This analysis is by Bloomberg Intelligence Senior ESG Analyst Rob Du Boff. It appeared first on the Bloomberg Terminal.

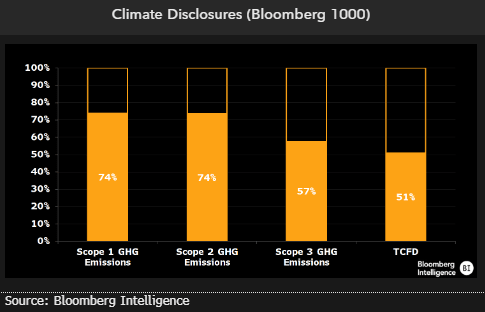

The SEC’s proposed climate rule may bring clarity to help investors manage risks and provide more transparency to ESG funds, but there’s much uncertainty about what Scope 3 requirements might look like when the rule is finalized, likely in the fall. The regulation, delayed more than a year and still facing significant legal challenges, would set parameters for how businesses talk about climate change, from board oversight and strategic operations through transition planning and scenario analysis. Only about half of the Bloomberg 1000 have plans for this level of transparency.

What’s at stake?

Mandatory Scope 3 Disclosures.

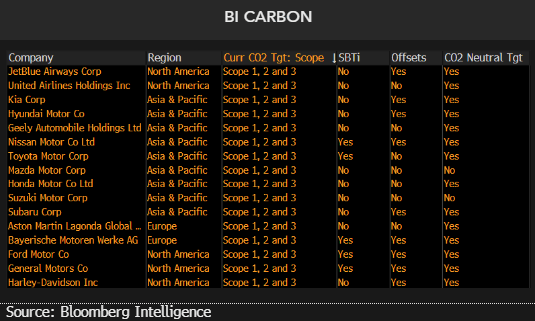

The biggest uncertainty as the market awaits the SEC climate rule is disclosure requirements for Scope 3 emissions where these are material or included in targets. Companies would need to report Scope 3 if they’re material — or over 40% of total GHG emissions, based on unofficial guidance — with the caveat that a quantitative threshold shouldn’t be the only consideration. The proposed rule gives enough help on the definition of Scope 3 emissions and a safe-harbor provision to encourage companies to make a good-faith estimate, but it got considerable pushback because of the potential impact of reporting on smaller suppliers. Only a few US companies, mainly automakers (GM, Ford), oil companies (Chevron, Occidental) and airlines (JetBlue, United) have set Scope 3 targets and disclose emissions.

What else?

Some Filers Must Play Catch-Up.

Only 15% of Bloomberg 1000 members have issued a Taskforce on Climate-Related Financial Disclosures report, with just over half the Index even mentioning TCFD in major filings, meaning costs for many as they get up to speed on reporting for 2024. About 74% divulged Scope 1 (operated) and Scope 2 (purchased electricity) emissions, and 57% for at least some Scope 3 (upstream and downstream) sources. The rules require disclosure of both constituent GHGs and in aggregate, absolute numbers and intensity per unit of economic value, and can’t include offsets. Professional services companies will also need to invest heavily to scale up assurance practices. The SEC estimated compliance costs for the first year of $640,000 (70% on outside services), dropping to $530,000 in later years for large filers.

Whats the outlook?

70% likelihood of October finalization, including modified Scope 3.

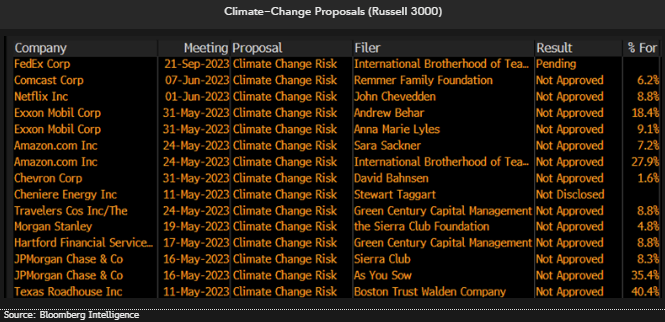

The SEC is in a tough spot, weighing pressure from investors and progressive lawmakers concerned about climate against incremental costs of collecting Scope 3 data, particularly up the supply chain to small companies. However, we believe investor demand for climate transparency is within the SEC’s mandate, and is supported by the number of shareholder resolutions seeking this data in recent years. There have been 70 US shareholder proposals this year specific to climate-change risk or GHG emissions, up 40% from 2022. Momentum was boosted by SEC guidance noting references to well-established frameworks like TCFD to alleviate concerns over complexity. So far, several got support from over 33% of shareholders, including at JPMorgan, Paccar and Texas Roadhouse.

What’s the issue?

SEC’s Long-Delayed Climate-Disclosure Rule.

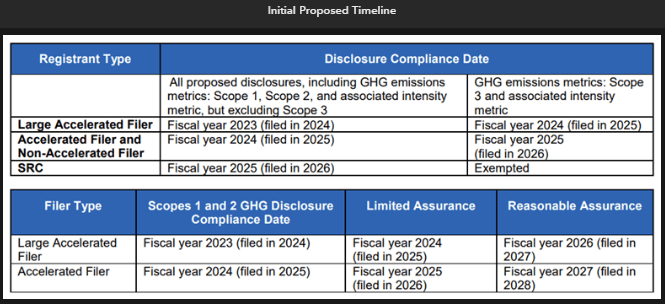

The SEC’s plan will standardize corporate disclosure around the framework of the Task Force on Climate-Related Financial Disclosures, helping shareholders quantify risks and track decarbonization. It will also mandate disclosure of Scope 1 and 2 greenhouse-gas emissions, with reasonable assurances by an independent expert. Scope 3 disclosure would only be required if it’s “material,” or if the filer sets Scope 3 targets. Finalization is now expected around October, a year later than initially anticipated. Accordingly, we think the current timeline (starting with 2023 filings for large accelerated filers) will be delayed at least a year, while aspects such as Scope 3 are modified from the draft rule. Michael Bloomberg, founder and majority owner of Bloomberg LP, is chair of the TCFD.