Revenge travel on steroids? China’s reopening in five BI charts

This analysis is by Bloomberg Intelligence Regional Market Analyst John Lee. It appeared first on the Bloomberg Terminal.

China is about to unleash its vacation-starved masses upon the domestic and international travel scene after nearly three years of lockdowns and social restrictions. We highlight via five key charts the key industries and companies that could record exponential growth.

China’s Revenge Travel Could Shake Tourism: Asia Centric Podcast

Will this be a case of revenge travel on steroids? Will the sheer numbers of travelers overwhelm the system? Do warm welcomes await at their destinations? Or will Covid concerns lead to Chinese tourists being given the cold shoulder? Join host John Lee and Tim Bacchus, senior aviation analyst at Bloomberg Intelligence, as they assess the business impact of China’s resurgent tourism on Asia’s major airlines.

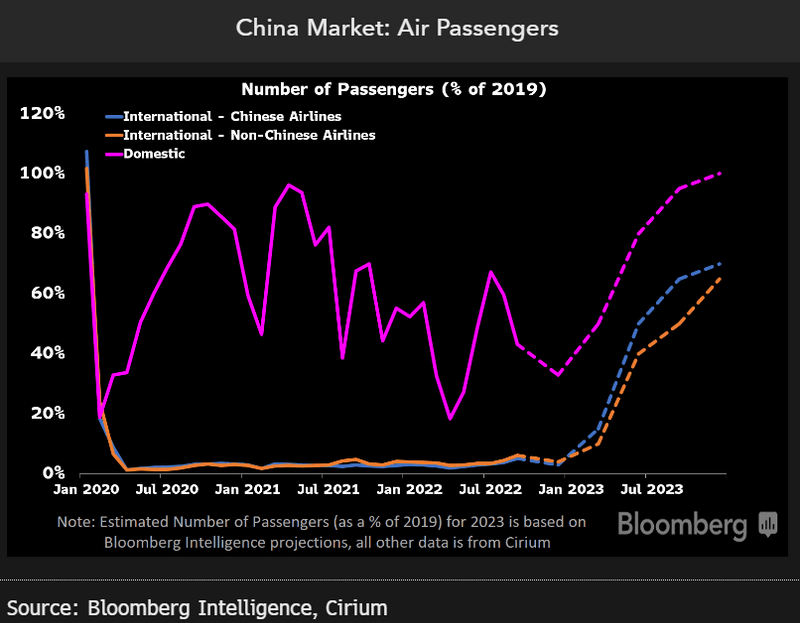

China could achieve an 80% air-passenger recovery by end-2023

China’s Covid pivot could lead to an 80% combined international and domestic air-passenger recovery by end-2023, according to BI senior analyst Tim Bacchus. The country’s domestic air-travel is likely to rebound quicker and achieve full recovery, while international travel is likely to hit 45% of 2019 levels by year-end. China’s largest low-cost carrier, Spring Airlines, and Cathy Pacific Group, which had a 22% exposure to the China market in 2019, are poised to benefit the most from China’s border reopening.

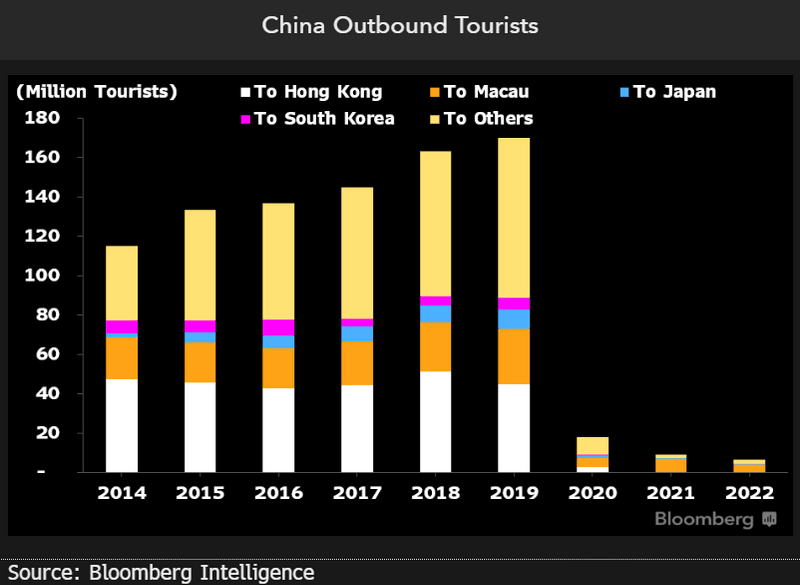

Chinese tourists might prefer Macau, HK, over Korea, Japan

China’s tensions with South Korea and Japan are intensifying after both countries tightened border restrictions against tourists from mainland China, Hong Kong and Macau in late December. China retaliated by denying short-term visas to both countries. Such border hurdles could boost the appeal of other offshore destinations, including Macau and Hong Kong, according to BI gaming and hospitality analyst Angela Hanlee. Japan and South Korea accounted for 9% of Chinese outbound tourists in 2019, vs. 16% for Macau.

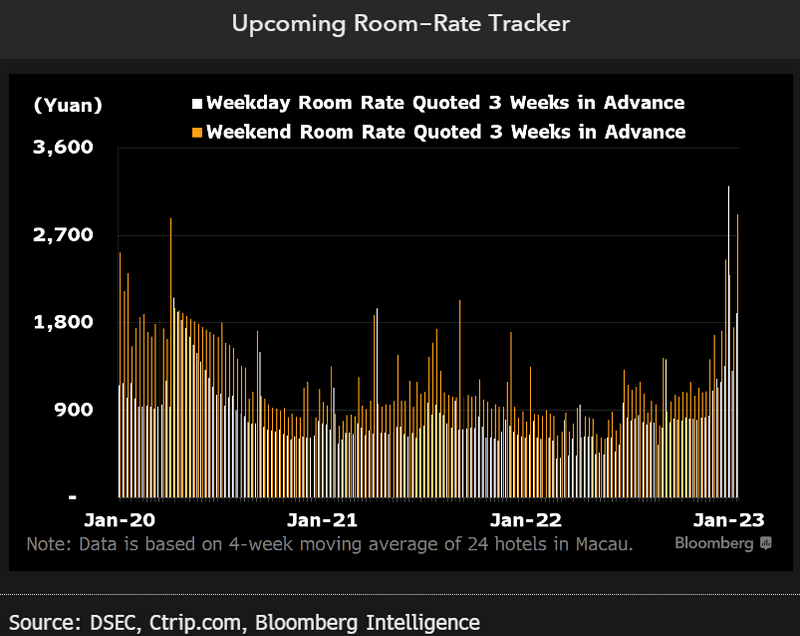

Average Macau room prices surge to almost $500

Macau hotel occupancy rates during Lunar New Year in late January could hit a record high since the pandemic began after bottoming out in March-May 2022, if advance room rates are an indication. Average room rates have jumped 171% year-over-year to $475 (3,200 yuan) and strong trends are continuing into February. Macau casino operators such as Galaxy and Sands China could post a sharp recovery in 1Q.

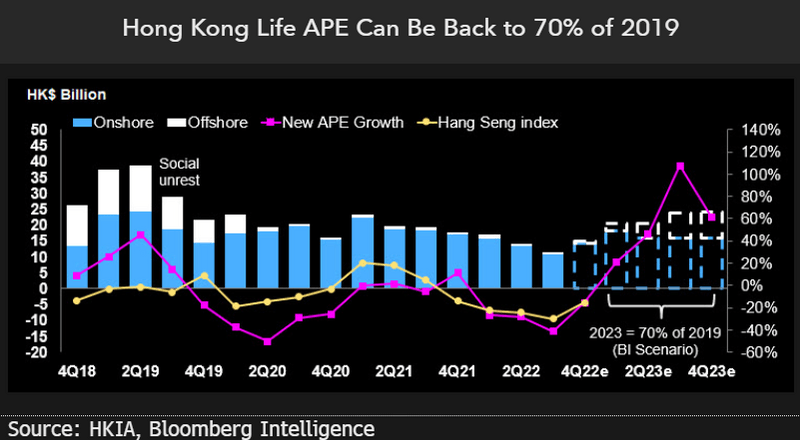

Hong Kong’s new life premiums might jump 60% with open borders

Pent-up purchase demand accumulated since the pandemic and the desire to diversify assets could drive Chinese visitors to splurge on life-insurance products in Hong Kong. According to BI insurance analyst Steven Lam, Hong Kong’s new life premiums might surge 60% this year to about 70% of 2019’s level. AIA and Prudential’s new annual premium equivalent (APE) could double in 2023.