This analysis is by Bloomberg Intelligence Senior Industry Analyst Herman Chan and Bloomberg Intelligence Associate Analyst Sergio Ferreira. It appeared first on the Bloomberg Terminal.

Regional bank lending could struggle against a tougher backdrop for deposits, and the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey signals both subdued demand and stricter underwriting. Commercial-loan demand results were the worst since the financial crisis. Credit tightening is evident across loan types and may indicate a pickup in bank loan losses ahead.

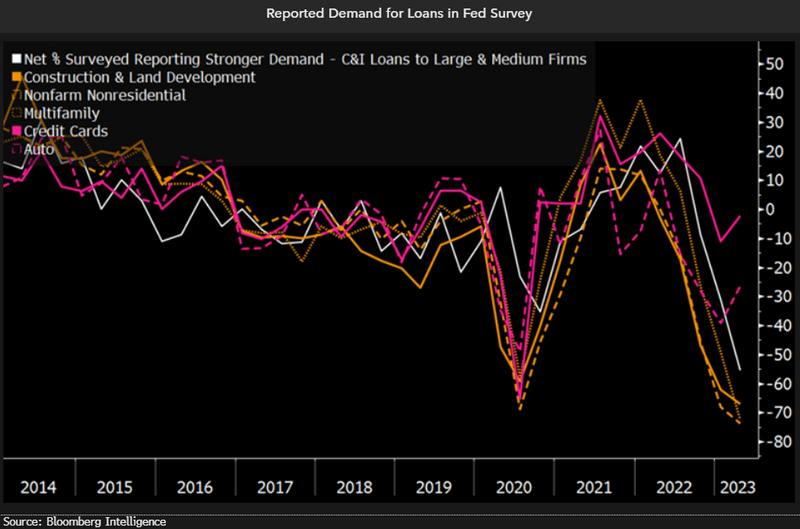

Loan demand declines across types

Loan demand retreated, as noted in the Fed’s Senior Loan Officer Opinion Survey (SLOOS), while business lending in particular showed the weakest results since the global financial crisis. A net 56% of banks surveyed are seeing reduced demand from large and middle-market businesses. Less investment in plant and equipment, along with a drop in inventory-financing needs, were cited as reasons for the subdued appetite. Zions recently said that continued central bank tightening would also result in waning borrower activity.

Demand for commercial real estate loans across various categories is back to pandemic-era levels. Borrower appetite for residential mortgage loans remains soft, though rebounded some from January’s weak survey results.

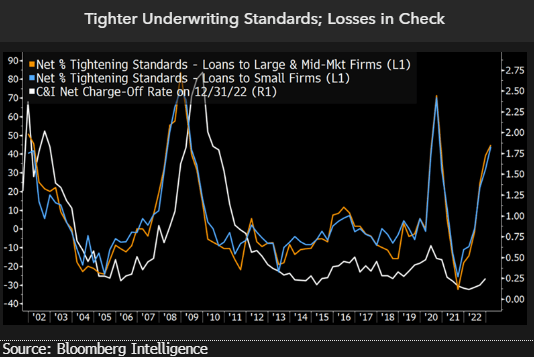

Underwriting standards tougher as uncertainty continues

Lending standards for commercial loans became stricter in 1Q, suggesting banks may pull back on credit availability amid a weaker environment for deposits. Standards for commercial real estate are also tougher across construction, multifamily and nonfarm nonresidential properties. Survey results mirror some of the commentary from 1Q earnings. Citizens noted recent credit tightening for consumers out of an abundance of caution.

For commercial lending, more disciplined underwriting is reflected by charging higher premiums on riskier loans, increasing loan spreads and the cost of credit lines. Historically, tighter credit has been an indicator of bank loan losses. The relationship broke down during the pandemic due to stimulus measures. This time, however, losses may return amid less fiscal and monetary support.

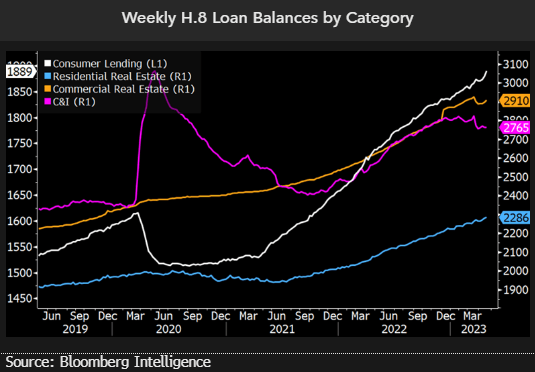

Industry loan growth climbs, despite uncertainty

Industrywide lending is proceeding at a modest pace so far in 2Q, a sign that recent bank turmoil hasn’t led to a retreat in activity despite the tighter underwriting and softer demand highlighted in the SLOOS. Fed data point to 0.7% growth in total industry balances through April. The loan gains are coinciding with stable deposits following the 1Q exodus tied to the failures of Silicon Valley Bank and Signature Bank. Commercial loans are rebounding, up 0.3% after a 1.8% decline last quarter, though results still trail other loan types. Consumer lending leads, up 1%, due to strength in credit cards. Auto loans remain soft.

Commercial real estate loans are also showing gains, with balances up 0.7% through April vs. 0.6% growth in 1Q.

Regional banks tighten credit, loan demand falls

SLOOS results indicate tougher lending conditions with declining demand and tighter underwriting. Join Herman Chan, senior equity analyst covering regional banks, and Roger Thomson, regional marketing analyst, as they discuss the results of the quarterly Fed survey and its implications for loan growth.

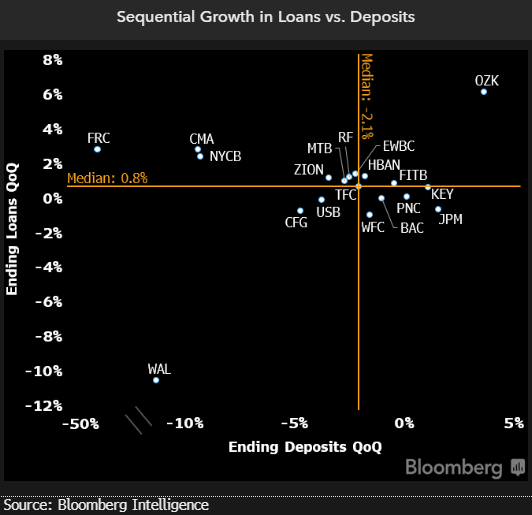

Banking turmoil exacerbates deposit attrition

Deposit outflows accelerated in 1Q after the failures of SVB and Signature, while balances are showing signs of stabilization at Western Alliance, which noted 2Q deposits were up $2 billion through April 14. First Republic, Western Alliance and Comerica had the weakest deposit results as the sector fallout spurred outflows from these banks’ high-net-worth depositors and tech companies sought sanctuary at larger competitors. First Republic faces a tough road ahead as it’s much more reliant on costlier funding after a 41% drop in deposits in 1Q.

Loan growth, up 0.8% at the median, slowed amid deposit attrition. Truist highlighted tighter credit underwriting, while Regions noted moderating loan pipelines. Client demand may be declining as well. Huntington expects softer capital spending.