This analysis is by Bloomberg Intelligence Chief Global Derivatives Strategist Tanvir Sandhu. It appeared first on the Bloomberg Terminal.

Equity volatility metrics, such as measures of skew and convexity, aren’t showing the same signs of stress as in other assets, despite the macro uncertainty. This dislocation can be explained by fall in the reactivity of volatility, given the grind lower in the market, preference for cash over convexity and lack of a shock factor.

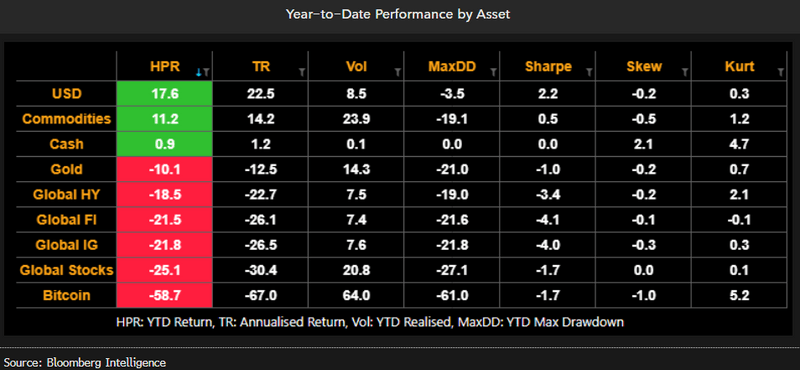

Returns leaderboard and distribution

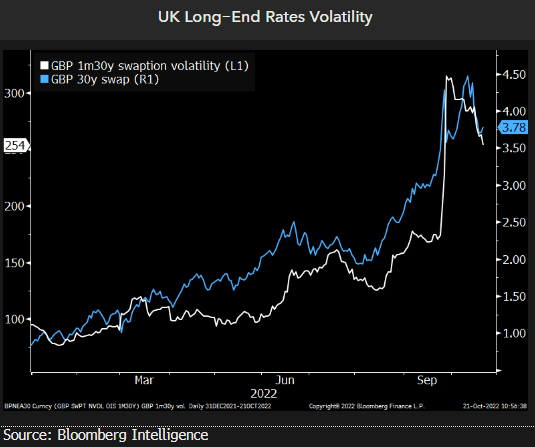

Crown jewel of volatility

UK rates have been at the epicenter of volatility, helping to push up volatility in US and EU. While political volatility is high, the expectation of the lessons of fiscal responsibility has been learn and exit of “Trussonomics” can help see implied vol decay over the coming weeks from extremely distorted levels. This can see the 1m30y swaption volatility move closer to our macro model ex-realized vol of 180 bp/year. This is also close to where the yield level implies, based off the pre-mini-budget linear relationship at around 200 bp/year (see left-side link).

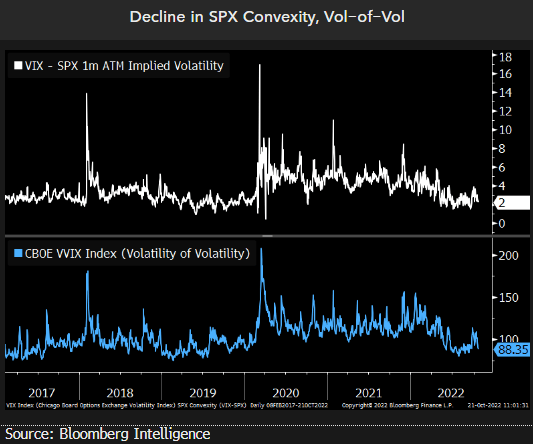

Higher floor in equity vol

The VIX index has been floored at a higher level this year, which is consistent with the wide dispersion of macro data and uncertainty around the terminal rate. However, the lack of a liquidity event and grind lower in the market has seen convexity underperform. Volatility knockout options — puts options that knock out if realized vol exceeds a defined level — can perform well in this environment where the market grinds lower and realized vol doesn’t excessively spike. KO options essentially take advantage of the discrepancy between implied and realized vol, where the steeper the smile the better at initiation.

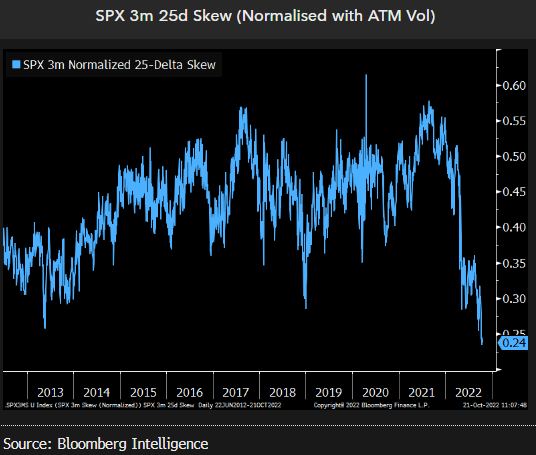

Skew continues to be marked lower

The flattening of the skew has reduced the discount that volatility KO options offer relative to vanilla puts. The grind lower in the market, monetization of hedges and less reactive vol to SPX declines is why the skew has been marked significantly lower this year, in our view. The absolute level of implied vol is high and therefore not expected to significantly increase further in a selloff, leading the skew to reprice lower.