fly to safety.

In the past 18 months, yield enhancing products such as autocallables, which account for the lion’s share of structured products issuance in the APAC region, continued their standout performance of recent years without any significant losses. Despite the reduced liquidity in the credit market and significant rise in the risk of default for sectors such as oil and gas, the bid-offer spread for structured products remained reasonably tight. Markets recovered so quickly that few autocallables barriers were actually triggered. Central bank action, technology, and especially a higher degree of automation played a major role in fostering this relative stability.

Q: What are the main lessons learnt from the market during the pandemic?

A: The benefits of digitization and especially the role automation plays in maintaining stability and liquidity, were felt sooner in the APAC region. Firms with a strong risk management framework fare better in times of crisis.

The more sophisticated markets, such as Japan and Singapore, are looking to extend automation to cover post-sales and risk management processes. Meanwhile, new emerging markets for structured products in the ASEAN region, may only be at the beginning of their automation journey. In recent years, these newer markets have acquired a taste for structured products, the yield-enhancing features of which provide a good solution to low-interest rates.

Onshore China, for example, has massively increased its appetite for structured products in the last few years, especially among the local banks. Such banks are striving to improve their risk management systems and automate workflow.

Another lesson learnt is the importance of forging a long-term partnership with a robust software provider. Financial markets depend on access to quality market data and pricing models – and this dependence is especially obvious during volatility. In an ongoing crisis, inappropriate market data creates a whole host of issues. Now firms realise more than ever the danger of cutting costs in the short-term and the benefits of finding a long-term partner whom they can trust to be resilient in the face of further market structure changes down the road.

Q: Looking ahead, how will structured products evolve post-pandemic?

A: All financial firms, especially banks, will continue to work on their digitization strategies. This doesn’t mean they want to cut human contact completely. In this digitized model, clients will still have the opportunity to speak with their relationship managers, but the conversations will be more focused, backed up by data and automation.

Ongoing market changes, like the LIBOR transition, will further accentuate the need to partner with a software provider capable of adjusting to market structure changes. In these fast-moving times, defined, on one hand, by low-interest rates and sudden spikes in volatility, and on the other hand, by sweeping regulatory changes, firms without the capacity to respond effectively to this evolution will lose out in the future. Other initiatives, such as the Uncleared Margin Rules (UMR), will require more technological sophistication, quality market data and robust models that can price structured products accurately.

In the APAC region, the continued growth of structured products is a response to specific demographic and socioeconomic challenges. For example, the increase in longevity has created problems for pension funds whose policies traditionally paid more if people lived longer. To cover the extra liabilities, pension funds need to grow their assets. While interest rates and yields for more traditional asset classes remain low, structured products, which can provide higher yields and returns, can help bridge the gap.

Investors may also appreciate the high level of flexibility and customization of structured products, often seen in regional trends. In Japan, for example, there is a preference for repackaged products where the underlyings are Japanese Government Bonds (JGBs), Convertible Bonds, and Credit Linked Notes (CLNs). In Southeast Asian (ASEAN) nations, the market is composed mostly of yield enhancement structures such as equity autocallables, albeit with extra demand from hedge funds for yield enhancement products across asset classes.

In China and Taiwan, there is a significant growth in demand for valuation and risk management of structured products, especially with regional banks. Some of the most common structures include digital barrier options, Daily FX range accruals, Shark Fins, Wedding Cakes and Basket Bull/Bear Spreads with quanto features, among others. There is also interest in structured products with ESG themes and underlyings/indices across all jurisdictions.

Another broad trend is the ongoing drive by local regulators to improve risk management and valuation services for structured products, opening opportunities for regional expansion by local and global sell-side firms in wealth management and private banking. Local major sell-side firms are also looking to expand into other APAC jurisdictions. As firms with a footprint in different jurisdictions look to comply seamlessly with local regulation, the need to invest in technology that improves lifecycle management and distribution capabilities will be made more apparent.

How we can help

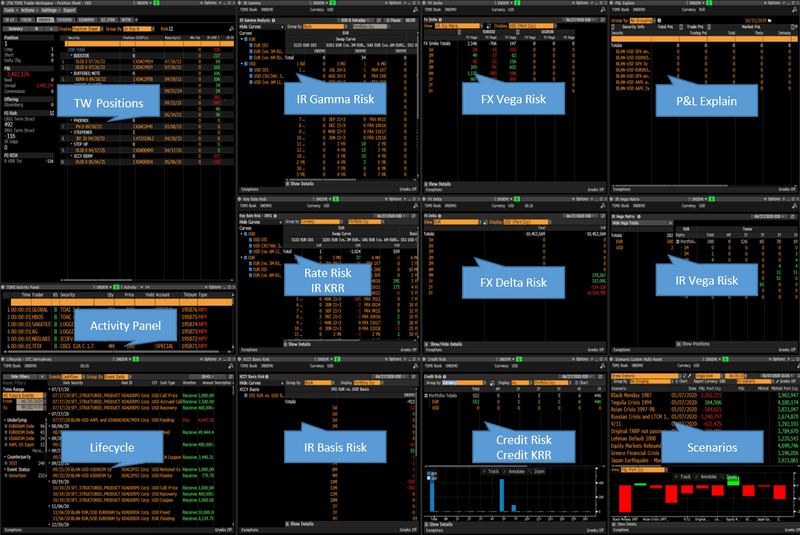

Investments in the appropriate technological solutions enable firms to “seize the moment” and build the right foundations to improve resilience, cost-efficiency and grow their business in today’s fast-changing landscape. Bloomberg provides a comprehensive suite of data and analytics to structured products players across the buy-side and sell-side. Bloomberg’s Derivatives Library (DLIB) can add coverage for the most exotic products in a matter of minutes.

Products created in DLIB feature:

- Seamless integration with all of Bloomberg’s front to back solutions

- Life cycle management

- Intraday and end of day mark to market

- Scenarios analysis

- Stress testing

- Collateral solutions (including ISDA SIMM support)

- Market risk suite of analytics such as Value At Risk and stress testing

- Counterparty risk and XVA solutions

Bloomberg’s goal is to make structured products as easy to trade and process as more vanilla instruments such as bonds, through using cutting-edge technologies such as machine learning and advanced quant models to help integrate the workflows front to back. Bloomberg is also increasingly offering its analytics and workflow components through APIs which can feed into various client systems. Dynamic dashboards can be easily “plugged in” to provide transparency, reporting and inform decision-making consistently across a firm’s target operating model.

For more information about Bloomberg’s related products, visit the Bloomberg risk management webpage or request a demo.