This analysis is by Bloomberg Intelligence Senior Industry Analyst Patrick Wong and Bloomberg Intelligence Senior Associate Analyst Yan Chi Wong. It appeared first on the Bloomberg Terminal.

Hong Kong and Tokyo landlords face unrelenting pressure on office occupancy rates as BI surveys find workers in both cities demand flexibility on working arrangements. Hong Kong’s office vacancy rate could stay at a record high through the year, with most workers planning to work from home at least some of the time, leading companies to cut costs by reducing office space. This could further depress office rental revenue for landlords like Sun Hung Kai, CK Asset and Hongkong Land. In Tokyo, our survey found employees could demand significant pay rises to return to the office. Flexible work arrangements are likely to persist, possibly shifting office demand to core locations like Tokyo’s Marunouchi area, to the benefit of Mitsubishi Estate.

HK office rents set to decline as work spaces shrink

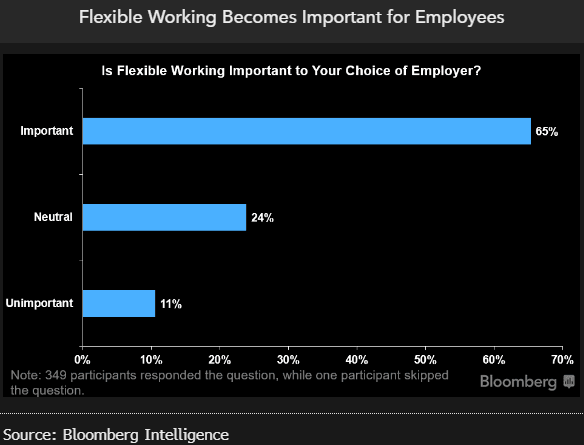

Hong Kong office rents could continue to fall in the second half, as some companies might further downsize offices by adopting hot-desk arrangements. Our survey found 65% of respondents considered flexible-work arrangements an important factor in choosing employers, and most don’t need fixed desks.

Office demand might struggle to rebound

Demand for prime office space in Hong Kong might still struggle to rebound significantly even after the reopening of the border with mainland China earlier this year. Some companies could continue to downsize offices by adopting flexible working and hot desking. Flexible work is gaining popularity in the city, with about two-thirds of our survey respondents saying it’s an important factor when selecting employers. This might prompt some firms to more aggressively offer flexible arrangements that could allow them to spend less on offices.

Standard Chartered and Hang Seng Bank recently released about 62,000 sq ft and 78,000 sq ft of their office space in Kowloon East for lease, according to Sing Tao Daily.

Companies might downsize office space

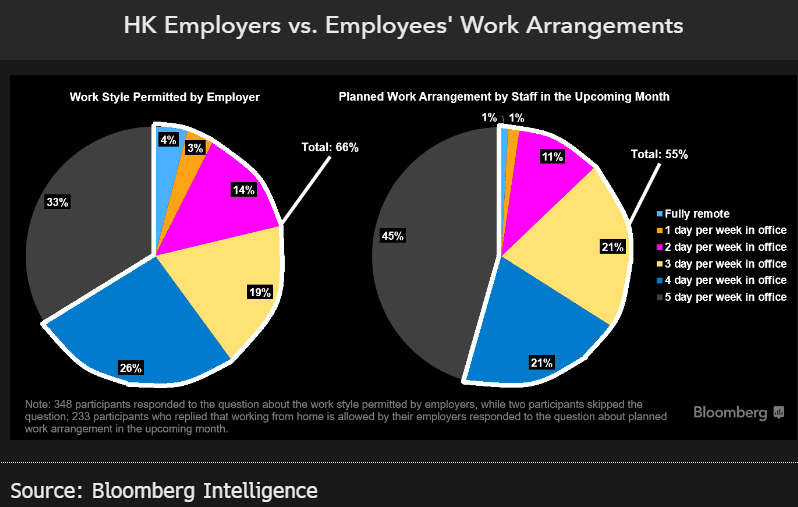

The majority of Hong Kong employees in our survey won’t be required to be in the office five days in a week, suggesting more companies might take the opportunity to downsize their office space by adopting hot-desk arrangements. Our survey also revealed that flexible working arrangements could be more popular in Hong Kong compared with Tokyo. About two-thirds of the 350 respondents in Hong Kong are permitted hybrid or fully remote arrangements, and 55% plan to work from home at least one day a week in the coming month.

We also polled 650 Tokyo office workers, of whom 56% are permitted hybrid or fully remote work while 47% plan to work from home at least one day a week in the coming month.

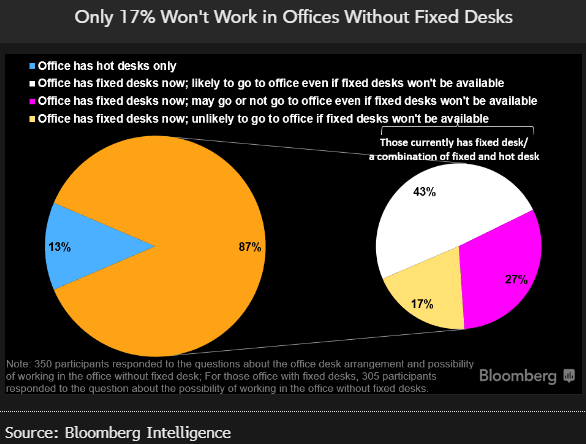

Flexible arrangements and co-working

Major companies in Hong Kong might consider increasingly using hot-desk arrangements to save on rent, as many employees don’t go to the office five days a week and are willing to work without fixed office spaces. Of the 350 Hong Kong respondents in our survey, 13% work in the offices that only have hot desks. About 43% are still likely to work in offices without permanently assigned spaces, and only 17% are unlikely to work in facilities that don’t have fixed desks.

The rising adoption of flexible arrangements could sustain demand for co-working offices and some landlords have already expanded in this business segment. Hysan formed a joint venture with IWG to operate the latter’s flexible workspace brands in Hong Kong and China’s Greater Bay Area.

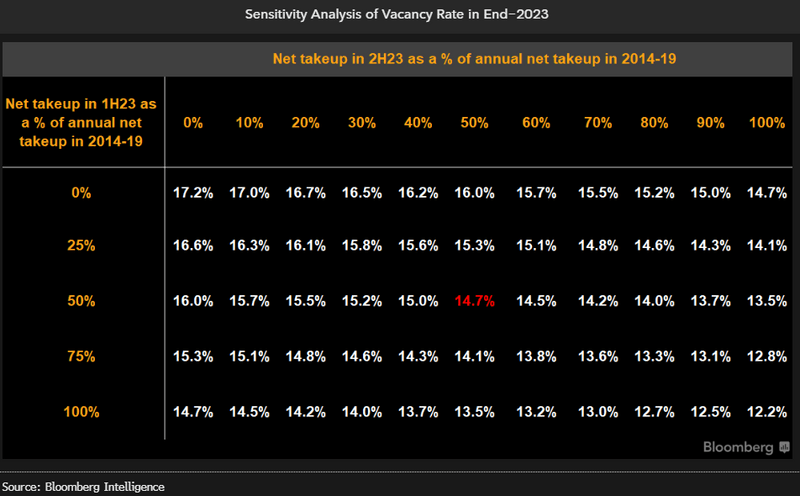

Vacancy rate unlikely to decline in 2023

Our base scenario of a gradual recovery in leasing demand shows that Hong Kong’s prime office vacancy rate could remain high at 14.7% by the end of this year due to ample new supply. Global financial uncertainties could limit demand, particularly from the banking sector. We assume the net absorption of office space for this year could be equal to the annual net take-up in 2014-19. The annual net absorption of office space was positive in 2014-19, with an average of about 2.3 million sq ft per annum. It fell to negative 1.8 million sq ft in 2020 and negative 950,000 sq ft in 2021. The net absorption was 350,000 sq ft in 2022, partly due to take-up of new office space.