European banks’ 10% ROE vs. 17% cost of equity is 2023 question

This analysis is by Bloomberg Intelligence Senior Industry Analyst Jonathan Tyce. It appeared first on the Bloomberg Terminal.

The value vs. value trap debate over European banks will roll into 2023, with the sector discounting an average 17% cost of equity, based on 2024 consensus, for an ROE nudging 10%. We believe that the momentum of EPS will remain positive as price targets and forecasts move forward 12 months, suggesting many banks will be trading on 4-5x one-year-forward PE within weeks.

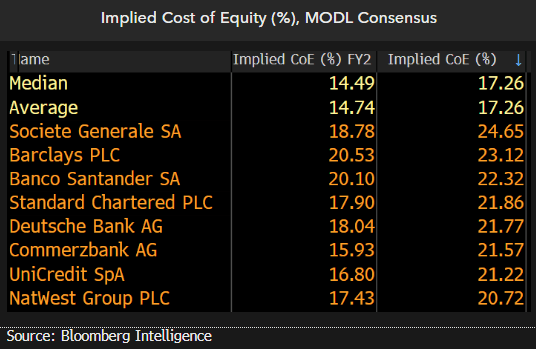

SocGen, Barclays’ 24% cost of equity tops bank sector fear list

When volatility and uncertainty are high, valuing banks has to start with how much capital they need and what returns can be made on that capital, with an improving return-on-equity trajectory as appealing as revenue growth. Using consensus, and rearranging the ROE/cost of equity equals price/book value equation, we derive what cost of equity the market implies, providing a sensible relative starting point.

Societe Generale and Barclays top the charts on this metric (2024 consensus), with an average 24% implied cost of equity despite top-line upgrades and with capital returns and capital reallocation high on their agendas. Capital efficiency and a tight rein on costs remain critical, and we note that UniCredit is a perfect example where a combination of capital return, benign cost of risk and upgrades has lowered its COE.

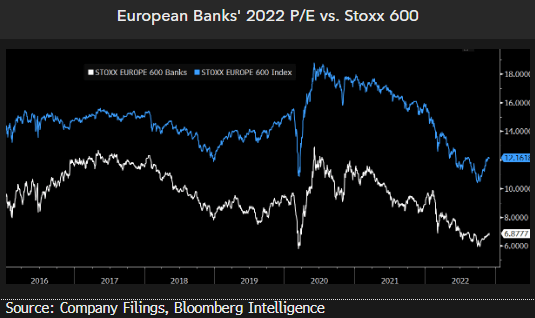

5x multiple PE discount to market seems fair

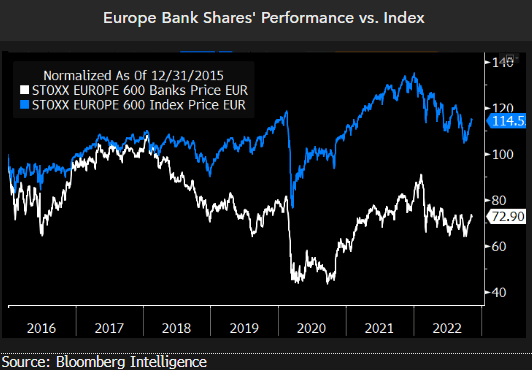

European banks’ revenue tailwinds from rising policy rates, yields and loan pricing remain a positive vs. many industries across wider European markets (STOXX 600 Europe). As such, the 5x multiple discount to the broader benchmark, at the lower end of the range in recent years, appears fair and can hold into 2023. The sector seems well placed to deliver additional EPS upgrades for this year and next as tech and growth stocks have de-rated, and the ultimate cost of the inflationary squeeze on consumer health and spending has yet to feed through to banks’ provisions.

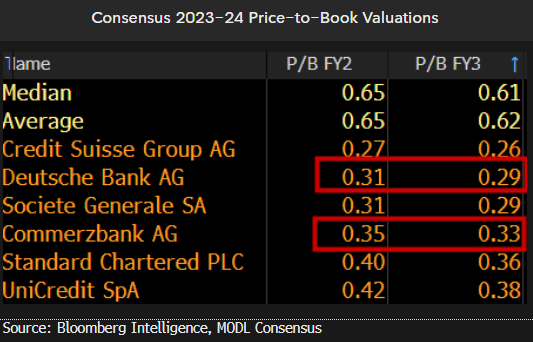

Deutsche, Commerzbank valuations echo Germany’s Russia-gas woes

Deutsche Bank, UniCredit and Commerzbank are trading among the lowest ratios of 2024 consensus price to tangible-net-asset values, partly, we believe, on concerns that Russian gas-supply risks for Germany continue to imperil credit quality. UniCredit’s German unit is expected to generate about 25% of 2022 revenue, and sovereign fears and fragmentation for its core Italian business are probably denting sentiment as well. Consensus currently implies a 90% chance of German recession in 2023, though unemployment is expected to hold steady at about 5.5%.

Stockpicking banks in a fast-moving rate environment

European banks’ pre-provision operating-profit cushions are being lifted by rising rates — with aggregate 2022-23 expectations exceeding Є50 billion higher year-to-date — and we believe the situation can continue to more than offset expected credit loss charges as inflation hurts corporate and consumer health. This year’s performance clearly shows how the sector raced from the blocks, easily outperforming the wider market until Russia’s invasion of Ukraine turbocharged inflation.

With peak EU (2.75% possible) and UK (4.5%) rates now likely in mid-2023 and the trajectory better understood, the interplay between regulators, central banks and the banking sector is tantamount, with tiering and capital requirements two key levers.

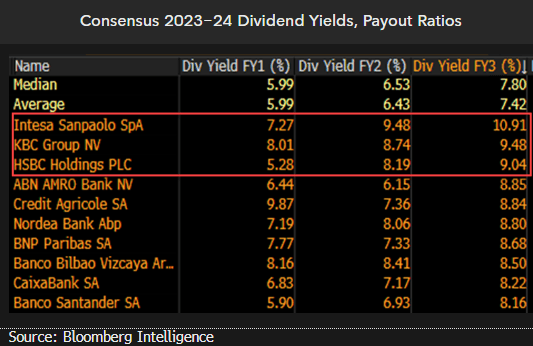

Intesa 11%, KBC 10%, HSBC 9%? 2024 dividend yields speak volumes

Dividend yields remain an important facet of European bank valuations, with buybacks providing a handy catalyst in some cases that can push annual capital-return yields well beyond 10%, though regulatory scrutiny is growing and buybacks may ease. Intesa remains the perennial leader on dividend-yield charts, with KBC second and HSBC a new entrant in the third spot with a 9% 2024 yield. Credit Agricole and BNP Paribas screen also well on this gauge. For BNP Paribas, further buybacks vs. reinvesting the proceeds of its BancWest sale still favors investment.

Credit Agricole’s ownership structure precludes stock repurchases as a significant option, but the majority-owned lender screens inexpensively on many measures, with Amundi still the jewel in its crown.