This analysis is by Bloomberg Intelligence Analyst Francis Chan. It appeared first on the Bloomberg Terminal.

China’s digital yuan, pushed by the central bank, could substantially threaten Chinese banks, Alipay and WeChat Pay. The PBOC has an option to expand the e-yuan’s application beyond the monetary base to M1 and M2, diminishing banks’ role in the economy. The e-yuan may also take significant market share from the private payment giants.

Banks’ future to be determined by PBOC e-yuan choices

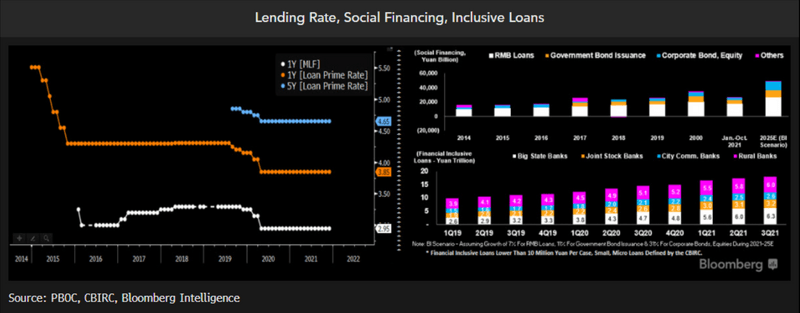

The role of big Chinese commercial banks in the economy could diminish if the digital yuan, now in a late stage of pilot testing, proliferates in the coming five years. The PBOC may consider expanding its application beyond the monetary base (M0) to M1 and M2 after the base of e-yuan’s users reaches a critical mass like 1 billion. In one future scenario the central bank could opt to pay interest on digital yuan, and its wallet may bypass banks to tap deposits. E-yuan funding at the PBOC could be directly channeled to areas targeted by Chinese authorities, such as inclusive finance, green and tech industries, in the form of credits. This could happen if the PBOC decides commercial banks have failed to transmit China’s monetary policy. Banks’ earnings and ROE could suffer accordingly.

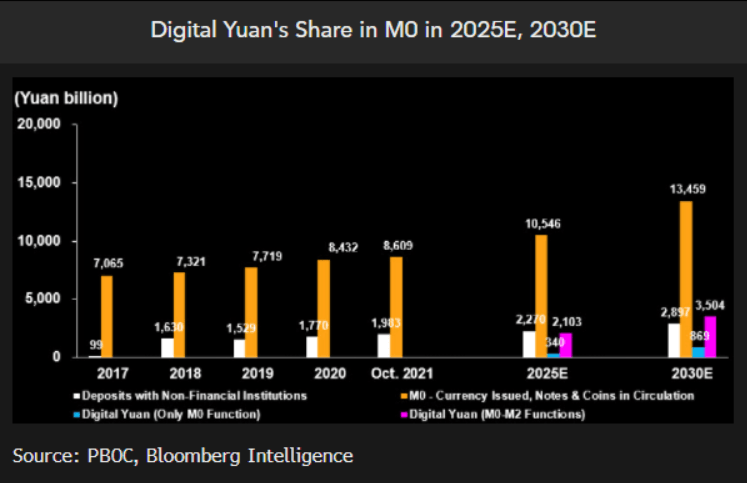

Digital yuan’s share in M0 could reach 20%

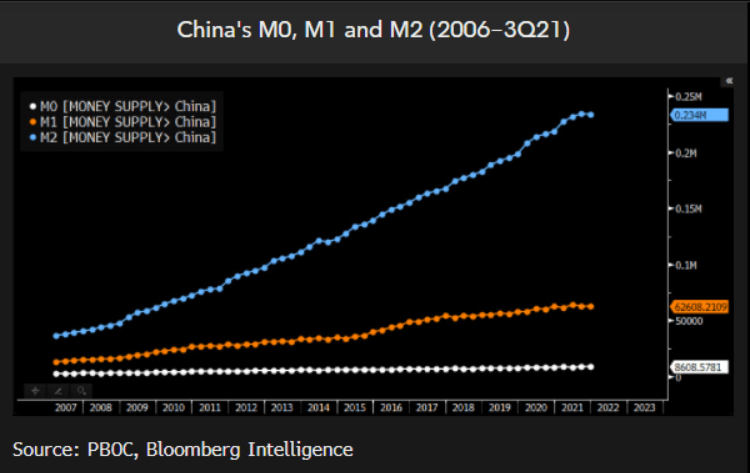

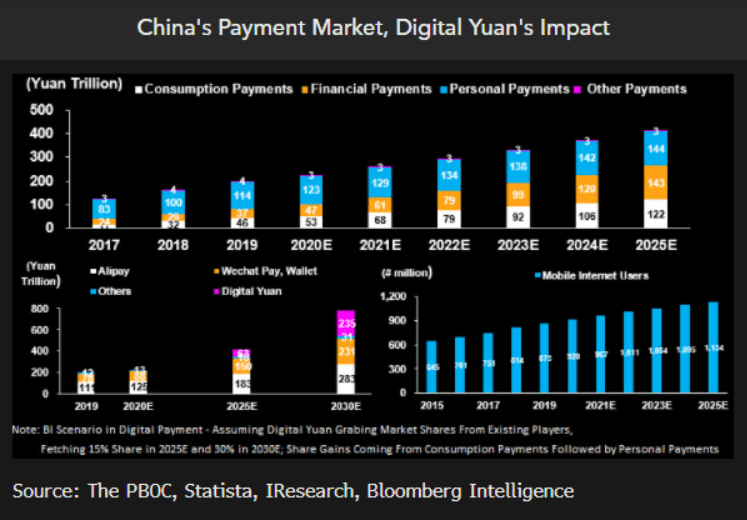

China’s central bank has clarified that digital yuan will be issued as M0 initially, mostly to displace the payment function of coins and notes in circulation. A digital yuan’s share in M0 could take a different path, depending on whether the PBOC later expands its function beyond M0 to M2. The tokens may take up 3.2% of 10.5 trillion yuan of M0 in 2025E, under our scenario that its function is limited to the displacement of cash. We assume e-yuan will acquire about 15% of online payment volume, with a similar share to non-financial institutions’ deposits in the PBOC. Yet a digital yuan’s share could reach 19.9% under the scenario if it carries the functions of M0-M2, or the deposit-lending functions of commercial banks. In 2030, e-yuan’s portion in M0 could reach 6.5% and 26% in the two scenarios.

Thriving e-yuan could diminish bank returns

A burgeoning digital yuan could erode Chinese banks’ ROE in the long term. A PBOC wallet may capture up to 2.1 trillion yuan, or about 2% of China’s retail deposits by 2025, if interest is paid on the tokens. Banking sector returns could slide to 8-9% in 2025 vs. about 10% in 1Q-3Q21, if the PBOC uses the e-yuan to manage market liquidity and short-term loan rates. Bank margins may narrow on the e-yuan’s asset-yield impact and lower loan prime rates. Negative interest rates, pressing banks’ asset yields, would be another policy option. The PBOC could also cut out banks as intermediaries in its push for inclusive finance, green loans and government projects.

China may move carefully in disrupting the banking sector to avoid unexpected systemic risks, though it has clearly tightened its grip over the economy this year.

Loud, clear call on squeezing Alipay, WeChat Pay

China’s government has been loud and clear on its intention to contain and even squeeze Alipay and WeChat Pay, with or without the e-yuan’s development. Both systems, with over 90% of the market together, may find their shares shrinking before 2030. From March 2022, personal accounts with the two can no longer receive business payments, while the Alipay app recently stopped showing its ‘Huabei’ brand for consumption-loan products. Also, the e-yuan doesn’t incur any merchants fees or service charges, vs. 38-60 bps charges at Alipay and WeChat Pay.

The two firms could lose market share to the digital yuan, mostly in small, lump-sum retail spending, card payments and money transfers. The e-yuan’s share of China’s digital payment may hit 15% in 2025 and 30% in 2030, based on our scenario and iResearch estimates.

Consumption scenarios may surpass Alipay, WeChat Pay

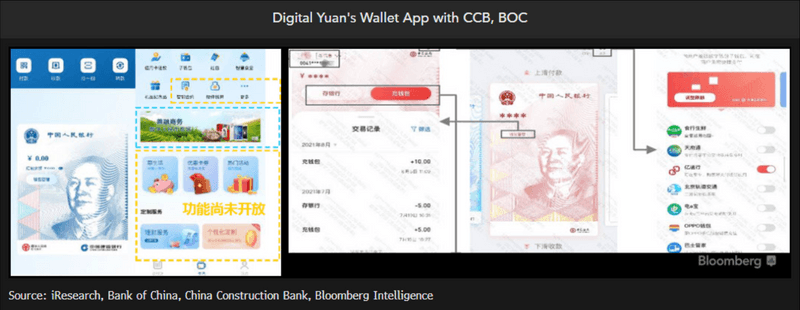

The PBOC may keep expanding the consumption scenarios in the digital yuan’s wallet, seriously threatening the dominant ecosystems of Alipay and WeChat Pay in the long run. As of mid 2021, 1.32 million scenarios were ready for digital-yuan payment, including wholesale and retail, catering, education, medical services, transportation, public services, taxation and government subsidies. Zero payment fees could be attractive to both merchants and retail users. In early November, 1.55 million merchants could accept e-yuan. Ten million corporate wallets were set up, on top of 140 million personal accounts. Some market participants envision e-yuan’s consumption scenarios could surpass Alipay and WeChat Pay at some point.