ARTICLE

Navigating derivatives market sentiment with volatility and correlation analysis

Functions for the Market

- There are a variety of pre-trade and derivatives trading tools that help examine market sentiment and formulate options strategies.

- This analysis explores such tools using the September 2024 Hong Kong stock market surge as an example.

- During the surge, The Hang Seng Index and other related indices showed strong technical breakouts in mid-September, while options market sentiment seemed to be turning less bearish.

Bloomberg APAC Market Specialist Kenny Chong, Equity and Quant Advanced Specialist Matthias Man, and Senior Equity Specialist Yoon Sik Yoo contributed to this article. The original version appeared first on the Bloomberg Terminal.

With the constant stream of events shifting markets and a proliferation of data related to it, how can derivatives market players quantify accurately market options exposures for options on single-name stocks, equity indices, and funds?

Leveraging advanced pre-trade analytical tools, investors can examine volatility curves and implied correlations of equity index to perform risk and scenario analyses for derivatives across asset classes.

PRODUCT MENTIONS

For instance, implied volatility skew compares the difference in implied volatility for the two moneyness levels such as comparing implied volatility between 90% (volatility on puts) and 110% moneyness (volatility on calls).

The value for volatility on puts is usually higher (puts are more expensive due to the natural demand from hedging market players being long the underlying). The higher the spread, the higher the risk the market’s pricing of the underlying price is going down.

You can also run pre-trade pricing and scenario analysis of different derivatives strategies using options, bond futures, listed or OTC warrants, short-term interest rate futures (STIRs), and exotic options such as variance swaps. This can be accessed via Bloomberg’s Option Pricer Equity/IR (OVME).

Notably, OVME uses interpolated market-implied volatilities when the underlying has an active market of listed options, allowing you to replicate the market conditions at the time of the trade. OVME also provides trading tools that allow you to manage and execute the trades you work up in the function.

Using the Hong Kong stock market surge as an example, we look at how OVME, together with other Bloomberg Terminal functions can be used in shaping options strategy.

Is a real estate-led rally about to ignite Hong Kong’s stock market?

Background

In September 2024, amid monetary easing by the Federal Reserve and corresponding measures by the Hong Kong Monetary Authority (HKMA), it appeared that Hong Kong stocks were on the rebound after four years of losses. HKMA dropped rates to 5.25%, down from a 17-year high, which could ease pressure on Hong Kong’s real estate market. The move was expected as Hong Kong’s currency peg keeps it in lockstep with the Fed.

Real estate is leading the recovery thanks to new Chinese policies designed to boost the market, including lower mortgage borrowing costs and reduced down-payment requirements for second homes. Real estate may gain further attention as traders have expressed disappointment with China’s broader, limited stimulus plans.

Analysts have raised earnings forecasts for companies in the Hang Seng Index from mid-year projections, meanwhile option traders are turning less bearish.

The issue

The Hang Seng Index, the iShares MSCI Hong Kong ETF and the MSCI Hong Kong Real Estate Index all showed strong technical breakouts in mid-September, with earning revisions rising over the coming years. Analysts suggest these improvements are tied directly to Federal Reserve monetary easing policies.

Analysts have raised forecasts for companies in the Hang Seng Index from mid-year, boosting the Bloomberg consensus estimate for forward EPS over the coming years. It signals a 14% total earnings rise over the next two years, which is modest, compared with a 33% gain at the end of 2023.

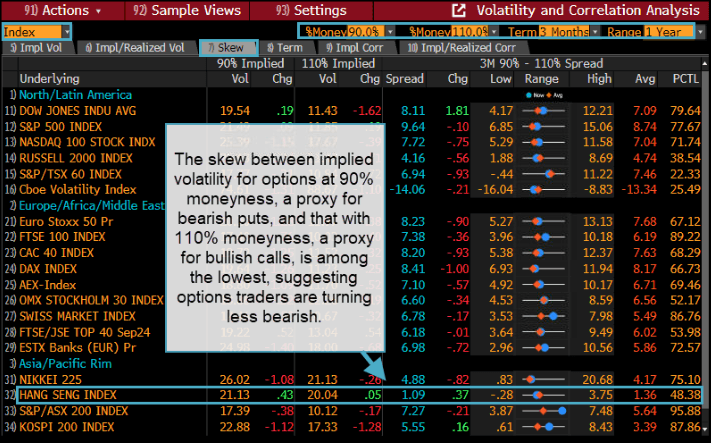

Meanwhile, looking at the options market sentiment, the skew between implied volatility for options at 90% moneyness, a proxy for bearish puts, and that with 110% moneyness, a proxy for bullish calls, is among the lowest, suggesting options traders are turning less bearish.

To check the skew for major stock indexes, investors can use Volatility and Correlation Analysis tool (VCA) on the Bloomberg Terminal. VCA allows users to analyze volatility across a universe of underlying securities including equity indices, index components, major commodities, and foreign exchange rates. This allows investors to perform rich/cheap analyses on implied and realized volatilities and determine which underlying has the steepest or most inverted skew and/or term structure.

VCA also allows index-implied correlations that help investors to determine the best time to execute a correlation trade on a certain index, as well as what components of the index should be included in the dispersion basket.

In our example, the PCTL column, which reflects the position of the most recent value, displays 48%. This suggests that its standing is becoming relatively neutral compared to the past year and appears less bearish in contrast to other major market indices.

Given that, option traders can formulate strategy that would pay out if the HSI would trade out of a certain range.

Tracking

To structure an option strategy, run OVME to price equity derivative products and strategies and develop an option strategy for HSI and others. To analyze stock markets use Bloomberg’s BI ATPR, EEG, VCA and OVME functions to analyze stock markets.

In this example investors can run HSI Index again, using OVME to price over-the-counter derivative contracts for equity underlyings.

The above example is structured to profit from a 10% gain or more in the Hang Seng Index with its payoff being flat when the gauge trades less than 10% either way. This so-called collar option cost the trader HK$71.98 per share (or Option Premium of 0.395% of the notional) with a 35 delta.

To see this options trade payoff, go to Scenario to Check the Profit and Loss Outlook for This Strategy in the selected period (in this case 12/30/2024 only).

There is downside protection for this collar all the way around 16,400 level for the HSI, and it starts to profit if the index rises above 20,045 or more by Dec. 30.

Want to learn more? Check out Bloomberg derivatives trading solutions and pre-trade solutions.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.