This article is by Gary Stone.

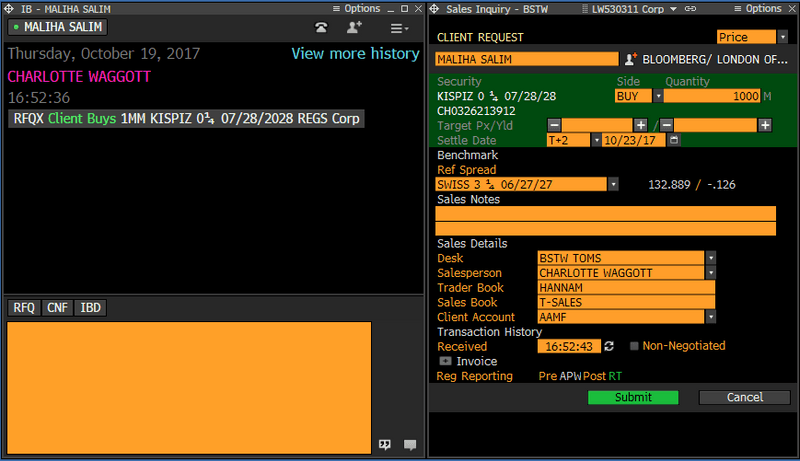

For illustrative purposes, we will use Bloomberg’s TOMS order management system sales-trader workflow (STW) screens as a back drop to understand how firms may use Bloomberg solutions to support their existing third-party or proprietary sales-trader workflow.

Customer inquiry to pricing

Let’s assume that a customer has contacted a salesperson via IB for color. As the conversation continues, it begins to move into a pricing/negotiation phase. A Pill can be created before or after the client makes a formal request for quote. In this phase, the time stamp of the inquiry is recorded and sent downstream.

If the Pill workflow is integrated using TNP, the salesperson can seamlessly request the trader for a quote via the firm’s third party or proprietary system by hovering over the Pill and clicking on the “Send to Trader” button at the bottom left of the card. A “Sales Ticket” appears pre-populated with the information contained in the Pill. The salesperson can then send the inquiry for pricing to the trader.

The STW pop-up box contains, and records, the key time stamp information as the trading process continues – when the quote was received by the salesperson from the client (Received), provided by a trader (Quoted), accepted by the client (Lift/Pass), and completed (Final).

1. When the markets are made

Once priced by the trader (or auto-priced), the salesperson can use the menu in the top right to say whether it is an indicative or firm quote. If indicative is selected, and the trader hits the “Send Quote” button, the quote will appear into the salesperson’s IB chat with the client (in the STW pop-up box), but not trigger transparency reporting.

If a firm quote is sent, it will also appear in the IB chat and this will trigger both a time stamp and a submission to Bloomberg’s Regulatory Reporting Hub (RHUB) to determine pre-trade transparency reporting eligibility. If the instrument (liquidity) and the quoted size require pre-trade transparency, RHUB will send the quote to Bloomberg’s Approved Publication Arrangement (APA) for public dissemination. Both TNP and the IB Chat API Service can send prices back into the IB Chat. However, time stamp submission to RHUB for pre-trade transparency reporting will be the responsibility of the firm if they are using the IB API Service instead of TNP.

2. Accept or pass – the client decision

Let’s assume that the client is buying. Once the client accepts, the salesperson, for the purpose of communicating this accurately back to the trader, will hit “LIFT” in the STW pop-up box. The time stamp will be recorded, after which the salesperson has the option to send a post-trade VCON confirmation to the client.

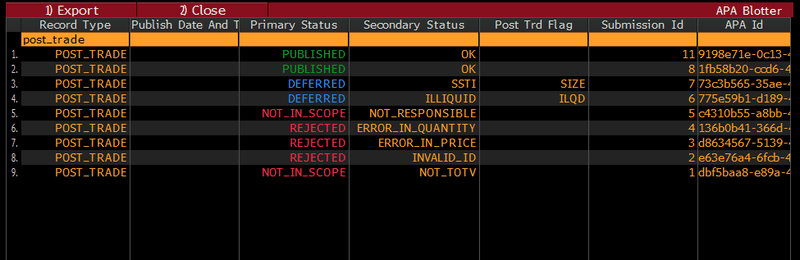

3. Trade reporting

The trade is also submitted to RHUB to determine post-trade transparency eligibility. Similar to the pre-trade workflow, RHUB will determine if the instrument (liquidity) and the trade size require immediate post-trade transparency. RHUB will then send the trade to Bloomberg’s Approved Publication Arrangement (APA) for public dissemination. All relevant time stamps can be passed back to third party systems either though the IB API Service or TNP in real-time, should they choose to store or send them downstream to alternative reporting solutions. However, for RHUB clients, once the trade has been transferred downstream, users can benefit from a complete end-to-end integrated workflow as it can also be moved to BTCA (to support compliance with RTS 27 and 28), BVAULT (for immutable storage) as well as to the APA and ARM, depending on reporting requirements.