APAC ex-JP

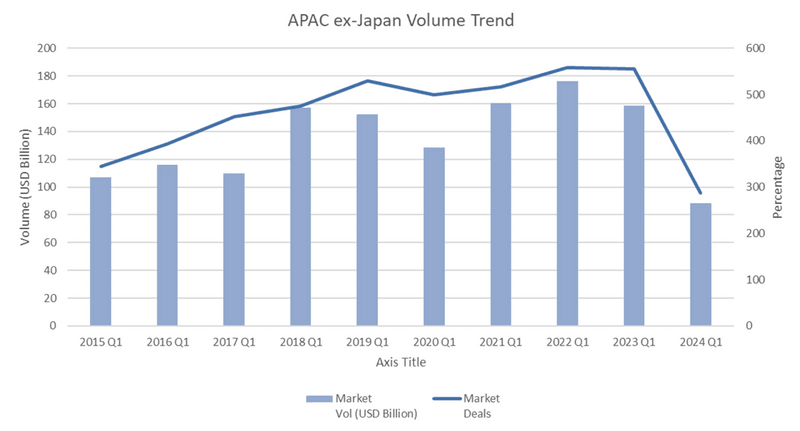

The APAC ex-Japan syndicated lending started off 2024 with a $88.46 billion market volume in Q1, a slump of over a quarter in comparison to the same period last year. For this loan volume, refinancing, general corporate purposes and capital expenditures each accounted for around 20% of the loan purposes, all of which were the leading use of proceeds in 2023.

Source: Bloomberg

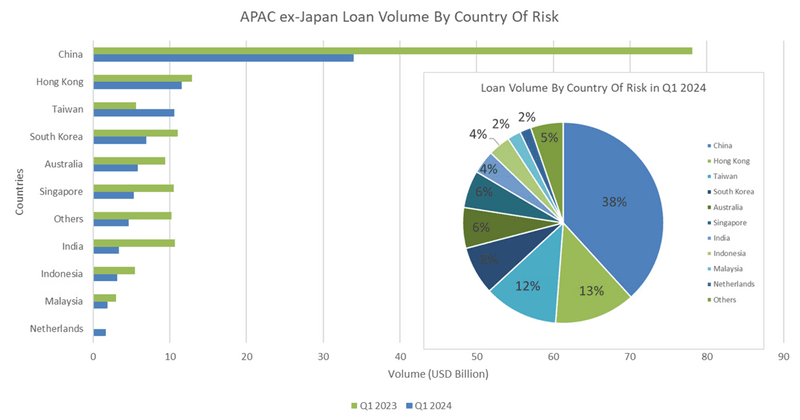

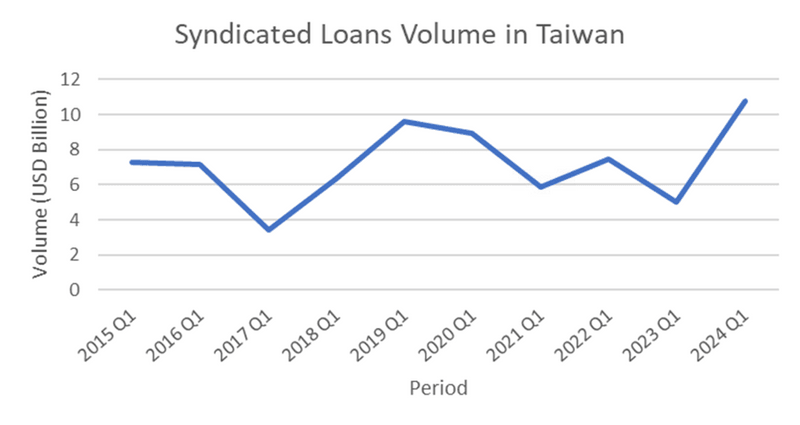

Worth noting, despite the weak loans supply, Taiwan borrowing market witnessed a huge emergence of demand totaling $10.59 billion, which was almost twofold year-on-year growth in volume. With such a surging demand, Taiwan’s issuances came up from the 8th in Q4 2023 to 3rd in Q1 2024. Meanwhile, China remained as the dominant contributor of the borrowing market, comprising almost 40% of the regional deal volume.

Source: Bloomberg

Across APAC ex-Japan, the 3 largest issuances syndicated this quarter were to Guangdong Shenda Intercity Railway Co Ltd for a CNY 23.9 billion facility, Isola Castle Ltd for a CNH 14.96 billion deal to acquire Vinda International Holdings Ltd and Wuxi Metro Group Co Ltd for a CNY 14.33 billion deal. Among the bookrunners and mandated lead arrangers, Bank of China took the top spot, followed by Bank of Communications and KB Financial Group Inc.

Greater China

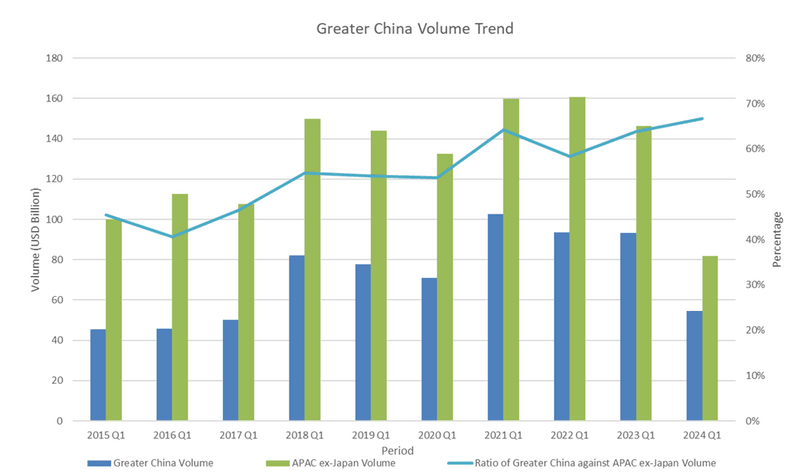

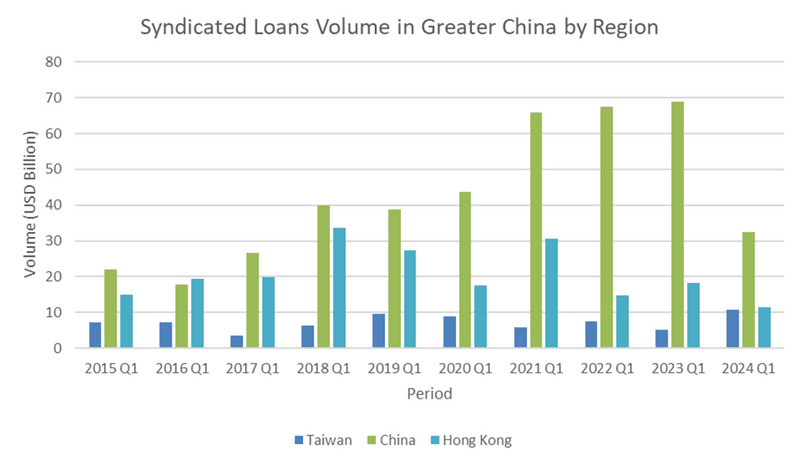

Syndicated lending in Greater China dropped by 42% year-on-year, with a total issuance volume of approximately $56 billion in 2024 Q1. China offshore market saw a 5% year-on-year increase in contribution to APAC ex-Japan ex-CNY market. Looking at individual markets within Greater China, Hong Kong and China experienced significant drops in issuance, which have decreased by 37.3% and 52.9% respectively. On the other hand, the loan transaction volume syndicated in Taiwan has increased by 114% year-on-year, marking a record high in the last ten years. Due to the uncertainty of US interest rate cuts, the cost of capital of the US dollar remained high, and thus the market opted for other currencies. The Greater China market saw higher issuance volumes denominated in TWD and CNH in the quarter.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

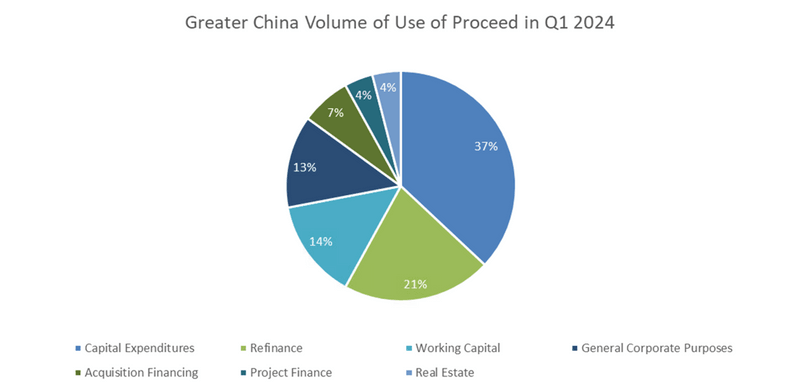

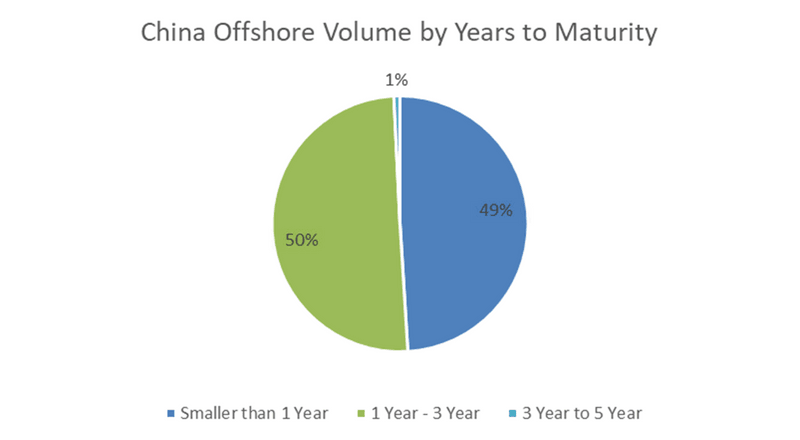

In the Greater China market, 37% of syndicated loan issuance was used for capital expenditures, followed by refinance (21%). M&A activity became active, with the rise of 21.3% in transaction volume from Q1 2023 to Q1 2024, and thus contributing a notable 6% increase in loans for acquisition financing. For China’s offshore market, there will be approximately $2.72 billion loans being matured this year which is 49% of total loans volume in Q1 2024. This implies a positive outlook for Greater China for potential new transactions especially for acquisition financing. It is worth noting China’s National Administration for Financial Regulation (“NAFR”) drafted “The Guidelines for Syndicated Loan Business” and sought public opinion on 22nd March 2024. The measures aim to enhance transparent and fair pricing for syndicated loan transactions in the market, and thus support the healthier environment to lower the risks.

Source: Bloomberg

Source: Bloomberg

ASEAN

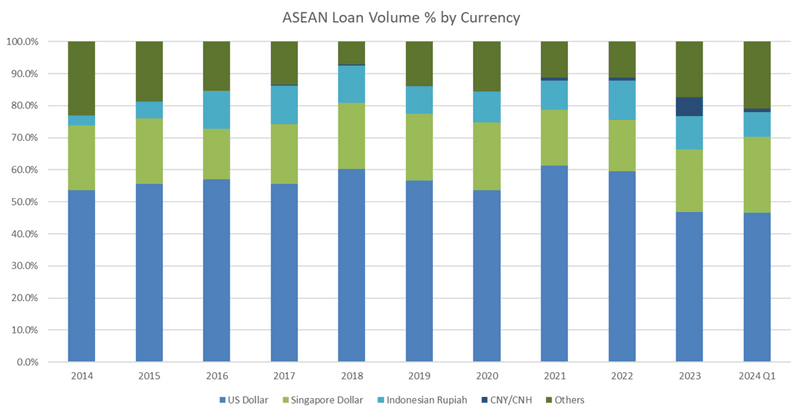

Syndicated borrowing amongst ASEAN borrowers in Q1 saw a quiet quarter in line with the broader APAC region, with a drop of 38.2% in Q1 volume year-on-year, totalling $15.1 billion. The momentum of strong demand from ASEAN borrowers in 2023 did not carry over into Q1. Overwhelming amounts of loans were raised for refinancing sitting at 61.4% of the total volume, while the volume for general corporate purposes and project finance came in only at 15.6% and 12.7% respectively. As the global economy watches closely on rate cut decisions from FED in 2024, dollar denominated loans continue to stay at historically low levels at 46.7% of the loan volumes, down from the peak of 61.4% in 2021.

Source: Bloomberg

Source: Bloomberg

The 3 largest corporate syndicated loan issuances in the region in 2024 Q1 were Trafigura Pte Ltd for a $1.90 billion facility, PnB-Kwasa International 2 Ltd for a GBP 1.11 billion ($1.42 billion) facility, and Indah Kiat Pulp & Paper Tbk PT for a $1.41 billion equivalent dual-currency facility. Among the mandated lead arranging banks, Oversea-Chinese Banking Corp started the year strong claiming the top spot, followed closely by DBS and SMBC, making up market shares of 11.2%, 10.9% and 8.9% respectively. Among the bookrunners, SMBC claimed the top spot, followed by Oversea-Chinese Banking Corp and DBS, with market shares of 9.5%, 9.3% and 7.9% respectively.

ESG

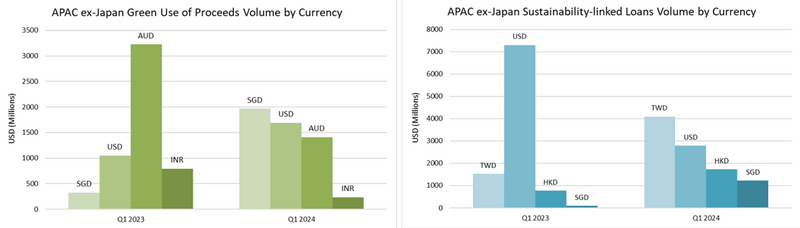

Green and sustainability-linked syndicated lending in Q1 of this year totaled $16.6 billion, a 5% drop from Q1 of last year. The Singapore Dollar dominated green loan lending with 33% of green loans in the region issued in SGD, while 38% of sustainability-linked loans were issued in the Taiwan dollar.

Source: Bloomberg

Sector-wise, borrowers in the industrials sector led the borrowing activity for green loans while those in the financial sector led the borrowing activity for sustainability-linked loans.

Similar as in the previous quarters, renewable energy projects (44%) saw the most investment from green loan issuance, followed by green buildings and infrastructure projects (28%). The largest green loan of the quarter was issued to Polestar Automotive Holding UK for $951 million, to be used for investments and expenditures in electric and hybrid vehicle design and manufacturing.

For sustainability-linked lending, the dominant KPI in Q1 continues to be greenhouse gas emissions (23%), followed by gender equality (11%). The largest sustainability-linked loan of the quarter was issued to AUO Corp for TWD 40 billion ($ 1.2 billion), with the borrower receiving a margin reduction upon becoming a member of the DJSI World, with the step down tied to the borrower’s ESG ranking of 4 dimensions: Environmental, Social, Governance & Economic, Total Sustainability Score. The borrower is expected to receive a margin reduction of 2-6bps depending on the dimensions achieved with 90 or above in ranking.

In terms of bookrunner and arranger rankings, DBS has topped the list as the lead bookrunner and mandated lead arranger for syndicated green loans across APAC, while Taipei Fubon led in bookrunning efforts and Mega Financial in mandated lead arranging efforts for sustainability-linked loans across the region.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except that Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products in Argentina, Bermuda, China, India, Japan and Korea. BLP provides BFLP with global marketing and operational support. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. BLOOMBERG, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG TELEVISION, BLOOMBERG RADIO and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries. Copyright: 2024 Bloomberg.