Global LNG outlook overview: Tight supply expected until 2026

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

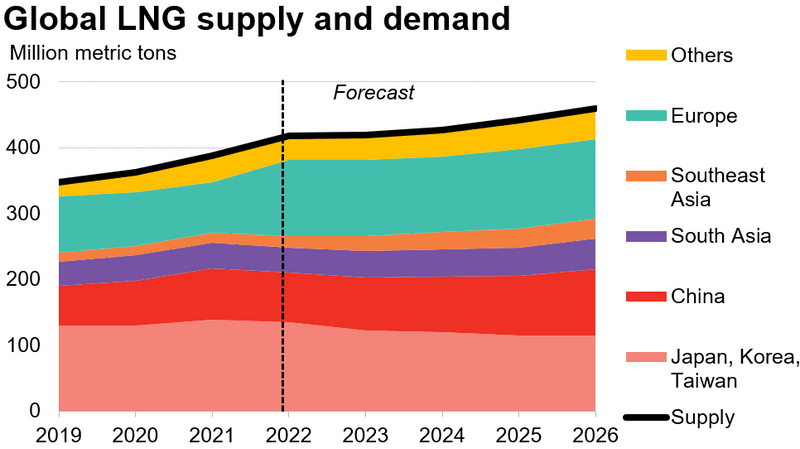

The global LNG market is expected to be tight over 2022-26 as Europe’s quest to reduce its dependency on Russian gas increases demand for LNG. This will curb gas demand growth in China and emerging Asia as the European market outbids these buyers for the limited amount of flexible LNG supply.

To attract the LNG needed to replace Russian pipeline gas to Europe, BNEF expects US LNG netbacks for European TTF prices to be higher than Asia’s benchmark JKM for the forecast period 2022-26. With tight supply anticipated in the coming five years, prices are expected to remain at elevated levels compared to historical averages over 2017-19, before Covid-19.

The ramp-up of new supply projects, especially in the US, is forecast to raise global supply to 460 million tons, up 19% from 2021. LNG demand growth is likely to be constrained by supply between 2021-26, with 18% growth estimated, although Europe is expected to see imports spike during the period.

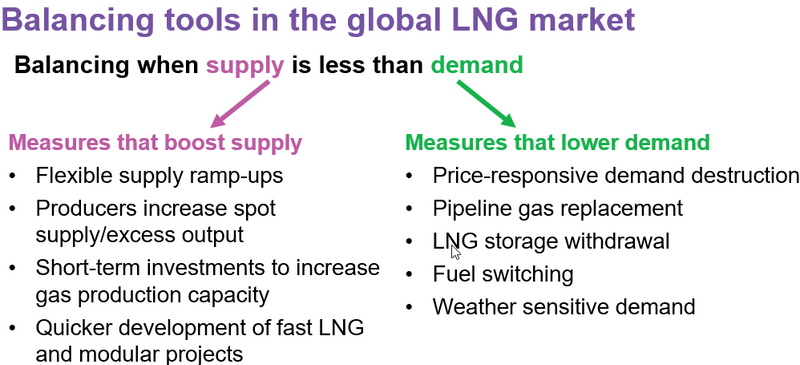

The expectation of high LNG prices may drive producers to ramp up flexible supply and increase spot volume. Investments in liquefaction facilities are likely to accelerate, but most are unlikely to add supply before 2026, given the lead time needed to construct a new plant. Development concepts for LNG projects with shorter start-up timelines could bring much-needed supply earlier, but unforeseeable delays and sanctions could reduce supply too.

Asian consumers will suffer most from the expected tight market. Price-sensitive buyers in China and South and Southeast Asia will be forced to reduce LNG imports and replace them with pipeline imports (in the case of China) or other fuels. Downstream users, especially in the power and industrial sectors, will need to reduce operations to cut gas consumption.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.