Institutional investor interest in multi-asset and cross-asset strategies is accompanied by an emphasis on workflow system integration. We have found that, although institutions may be using pair strategies in their executions, they have not implemented pair algorithms due to electronic trading workflow limitations. Fortunately, technology innovations exist that offer multiple integration solutions. We discussed this during our recent presentation at the Alpha Trader Forum Global Summit in London, and we surveyed institutional investors on cross-asset strategies.

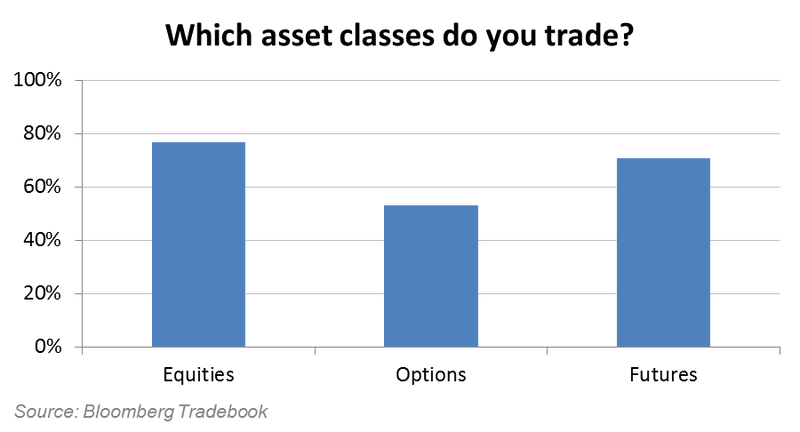

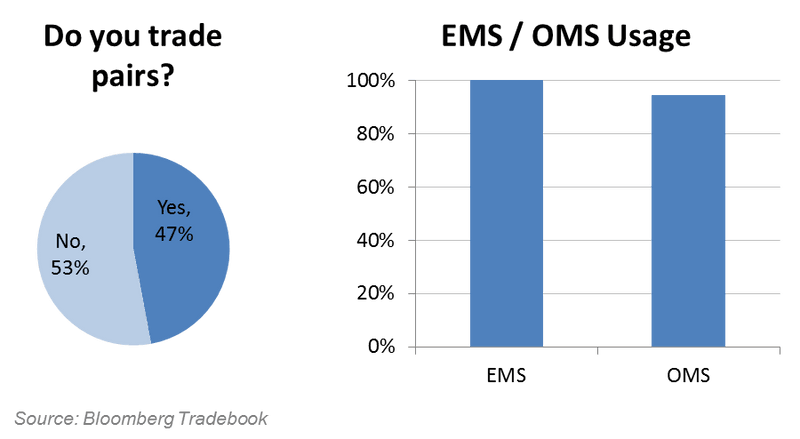

Many attendees indicated that they trade multiple asset classes—76 percent Equities, 53 percent Options, and 71 percent Futures. When asked if their firms executed pair-type strategies, nearly half (47 percent) responded Yes. In their execution workflows, 100 percent of respondents use an Execution Management System (EMS), with 94 percent also using an Order Management System (OMS).

Even though nearly a majority of respondents trade pairs, an electronic workflow challenge faced by many institutions is the certification of cross-asset algorithms into their EMS and/or OMS. It is important to identify and leverage integrated solutions due to the versatility of cross-asset algorithms. We do however recognize that the complexity of pair and cross-asset algorithms and their non-standard parameters have been a hurdle to their implementation in EMS’ and OMS’. In this discussion we interchangeably use the industry-common terms “pair” and “cross-asset” to describe these algorithms that can execute two or more securities simultaneously.

Single-order and list algorithms will have common parameters at the single-order level, such as time-scheduled slicing, bid/ask spread capture aggression levels, or percentage of volume participation. Cross-asset algorithms, on the other hand, will apply additional parameters on the defined relationship of the securities, such as the spread or ratio between the securities trading simultaneously.

Whereas a single-order or list of algorithms execute independently, a cross-asset algorithm is aware of the other securities trading at the same time. In other words, a cross-asset strategy is a contingent order—the action of one order is dependent on the action of another order.

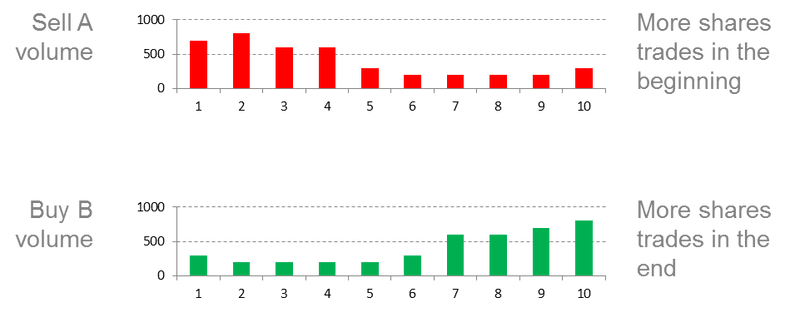

To illustrate with volume profiles, we have 2 orders (selling security A and buying security B) with the equivalent quantities to be executed. The two VWAP (Volume-Weighted Average Price) algorithms will independently complete each order. In the diagram below, selling security A could finish before the buy order in security B is completed, because more volume is trading for security A in the beginning.

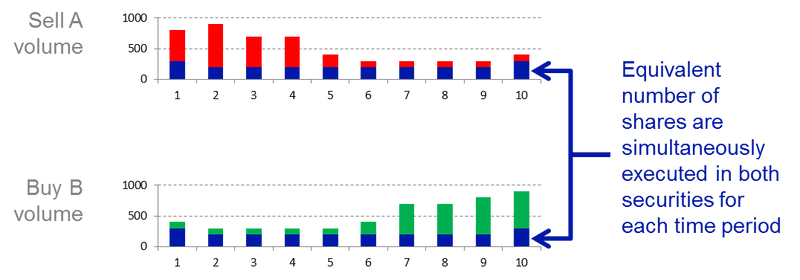

In comparison, a pair algorithm will simultaneously execute both orders on a pro-rata basis, in conjunction with the defined relationship between the two securities. Taking the same example, where the same total quantities need to be executed for each order: the pair algorithm will keep the number of shares executed balanced for each time period.

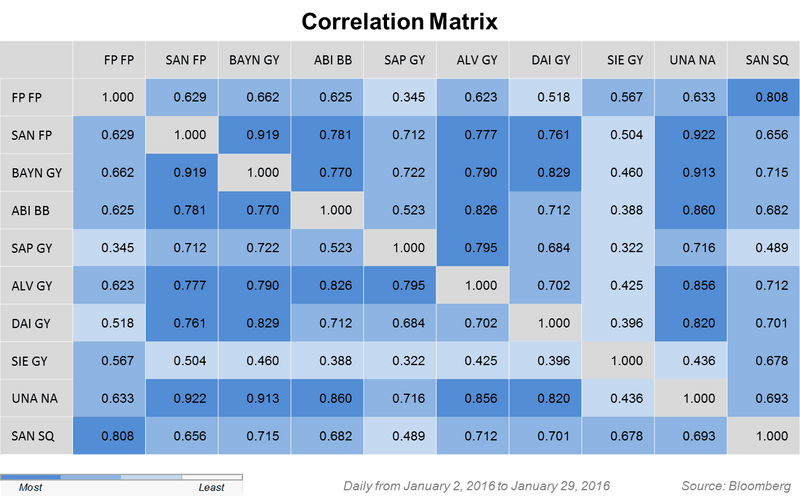

In our Alpha Trader Forum presentation, we described the components of pair algorithms. Using a correlation matrix, we pointed out that individual securities aren’t random walks, but are influenced by other securities or markets. For example, two pharmaceutical companies Sanofi [SAN FP] and Bayer AG [BAYN GY] have a significant correlation (0.919) with each other. Household products manufacturer Unilever NV [UNA NA] also has a significant correlation to each of them (0.922 vs Sanofi, and 0.913 vs Bayer AG), as they are all in the consumer sector. The audience recognized that their orders are not executed in isolation, but can be impacted by other market forces.

If a statistical relationship can be identified between 2 securities, then the relationship can be defined with a formula. Common formulas are:

- Spread = price A – price B

- Ratio = price A / price B

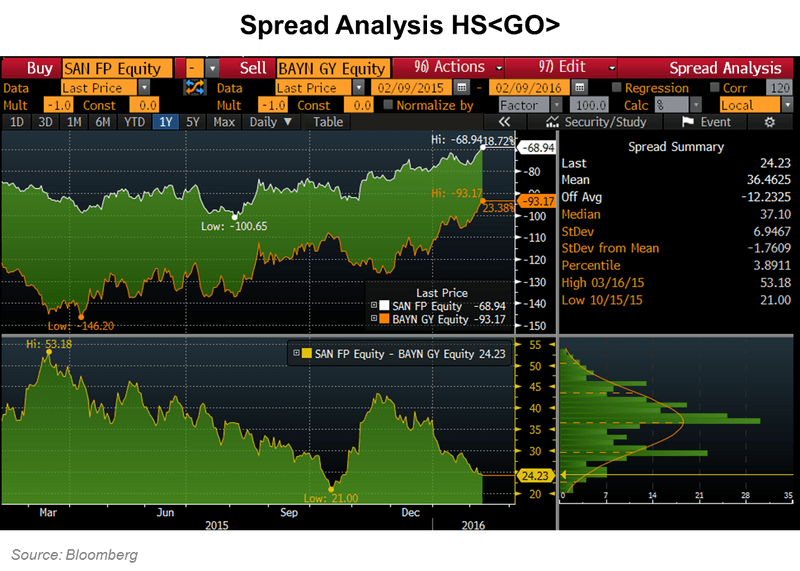

To analyze a Spread or Ratio, the Bloomberg functions HS<GO> and GR<GO>, respectively, can be used.

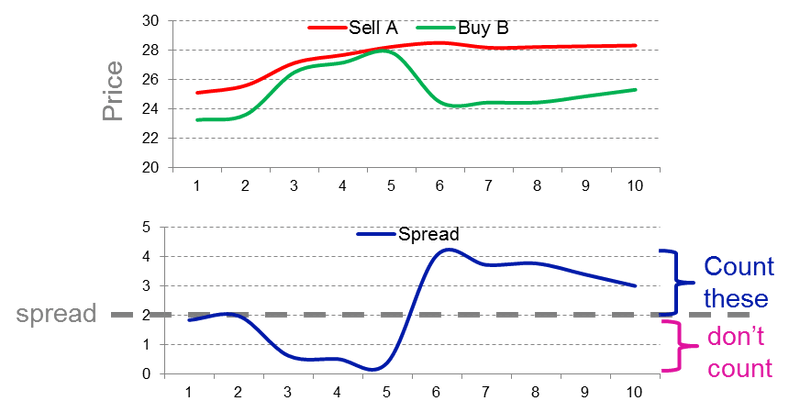

To illustrate how a pair algorithm works, let’s use a Spread example. As defined previously, a Spread is the price of security A minus the price of security B (price A – price B). In the diagram below, Selling A and Buying B, we’ll use the value of 2 as the spread to start trading the pair.

The first condition for a pair algorithm execution is to look at the relationship between the two security prices. When the spread between A and B is higher (or wider) than 2, then it is the right time for the pair algorithm to trade. The Sell A security is trading higher, and/or the Buy B security is trading lower. When the spread is less than 2, the pair algorithm is not trading. In our example above, the pair algorithm should be trading after time period 6.

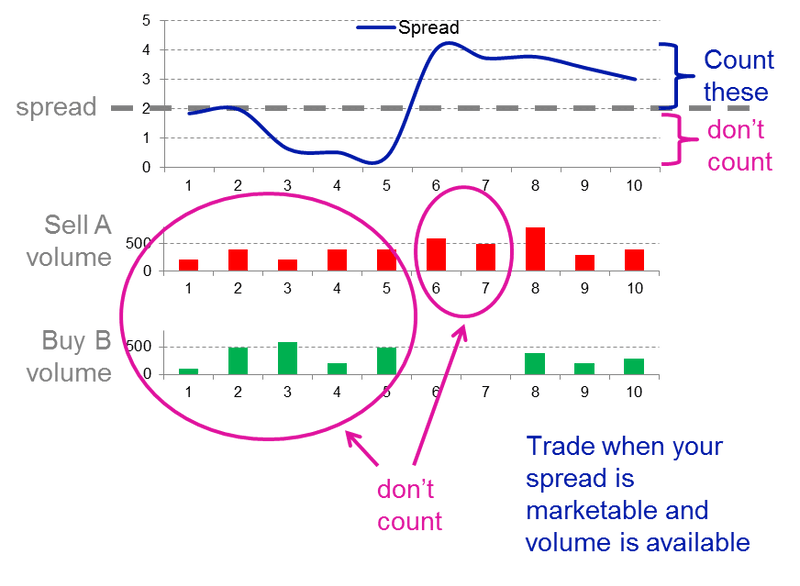

We described earlier a second condition for a pair algorithm to execute—when volume is available in both securities at the same time. Looking at the same spread example, after time period 6, the price spread is higher than our 2 limit, and should be executing. However, no volume traded for security B during time periods 6 and 7. Therefore, the pair algorithm will only start executing after time period 8 when both the price and volume conditions are met.

As discussed, single-order algorithms executing independently from each other may optimize the execution at the single order level. In contrast, a pair or cross-asset algorithm recognizes that correlation may exist between the 2 securities, which could optimize the execution for other factors, such as, maintaining market or cash neutrality between a buy and sell order or handling the price correlation between the 2 securities.

In our next installment of this series, we will take a more detailed view into how pair algorithms work.