This analysis is by Bloomberg Intelligence Senior Industry Analyst Salih Yilmaz and Bloomberg Intelligence Senior Industry Analyst Will Hares. It appeared first on the Bloomberg Terminal.

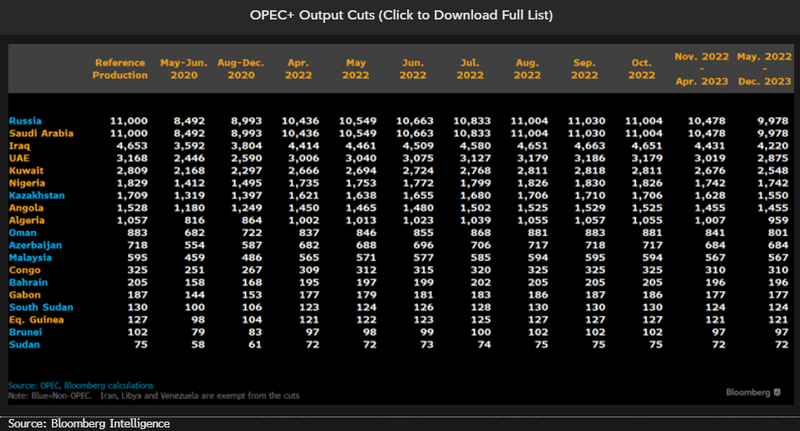

OPEC+’s surprise output cut of 1 million barrels-plus a day looks designed to provide price support following pressure from weak macroeconomic sentiment amid recession fears and banking turmoil and may deepen the market deficit to over 2 million barrels a day in 2H as Asian demand booms. That sets the stage for a price close to $100 a barrel.

Unexpected OPEC+ move to tighten market in 2H

The surprise 1.1 million barrel output cut by OPEC+ — led by Saudi Arabia’s “voluntary” cut of 500,000 barrels a day — may deepen the oil market deficit in 2H, which we our core scenario puts at more than 2 million barrels a day. A significant increase in oil demand as China reopens and constrained supply — exacerbated by the group’s additional cuts — are likely to outweigh any potential effect of a recession on demand, setting the stage for a very tight market and higher oil prices, likely closer to $100 a barrel. OPEC+ is likely to defend its move as a pre-emptive decision, once again, driven by recessionary challenges and a bleak oil-demand outlook.

The group of producers continues to demonstrate it can be reactive to changing market fundamentals, having responded to numerous uncertainties in the past couple of years.

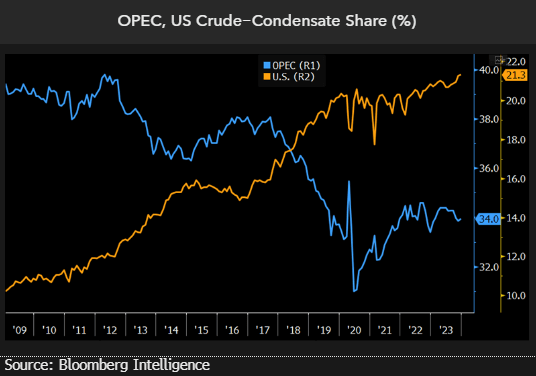

Over past decade OPEC lost market share

OPEC’s global crude and condensate-supply share has fallen 10 percentage points over the past decade, with almost all of this ground ceded to American shale producers. That’s driven up the US global supply share by 9 percentage points over the period.

Though the backdrop of slowing oil-demand growth — as a result of greater fuel efficiency and a steady increase in electric vehicles — may also raise doubts about OPEC’s relevance, the group’s supply management in 2020 deminstrated its continued importance to bringing balance to the market and reducing volatility.

Call on OPEC crude has been diminishing

Potentially lower Russian output as a result of sanctions suggests there may be greater need for OPEC supply — also known as “call on OPEC” — this year. The International Energy Agency expects call on OPEC to be about 29.7 million barrels a day in 2023 — up from 29 million in 2022. In 2021, OPEC and the US Energy Information Administration lowered their forecasts for the global needs of OPEC crude, given the adjusted projections for reduced oil demand and higher non-OPEC crude production.

Call on OPEC is the difference between global oil demand and non-OPEC crude production. The Saudi Aramco, BP, Shell, Total, Exxon, Chevron, Rosneft and Lukoil are among the world’s major oil producers.

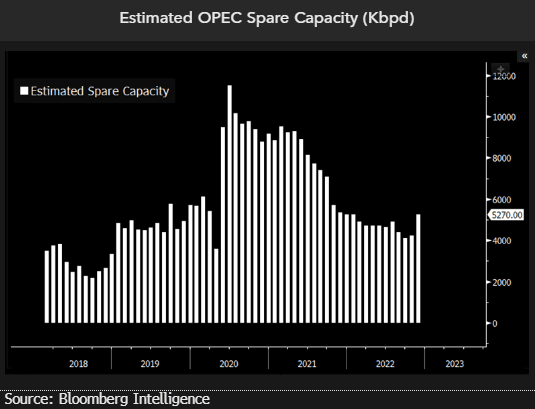

OPEC’s spare capacity is still relatively low

OPEC has held meaningful spare capacity since the pandemic, though a tapering of output cuts means this will continue to decline. Meanwhile, the group is regaining market share as oil demand gradually recovers. The high level of unused capacity within OPEC has been one of the main reasons that crude prices have been more immune to supply shocks, as demonstrated by the 2019 missile attacks on Saudi Arabia. The abundance of available supply has therefore made a sudden oil-price surge less likely.

The largest shares of OPEC’s 4.8 million barrels a day of spare capacity are held by Saudi Arabia (34%), Iran (27%), the United Arab Emirates (20%) and Iraq (7%).