Bloomberg Professional Services

APAC ex-Japan

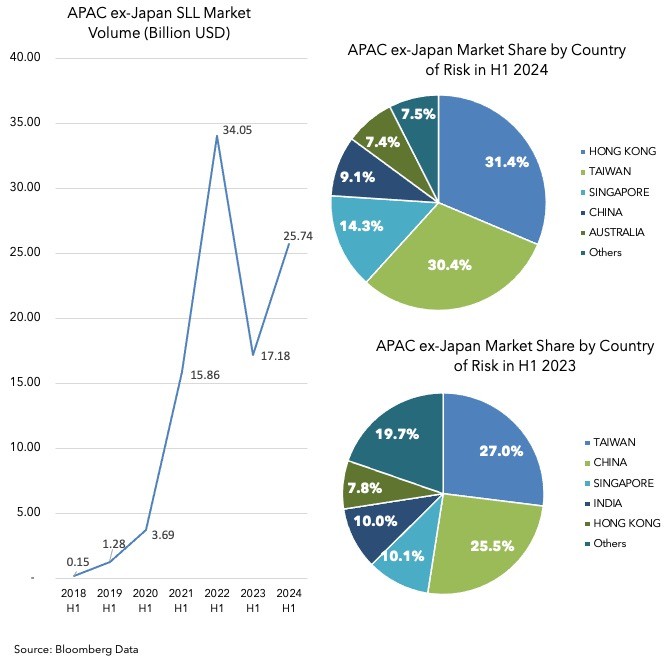

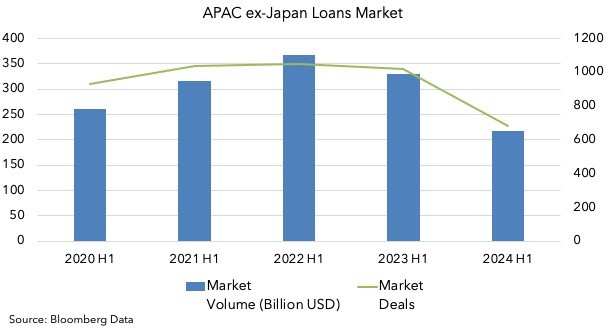

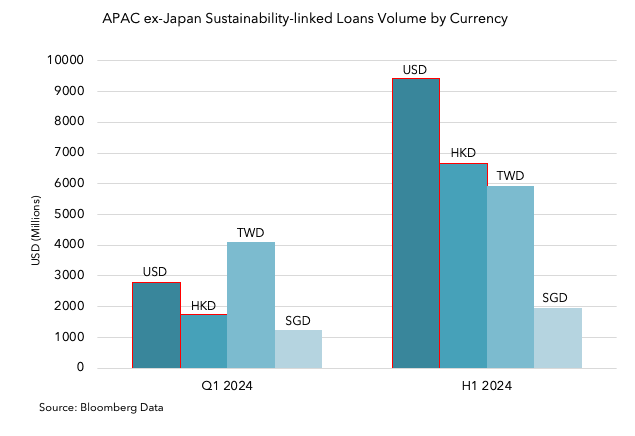

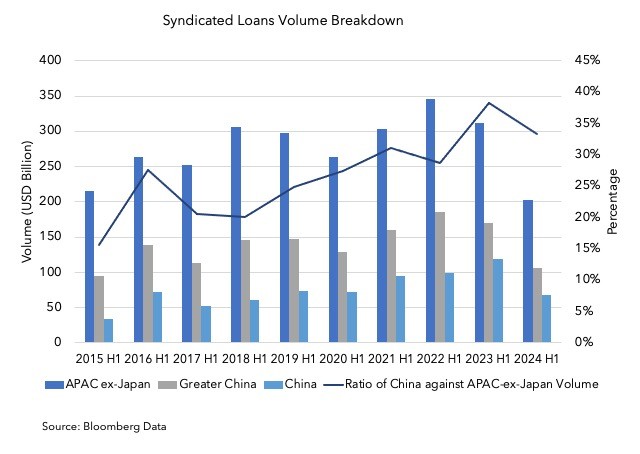

APAC ex-Japan syndicated loans market volume in H1 2024 concluded at $218.3 billion with 682 deals, down by 33.9% from H1 2023’s $330.3 billion. While most of the APAC saw a decrease in lending activities year-on-year, sustainability-linked loans almost doubled in issuance, totaling $25.7 billion. Within the sustainability-linked loan market, Hong Kong topped the region, contributing an unprecedented level of 31.4% to the whole volume. This huge demand has also led to an increase of deals issued in HKD, making HKD the second largest currency in the sustainability-linked loan market for H1 2024, while USD still remains to be the largest denominated currency.

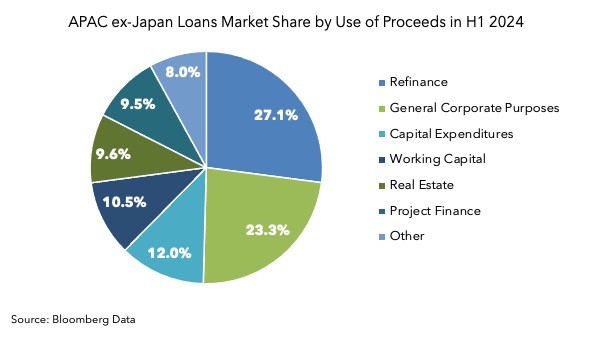

For the loan purpose breakdown, APAC ex-Japan borrowers showed high appetites in refinancing (27.1%), general corporate purpose (23.3%), and capital expenditures (12%) in H1 2024. Top 3 deals in H1 include Guangdong Shenda Intercity Railway Co Ltd for a CNY 23.9 billion ($3.3 billion equivalent) facility, Shanghai Bund Urban Renewal Investment Development Co Ltd for a CNY 20.6 billion ($2.8 billion equivalent) facility, and Isola Castle Ltd for a CNH 14.9 billion ($2.1 billion equivalent) facility.

Bank of China and KB Financial Group continued to lead the market by securing the top 2 seats of the bookrunner and mandated lead arranging table.

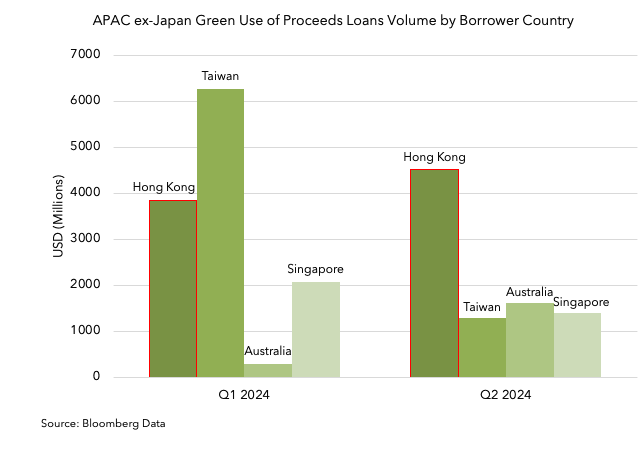

ESG

Green and sustainability-linked lending totaled $19.7 billion in the second quarter of the year, bringing the total volume of ESG-related lending to $39.3 billion year to date. Most green loan issuance in the APAC ex-Japan region continued to originate from Singapore borrowers, and SGD remained the dominant currency for green loan issuance throughout the second quarter. As for sustainability-linked loans, the region saw a sharp rise in issuance from Hong Kong borrowers in Q2, helping the USD and HKD surpass TWD in issuance volume by the end of H1.

Renewable energy, specifically solar power projects, once again topped the list for green loan issuance categories, with notable deals such as the $400 million loan issued to Adani Green Energy for solar projects under project Snowman, advised by Sumitomo Mitsui Banking Corp as the green loan advisor. For sustainability-linked loans, greenhouse gas emissions reduction was again the most popular metric across the region in Q2. Most notably, a $1.2 billion sustainability-linked loan was issued to Gunvor Singapore to refinance a previous SLL from 2023, which is linked to the company’s reduction of scope 1 and 2 greenhouse gas emissions, and reduction of scope 3 emissions associated with improved energy efficiency of its shipping fleet.

Oversea Chinese Banking Corp has risen to lead the bookrunner and mandated lead arranger rankings in the region for green loan issuance as of H1, with Sumitomo Mitsui Financial and DBS closely following.

As for sustainability-linked loans, Oversea Chinese Banking Corp is once again the top mandated lead arranger across the region, and Mega Financial leading in the bookrunner ranks.

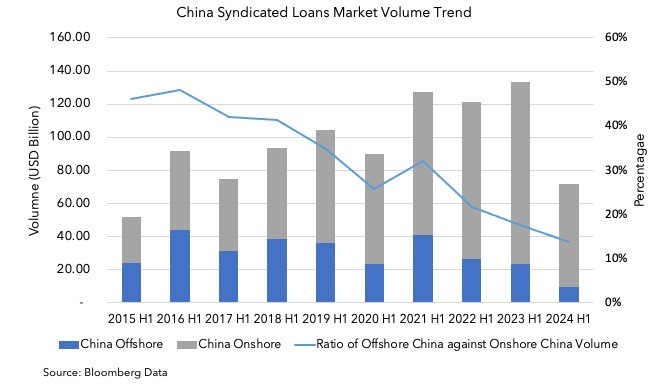

Greater China

In the first half of 2024, the total issuance of syndicated loans in Greater China, China onshore and China offshore each decreased by 37.1%, 43%, and 53.9% compared with the same period last year. As borrowing costs of the renminbi fell, Chinese companies increased demand for offshore renminbi (CNH) loans. According to Bloomberg statistics, loans denominated in CNH issued in the Asia-Pacific region (excluding Japan) increased significantly by approximately 4.8 times compared with the same period last year. In the Chinese market, the featured deals were CNY 23.9 billion deal from Guangdong Shenda Intercity Railway Co Ltd led by Bank of China, CNY 20.6 billion deal from Shanghai Bund Urban Renewal Investment Development Co Ltd, and CNY 14.3 billion deal from Wuxi Metro Group Co Ltd led by Bank of Communications. The largest loans so far this year have been issued to railway and transportation companies for capital expenditures.

In China’s syndicated loan market, sectors with the largest proportion of borrowers were financials (49%), industrials (31%), and consumer discretionary goods (13%). Within the financial sector, real estate (32%) accounted for a relatively high proportion. For loan purposes, capital expenditures (43%) accounted for the largest proportion, followed by project financing (16%), and real estate (11%). As compared with the same period last year, there was a significant increase in real estate loans, including newly issued loans to Vanke in May and June from Chinese banks.

This year, the Chinese government has actively implemented measures for the real estate market, including the “Notice on Effective Management of Commercial Property Loans” 《关于做好经营性物业贷款管理的通知》to clearly define regulations for business management and strengthen risk management, thereby promoting healthy development of the real estate industry. Also, “The Syndicated Loan Business Management Measures” 《银团贷款业务管理办法(征求意见稿)》was issued in March to improve distribution ratios and secondary market transfer rules, standardize syndicated loan fees, and reduce credit risk.

Overall, the Chinese market was conservative in H1 2024, and the banking industry was impacted by the high interest rates. However, the macro environment in China is gradually improving as seen by the country’s rising GDP and CPI. According to Bloomberg data, most loans will not mature in the short term with only about $51.6 million from Chinese borrowers and $1.4 billion from APAC ex-Japan maturing by the year end.

ASEAN

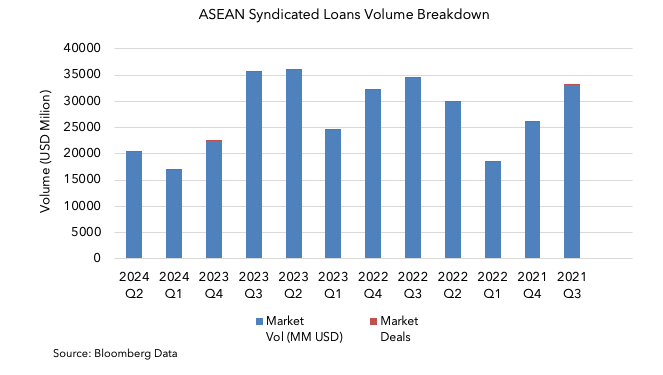

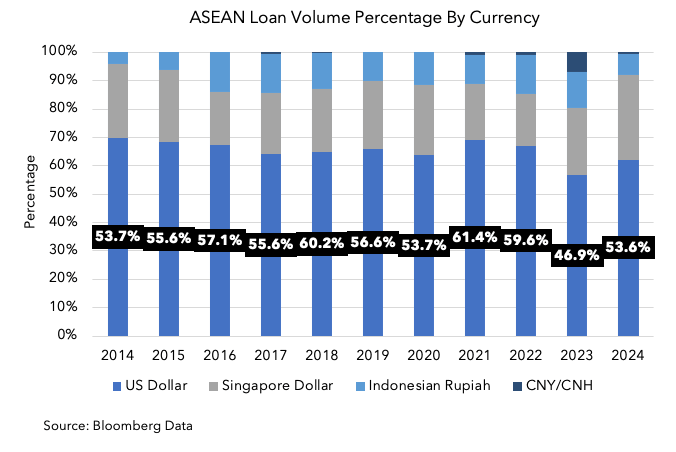

Syndicated borrowing amongst ASEAN borrowers in H1 were in line with the broader APAC region, with a drop of 39.7% in H1 volume year-on-year, totaling $34.2 billion. The momentum of strong demand from ASEAN borrowers in 2023 did not carry over into H1 2024. Overwhelming amounts of loans were raised for refinancing sitting at 53% of the total volume, while the volume for project finance and general corporate purpose came in only at 17.3% and 10.5% respectively. Even though the global economy continues to anticipate rate cuts from FED in 2024, dollar denominated loans seemingly bounced off the record low level at 46.7% of the loan volumes in Q1, sitting at 53.6% for H1 2024. Several large dollar denominated refinance and project finance loans helped the case, including $2 billion San Miguel and $1.8 billion Olam Treasury refinancing facilities, and $1.8 billion Vietnam Long Thanh International Airport project facility.

Among the mandated lead arranging banks, Oversea-Chinese Banking Corp started the first half of the year strong claiming the top spot, followed closely by DBS and UOB, making up market shares of 11.6%, 10.2% and 6.1% respectively. Among the bookrunners, Standard Chartered Bank claimed the top spot, followed by SMBC and Oversea-Chinese Banking Corp, with market shares of 11.7%, 10.7%, and 10.2% respectively.

South Korea

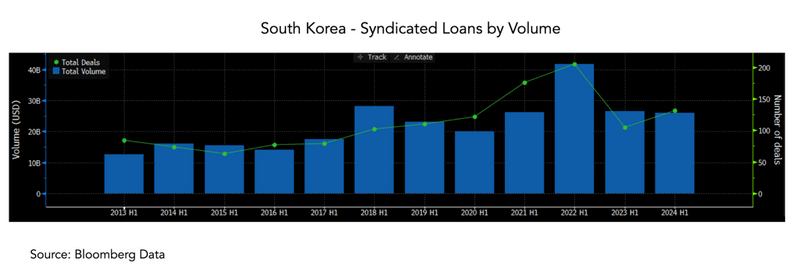

South Korea’s loans market totaled 125 deals, worth $24.4 billion in the first half of 2024. This was an increase in the total number of deals but a decrease of about 7.9% in the total deal volume compared to the same period last year. However, South Korea loans market is still more active than the rest of the region, where the APAC ex-Japan loan issuance was down by 33.9%.

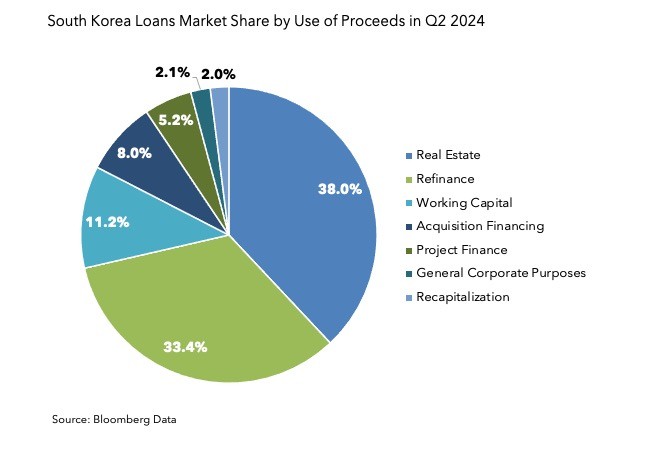

Real estate financing doubled from last quarter, making it the highest use of proceeds with 38% of the total market volume. Amid unstable real estate project financing conditions in Korea, it seems like expectations of falling interest rates and demand for guaranteed real estate properties has led to such an increase. As the South Korea Financial Supervisory Service (FSS) announced a temporary ease of financial regulations until the end of year to speed up restructuring real estate project sites, it would be necessary to keep an eye on how this will alleviate the current real estate market. Top deals for H1 included KRW 2 trillion Shinhan Bank facility which was to finance Krafton office building in Seongsu, and the IFC complex refinancing at KRW 2.6 trillion.

For H1 2024 mandated lead arranger ranking, KB Financial Group again claimed the top spot with 44.1% of market share, followed by Shinhan Financial Group with 22%. For the Legal Adviser – Lender table, Lee & Ko ranked first, and for the Legal Adviser – Borrower table, Kim & Chang ranked as the top legal firm.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except that Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products in Argentina, Bermuda, China, India, Japan and Korea. BLP provides BFLP with global marketing and operational support. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. BLOOMBERG, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG TELEVISION, BLOOMBERG RADIO and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries. © 2024 Bloomberg.