ARTICLE

European Institutional Equity Trading Study: Liquidity and execution

Bloomberg Intelligence

This article was written by Bloomberg Intelligence Market Structure Research Strategist Nicholas Phillips. It appeared first on the Bloomberg Terminal.

With multiple execution mechanisms in a European trader’s toolbox, Systematic Internalizers (SIs) and Periodic Auctions are being used to help with additional liquidity and best execution. Goldman Sachs is the No. 1 provider SI provider, ahead of JPMorgan and Morgan Stanley, among participants in our study.

European execution bilateral in nature

MiFID II broadened the trading landscape, allowing activity across more venues from primary exchanges to multilateral trading facilities (MTFs) for lit and dark trades, to SIs. We’re now seeing a shift in European equity execution toward more bilateral trading, which along with SIs, off-book on-exchange and OTC trading accounts for about 55% of total European market activity. In contrast, lit market trading declined to about 40%, down from a peak of 47% and up from a low of 32%. Dark pool trading remained relatively stable, at approximately 5%.

For market participants with a variety of execution mechanisms at their disposal, selecting the right tools for their flow is key.

Excluding non-price-forming trades, such as those flagged as TNCP (trade not contributing to price discovery) and NPFT (non-price forming trades), reveals a very different picture of European liquidity. Once adjusted, bilateral trading accounted for 41% of overall activity in 2Q, distributed across off-book on-exchange (7%), OTC (19%), and SI (15%). By contrast, lit trading stood at 53% – lower than its MiFID II peak of 60%, but still above the 40% unadjusted total.

The sharp contraction in off-book on-exchange volumes underscores that much of this segment is driven by non-price-forming flows that represent no real economic interest. Stripping these out makes clear that bilateral trading still remains a meaningful component of trading, though not as large and creates a clearer picture of European trading activity.

Among the heads of trading and senior traders surveyed, only 11% expressed opposition to bilateral liquidity, with this view most prevalent among medium-sized funds (22%), compared with just 6% of respondents from both large and small funds. In contrast, 48% of participants were supportive of bilateral liquidity (Fig 1), a sentiment most strongly held by large funds (56%), followed by small funds (48%) and medium-sized funds (37%). Meanwhile, 41% of institutions maintained a neutral stance on the subject.

Larger funds tend to have more flow and connections to multiple participants and often are likely to have flow tailored to their needs than the smaller funds. This may be a reason for the strong sentiment among these funds.

Figure 1: Who’s In Favor of Bilateral Liquidity?

Buyside traders are increasingly engaging with liquidity from Electronic Liquidity Providers operating under the SI regime (ELP SI), as these providers are enhancing both the volume and quality of their pricing. This has led to greater interaction between the buyside and ELP SIs. The ongoing integration of market makers and ELP SIs directly into buyside execution management systems (EMS) is further embedding bilateral liquidity into the buyside’s trading workflow. Bilateral execution is just one component of the buyside’s broader execution toolkit. Traders continue to adapt their strategies based on prevailing market conditions — for example, reverting to lit markets during periods of heightened volatility, where transparency and immediacy are prioritized.

Larger institutions increase systematic internalizer flow

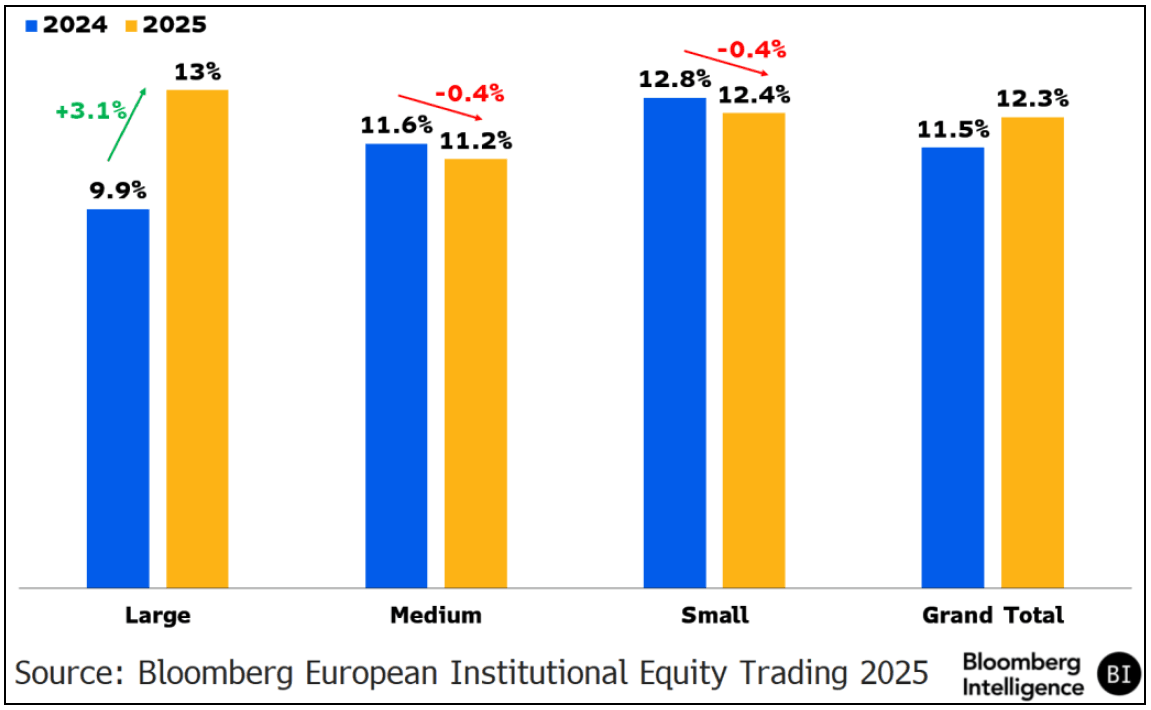

Among the buyside institutions we surveyed, the bigger funds are directing a larger proportion of their flows (13%) to SIs, up 3.1% on 2024 compared with their medium (11.2%) and small (12.3%) counterparts, both down 0.4% from 2024, with overall participants directing 12.3%, 0.8% higher than in 2024.

Figure 2: SI Execution Flow by Institutional Size

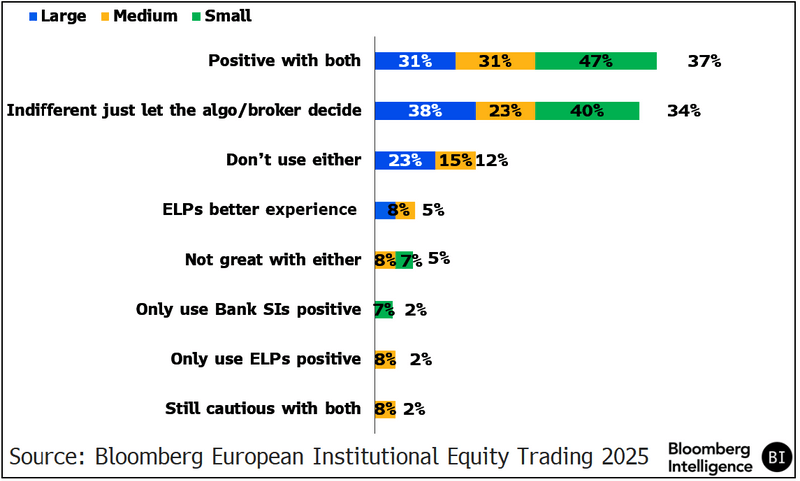

Thirty seven percent of senior buyside traders sampled stated they had positive experience with both traditional bank SIs and ELP SIs, with almost half (47%) of those at smaller institutions having a good experience with both, while 40% of smaller funds and 34% overall stated they were agnostic in their SI experience as they just let their algo/broker decide on the SI they interact with.

ELP SIs are increasingly playing role in proving an additional source of liquidity, as a number of funds just let their algo/broker decide on the execution channel, with majority brokers offering access to both their own internal SI liquidity and ELP SI flow.

Figure 3: SI Execution Channel and Experience

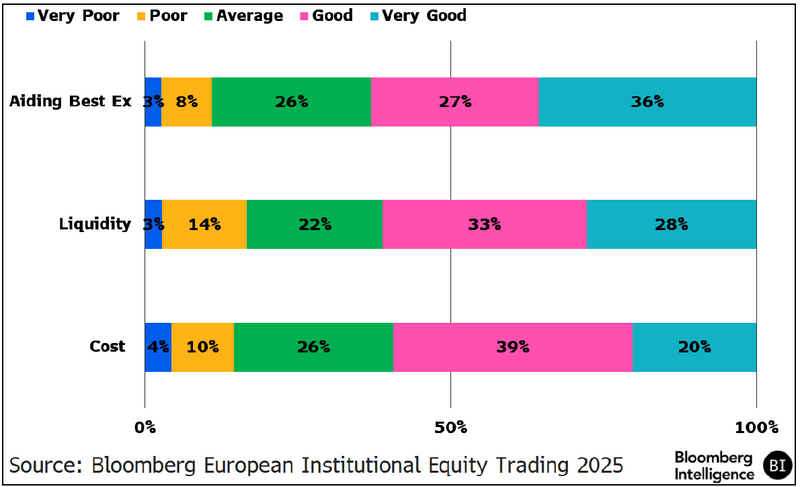

About 63% of European buyside traders queried believe that systematic internalizers (SIs) greatly help in obtaining best execution. That compares with 31% who feel it helps with liquidity and 50% who deem SIs help greatly lower costs. Prioritizing best execution helps institutions meet regulatory compliance and attract and retain clients. Given the challenges in Europe, sourcing liquidity has become increasingly crucial, prompting participants to seek alternatives beyond traditional exchanges.

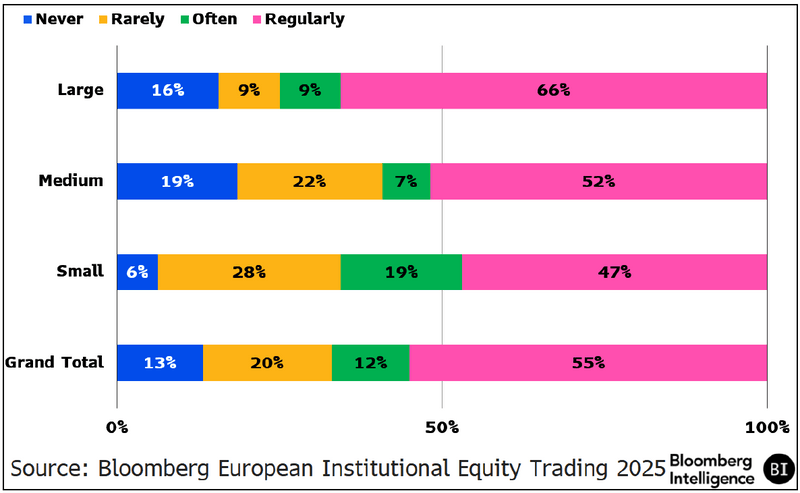

Only 13% of funds have never used periodic auctions

Only 13% of funds surveyed in our study said they’ve never used periodic auctions; 16% from larger institutions, 19% from mid-sized and 6% from small (see Fig. 4). The use of periodic auctions has been on a steady climb over the past few years as an additional tool to a traders’ toolbox in trying to source liquidity, with 76% of institutions using this trade category regularly or often (75% larger funds, 59% medium and 66% small), a figure that’s likely to increase.

Figure 4: How Frequently Do You Use Periodic Auctions?

After best execution, periodic auctions aiding liquidity are just behind with 61% say they are good or very good in that role. That compares with 59% who believe it helps with reducing costs.

Figure 5: Periodic Auction by Best Ex, Liquidity & Cost

Liquidity and fragmentation no. 1 issue for medium funds

Liquidity and Fragmentation No. 1 Issue for Medium Funds For buyside traders, finding European equity liquidity is their second-largest challenge, highlighted by our study. Led by medium-sized asset managers, 43% mentioned liquidity and market fragmentation as the toughest aspects of their job, followed by lack of innovation and over regulation at 29%. Twenty two percent of small funds ranked liquidity, and the lack of a consolidated tape and T+1 settlement, as the most important issue, while larger funds marked this as their third most-important, at 14%, behind no consolidated tape and lack of innovation and excessive regulation.

Institutional equity traders frequently complain about UK/European liquidity. This is because the many venues, as well as currencies, clearing/settlement facilities and the lack of a consolidated market data feed pose challenges to the search for liquidity. Yet in normalizing US and UK/European equity value traded, volume appears to move in a coordinated manner. There’s an 80.7% correlation between monthly average daily value traded in the US and the UK/European equities. Even during the height of tariff volatility, UK/European equity volume kept pace with the US.

Senior buyside traders we spoke with at large and medium-sized buyside firms see ETF trading taking on a bigger role in their future trading strategies, even though it’s not significant at present amid little demand from clients. A number of traders from smaller institutions have been increasing the use of ETFs in their strategies, and not just from a closing-auction perspective (after which a number of benchmarks are set). The conclusion from our survey is that ETF trading for equity buyside institutional traders is likely to increase more over the near term.

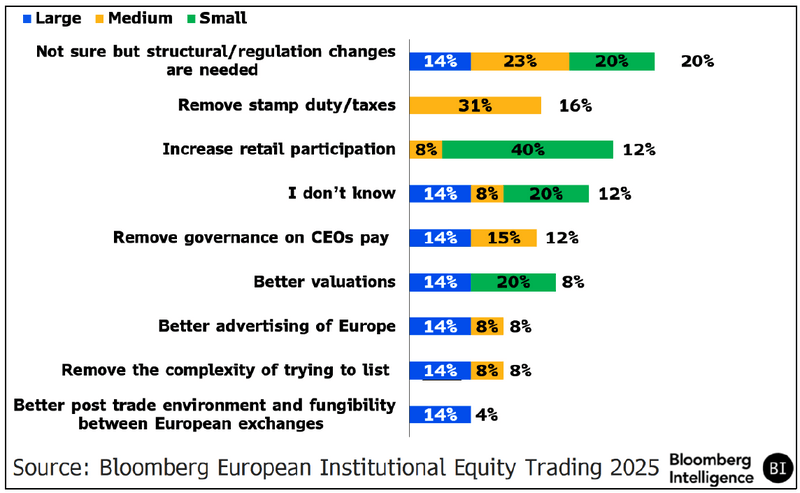

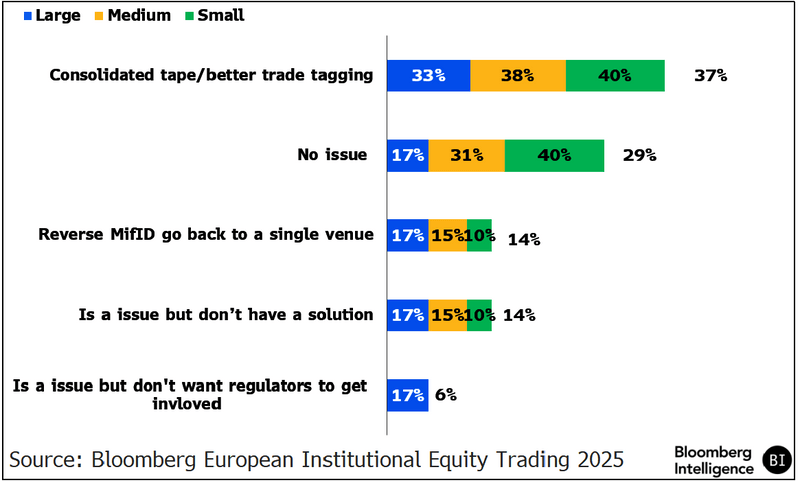

A significant majority – 71% – of senior traders view accessible liquidity as a challenge in European markets, while 84% from large funds express concern, compared with 68% from mid-sized firms and 60% from smaller funds. When asked about potential solutions, 37% cited the introduction of a consolidated tape and/or enhanced trade tagging as key steps toward improving market transparency and access to liquidity. Interestingly, 14% expressed a preference for reversing MiFID I and II and returning to a single trading venue structure, while another 14% acknowledged the issue but were unable to identify a clear solution. A further 6% recognized the problem but were reluctant to see regulatory intervention, instead favoring a market-driven resolution.

Figure 6: Is accessible liquidity an issue and how to fix it

A recurring concern in Europe is the difficulty in forming a consistent understanding of true liquidity conditions responses often vary depending on the market participant spoken with. Improved post-trade data granularity and/or a unified tape could address these disparities, enabling a clearer and more reliable picture of liquidity across European markets.

Of the senior buyside traders we spoke with, 68% said internally crossed trades, especially around the closing auction, weren’t a concern, 79% of respondents from large funds expressed no concern, compared with 50% from mid-sized firms and 68% from smaller funds. Buyside traders didn’t view the act of crossing trades during the closing auction as a concern and they understood why the sellside crossed them, particularly during the closing auction. However, they still wanted to know the type of liquidity they were interacting with.

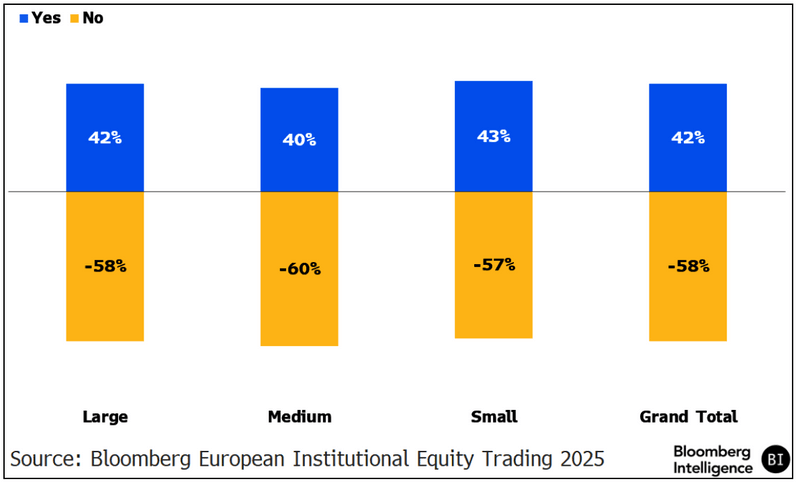

The general consensus (58%) among senior traders is that the growth of the closing auction is no longer a concern. Buyside participants have largely adjusted to the increasing significance of the final five minutes of the trading day, which has evolved into a key liquidity event. In response to this structural shift, exchanges such as SIX and Euronext have introduced specialized order types designed to facilitate greater participation and efficiency during the closing auction window.

Figure 7: Is Growth of the Closing Auction a Concern?

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.