This blog is the fourth installment on ETF trading that is excerpted from a Journal of Trading paper published by our quantitative research team.

On ETF-specific algorithms, we believe that applying unmodified common stock execution techniques to ETFs will result in suboptimal execution.

At a macro-level, an unmodified stock execution algorithm will often extend the trading horizon by over-emphasizing stealth versus speed. ETFs can be traded more rapidly than stocks of similar liquidity, so for example a 60-minute execution strategy for a stock might only be a 20-minute execution strategy for an ETF.

Conversely, at the micro level, the picture is completely different because the way ETF order books function actually makes the slower firing of orders beneficial. The key is for the ETF algorithm to pause before moving to the next price level in the order book, to allow liquidity at the existing price level to replenish, thus presenting an opportunity to trade again at a better price. By contrast, an execution algorithm that steps immediately to the next price level after clearing out the current level (or one that fires orders at multiple price levels simultaneously) is almost inevitably overpaying/underselling.

We believe that brokers should incorporate ETF-specific execution algorithms to reflect the above characteristics, plus some sort of a short term ETF-specific price prediction model to provide a reliable indication of the immediate direction of the ETF that can help to determine whether a more/less aggressive trading stance is appropriate (i.e. if it is worth crossing the spread). Coupling these models with ETF-specific execution techniques will allow the broker to deliver more effective ETF executions.

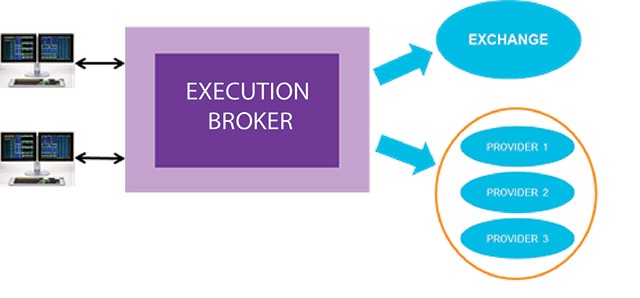

- Aggregation: The platform electronically aggregates ETF liquidity from multiple liquidity providers to dynamically source best prices and liquidity

- Anonymity: The platform is anonymous to minimize information leakage and protect the interests of institutional clients

- Analytics: The platform provides actionable statistical guidance on optimal execution strategies as illustrated in Figure 2.

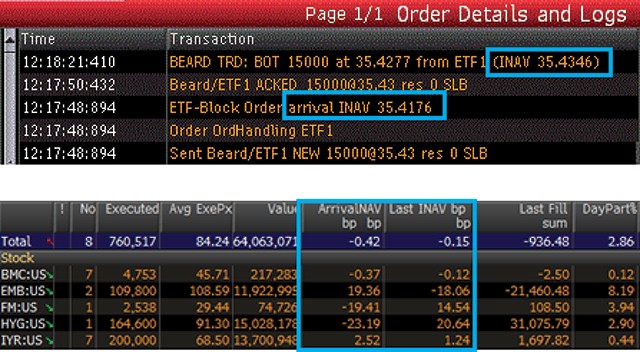

- Audit Trail: The platform provides full order handling transparency in terms of order details and transaction logs. It includes relevant ETF benchmarks such as Arrival INAV and LastFill INAV. It should also deliver interactive pre-trade and post-trade analytics with the same Arrival and LastFill INAV benchmarks captured by the order logs. Figure 3 shows samples of audit trails.

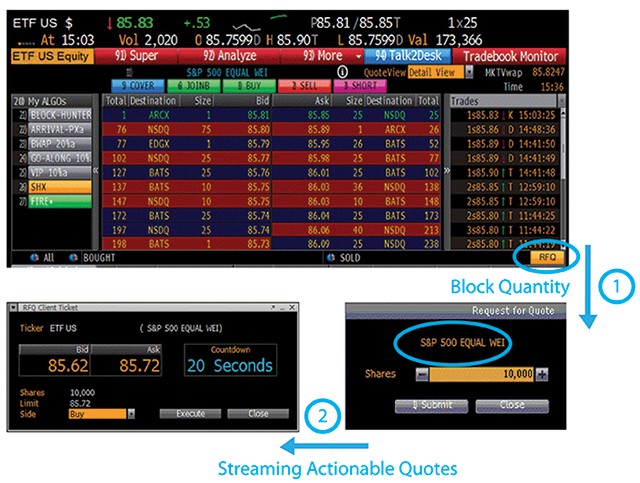

Tradebook’s ETF RFQ (Request-For-Quote) platform anonymously sources block liquidity from multiple providers. To initiate a request for quote, traders can click on the “RFQ” button on the bottom of the ETF single-security montage. The trader is prompted for the block quantity and the RFQ is sent to a diverse set of market makers who return two-sided quotes. The trader can then either decline or accept the bid or offer to consummate the trade.

Putting it all together, Figure 4 shows Tradebook’s ETF RFQ trading platform which gives institutional clients the ability to launch RFQ ticket and enter a block quantity. After the request is submitted, liquidity is sourced from a diverse set of market-makers and authorized participants to provide actionable quotes.

One of the greatest challenges with the current market structure is that the most important insights are often buried beneath the data. In the case of ETFs, addressing that involves two steps:

- Deciding when/where/how to tap primary market liquidity from authorized participants or when/where/how to tap secondary market on-exchange liquidity.

- Being able to act upon the resulting decisions as quickly and efficiently as possible.

- Practical experience shows that in the case of relatively small order size as a percentage of ADV a combination of schedule driven algorithms (such as TWAP, VWAP or Volume Participation) and ETF specific algorithms works well. The algorithms should minimize adverse impact especially if on-exchange liquidity is thin.

For relatively large orders sizes as a percentage of ADV, an Electronic RFQ based platform can obtain anonymous quotes on blocks from a network of liquidity providers, market-makers and authorized participants minimizing market impact. Authorized participants can initiate the ETF creation/redemption which can then be delivered to the trading entity.

Individual circumstances vary considerably, but two execution strategies that make the best of both primary and secondary ETF liquidity are:

- Anonymously purchasing an initial block of ETFs from an ETF liquidity provider and putting the remainder of the order into an ETF specific algorithm

- Starting in a ETF specific algorithm and picking points at which to buy (sell) blocks of ETFs anonymously from (to) an ETF liquidity provider through an electronic RFQ based platform.

As part of the Quantitative Product Development team, Kiran Pingali works on multi-asset trading products for Bloomberg Tradebook. Kiran started his career at Citigroup Japan where he worked in Equities Technology and Equities Quantitative Research. He then worked for Lehman Brothers, Japan in their Equities Electronic Trading Desk providing Execution Services to Hedge Fund and Institutional clients trading Pan-Asian Equities. Most recently Kiran worked at Thomson Reuters, New York as a Global Product Manager in their Quantitative and Event Driven Trading Solutions Group.