Successfully navigating the highly sophisticated Agency MBS market requires advanced models and analytics. Bloomberg’s mortgage valuation platform – with the Bloomberg Agency MBS Index Prepayment Model (BAM) at its core – is the industry-leading solution for conducting Agency MBS calculations and analysis.

With the recent surge in conventional MBS refinancing and uncertainty stemming from the expiry of COVID-19 related forbearance programs, a consistent and robust valuation framework for managing market and prepayment risk is increasingly important. BAM enables users to utilize the most extensive coverage of the Agency MBS market, react rapidly to changes in the market environment, and stress test securities.

BAM empowers users with cutting edge models that incorporate the latest trends in refinancing activity, servicer behavior, mortgage rates, unemployment, delinquencies, forbearance programs, home prices and government programs – all with customizability (via a wide array of model overrides) and the flexibility to adjust to market changes in real-time.

BAM was recently updated to incorporate key changes in the mortgage refinancing outlook and economic projections. On Jan. 8, 2021, the new BAM model, V1.42, became the production model used in Bloomberg systems (Terminal, Index, and PORT).

What’s new for the Bloomberg Agency MBS Index Prepayment (BAM) Model?

The BAM updates reflect a return to pre-financial crisis like refinancing behavior. Record lows in mortgage rates combined with recent changes in origination technology (property inspection waivers, etc.), rising employment in mortgage lending operations, as well as strong gain on sale for MBS have together led to a regime change in the refinancing response. In particular, conventional prepayments over H2 2020 have been 1.5-2x faster (when controlling for rate incentive) compared with other post-crisis refinancing episodes (late 2019, 2016, 2012-13).

Key model updates include:

- Updated conventional and GNMA models (30Y, 15Y, and ARM)

- Steeper s-curves, stronger burnout and stronger media effect

– Updates aim to capture the regime shift in conventional fixed-rate prepayments - New LLPA adjustment for conventional refinance loans

– Model incorporates higher delivery fees (50 bp. upfront adds 12.5 bp. to mortgage rates) for refinance loans with balance > $125K delivered to the GSEs after Dec 1, 2020 - Updated economic scenarios and HPA forecast

– New model incorporates stronger than expected home price appreciation and housing market outlook (6% 2020, 3.5% 2021, 4.0% 2022, 3.8% 2023 versus -3% 2020, 0% 2021, 6.5% 2022, 4.5% 2023 in V1.41) - Lower Conventional and GNMA CDRs

– Improving economic prospects point to better cure rates for borrowers coming out of forbearance agreements - Updated primary secondary spread model

– New model assumes that primary secondary spreads remain elevated (~8bp wider than implied by historical data as of December 2020), then revert linearly to historical levels by June 2021.

Impact on analytics

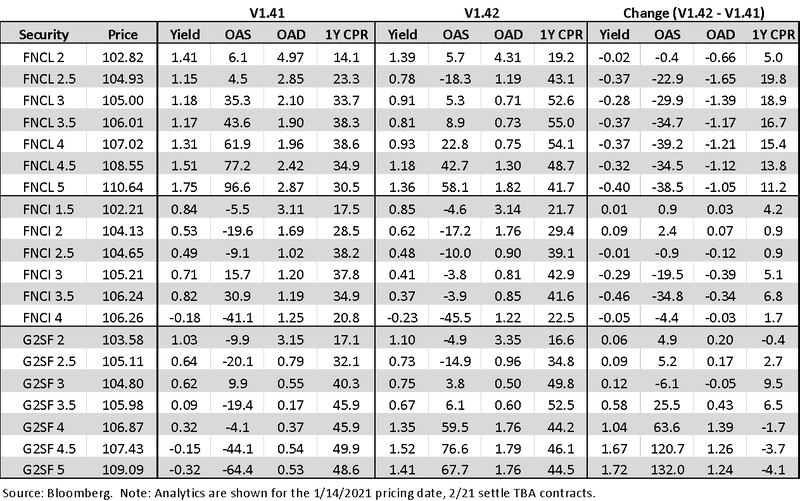

The new model version has a stronger refinancing response, particularly for conventional 30Y collateral. However, for other types of collateral, the impact to TBA analytics is mitigated somewhat by wider primary secondary spreads, the new LLPA for refinance, and stronger burnout. As a result, OAS, OAD, and 1Y CPR changes are smaller — or in some cases opposite — to what one might initially expect. A summary of changes to TBA analytics is shown in the table below.

- UMBS 30Y have lower OAS and shorter duration relative to previous model version. Stronger refinancing behavior in the new update overwhelms the effects of the new LLPA and wider primary-secondary spread model.

- UMBS 15Y display unchanged (lower coupon) to tighter OAS and OAD. Relative to 30Y collateral we have weakened the refinancing response for 15s, and consequently, we see a much smaller change in analytics versus previous version.

- G2SF 30Y generally display higher OAS and longer OADs. Stronger burnout in the model combined with a reduction in CDRS are the primary drivers.

How can users access the new BAM model?

On the Bloomberg Terminal

- As BAM V1.42 is now the default model, you can see model analytics and projections in any of the screens that support them (e.g. OAS1, SYT, etc).

In the Excel API

- Limited OAS and static BAM model analytics are available through BDP for the previous business day’s close (for OAS) and real time (for static analytics).

Dynamically in Excel via CMP

- To run BAM v1.42 or model overrides across thousands of securities more efficiently, you can subscribe to Core Mortgage Premium (CMP). Accessed via the Bloomberg API, CMP gives you the full power of SYT, OAS1, and more in a programmatic environment using the Microsoft Excel API wrapper. For more information, visit CMP <GO> on the Bloomberg Terminal.

Learn more

BAM model documents and reports are available on the Terminal through the Bloomberg Mortgage Market Insight (BMMI) page.

Model White Papers

A write up on the BAM V1.42 model update and other BAM model documents are available on:

BMMI <GO> -> BAM – Bloomberg Agency MBS Index Prepayment Model Documents

For the latest updates, see the BAM V1.42: Prepayment Model Update (Dec 22, 2020)

Model Error Reports

The BMMI page also contains fixed-rate and ARM collateral error reports, as well as error reports for the mortgage rate model.

BMMI <GO> -> Model Projections > BAM Reports / Prepay Reports.

For a tutorial on the full capabilities of the model, please contact your Bloomberg Sales Representative.