Bloomberg Market Specialists Kai Blatnicky and Adam Lynne contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Wondering how to reposition your U.S. equity portfolio to benefit from prolonged inflation?

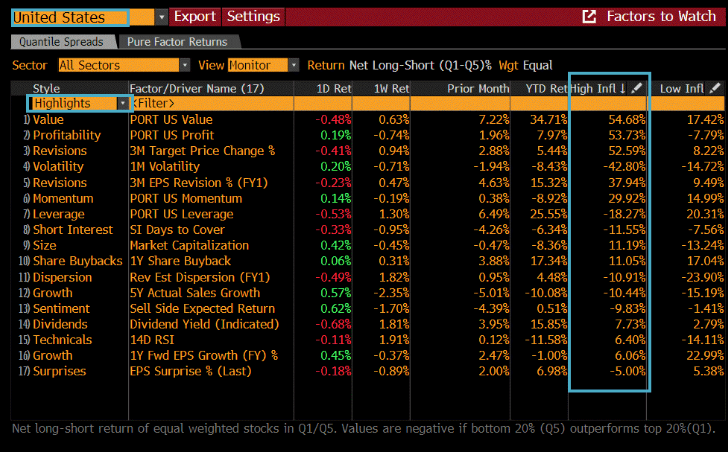

A factor analysis supports common assumptions about value outperforming in periods of higher-than-average inflation. Additionally, high-quality companies, characterized by high profitability and lower leverage, performed well during the higher inflation periods. If your view is that higher inflation is transitory and will soon dip below 2.1%, one-year forward growth is a factor to tilt your portfolio toward.

The questions equity investors now face are how they should hedge against inflation expectations and for how long.

The issue

The April inflation reading of 4.2% shocked investors, who haven’t seen levels that high since 2008. The risk of lingering higher-than-average inflation has made investors question whether tech stocks, the high-growth, high-return stars of the last decade, will continue to pull ahead of the broader market.

Inflation was above average in nearly all 55 months between March 31, 2004, and Oct. 31, 2008, while it was below average in most of the 55 months between May 31, 2012, and Dec. 31, 2016.

The highlighted column above shows a strategy focused on value outperformed during the period of above-average inflation. The 54.68% return is calculated by simulating a portfolio, re-balanced monthly, that goes long on the 20% of the stocks with the highest exposure to value characteristics and shorts the 20% with the lowest exposure.

In a low-inflation environment, companies with low revenue dispersion were among the most favored stocks by investors during this period. A growth-factor portfolio outperformed the average, followed by leverage and value factors. Value’s relative performance in both periods suggests this factor could provide a hedge for those undecided about the direction inflation will take.

Tracking

Use Bloomberg’s Factors to Watch function to measure factor performance over custom time periods to see how inflation will affect equity portfolios.

For more information on this or other functionality on Bloomberg Professional Services, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.