This analysis is by Bloomberg Intelligence Senior Industry Analyst Francis Chan and Bloomberg Intelligence Associate Analyst Peter Lau. It appeared first on the Bloomberg Terminal.

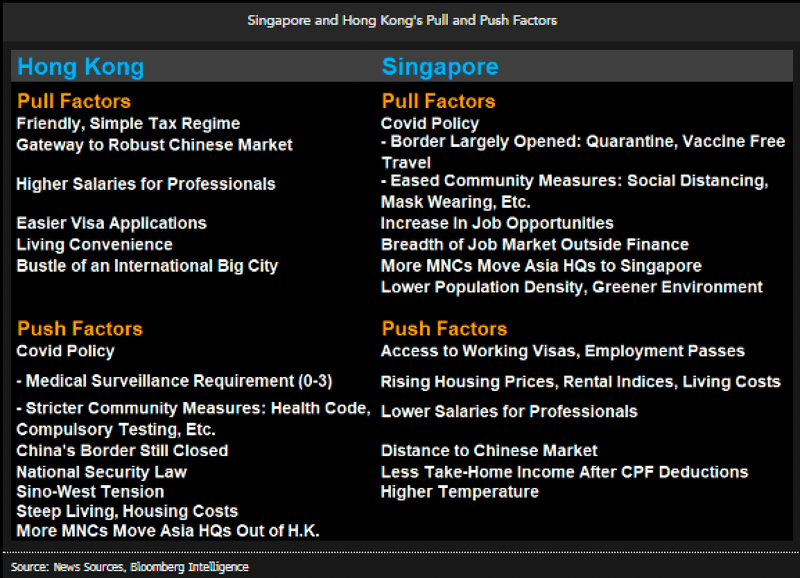

Singapore could extend its lead over Hong Kong as Asia’s top business hub, fueled by its more lenient Covid-19 policies and its tension-free ties with western nations. Job opportunities beyond finance are more abundant for expats in Singapore. Yet, the city-state is quite selective about foreign workers, and high earners bear a weightier tax burden.

Singapore Leads Hong Kong in Regional Hub Race

Singapore could maintain the upper hand over Hong Kong as Asia’s top business hub in the near term, as the former leads with more permissive virus containment policies. Hong Kong’s long-tail medical surveillance measures and community monitoring remain its biggest turnoffs despite tentative easing, while China’s National Security Law and its clashes with western powers give pause. The contrast with Singapore requires little elaboration, with the latter using favorable policy to attract talent and capital. Its copious employment opportunities have expansive breadth beyond finance.

Hong Kong can make up some lost ground only if its border with mainland China reopens, which is the bedrock of its perennial attraction to the international community.

Singapore Hits Full Stride as Hong Kong Tiptoes

Singapore has joined New York and London in lifting quarantine and Covid test requirements, while Hong Kong remains mired in vaccination protocols, virus testing routines, and medical surveillance measures. Visitors to Singapore are subject to the same restrictions as residents, with mask requirements restricted to public transport and healthcare facilities. Yet visitors to Hong Kong would be subject to an array of health codes, forbidding them entry into restaurants and bars until days after arrival. Other restrictions include compulsory mask-wearing and four-person maximum gatherings in public venues. Singapore’s more stable GDP growth is partly attributable to its more flexible measures.

H.K.’s restrictions have delayed or canceled several sporting events while Singapore pushes ahead with the F1 Race in late September.

Singapore’s High Earners Are Taxed More Heavily

Hong Kong and Singapore have similar tax rates on low-to-middle income earners. Yet, the latter hits higher earners harder, which could shape some senior professionals’ relocation choices. In Hong Kong, progressive tax rates for salary earners range from 2% to 17% for various income brackets. But a cap or standard rate is set at 15% for high earners who make about $260,000 or more per year. In Singapore, residents’ income tax rates, including salaries, dividends and interest payments, ranged from 2-22% in 2022, rising to 2-24% in 2023. Taxes on incomes exceeding S$370,000 ($261,743) are higher in Singapore than in Hong Kong, and effective tax rates can exceed 20% for those making $1 million or more.

Singapore will offer five-year work visas to foreigners making at least S$30,000 a month starting January 2023.

Singapore Selective in Foreign Workers, H.K. Losing Appeal

Singapore’s attractiveness to foreign enterprise and talent could surpass Hong Kong’s in the near term. Yet, Singapore’s exclusionary policies protect jobs for local residents. Its new Overseas Networks and Expertise (ONE) pass will grant five-year work visas for senior professionals making more than S$30,000 a month. Rules for foreign workers are tighter, including a points-based immigration system. Employment pass holders — typically for skilled workers — fell to 161,700 in 2021 from 193,700 in 2019.

Hong Kong’s faded appeal is apparent in the plunge in working visa approvals, from 41,289 in 2019 to 5,701 during 1H. Chinese firms could come to Hong Kong for its looser Covid restrictions. Mainlanders accounted for 92% of visa approvals in the financial services industry in 1H vs. about half in 2019.

Singapore’s Job Listings Rise as Hong Kong’s Shrink

Singapore and Hong Kong’s job vacancy patterns underscore their diverging fortunes and international business appeal. The southeast Asia city’s job vacancies expanded to 126,600 in June vs. about 50,000 at end-2019, with easing Covid restrictions and border openings powering a modest economic recovery. Geopolitical risks hamstringing China and Hong Kong also drive more business flows to Singapore, where GDP rose 3.8% in 1Q and by 4.4% in 2Q. Hong Kong’s job vacancies shrank to about 54,000 in June from about 63,000 at year-end 2019.

Many foreign firms probably scaled back their business presence in Hong Kong due to 2019’s social unrest, the National Security Law, and rising U.S. China tensions. Hong Kong’s social restrictions — partly aligning with Beijing’s Covid Zero strategy — has crushed economic growth.