Enhance your pre trade liquidity analysis with aggregated Axe data

Finding liquidity in the global fixed income markets can be a challenge, and one that is compounded by volatility and uncertainty. The reliance on over-the-counter (OTC) markets requires users to aggregate data themselves to support liquidity and price formation. Therefore, technologies that offer more efficient ways to connect, collaborate, and execute trades are always in demand.

It’s clear that the buy-side seeks to increase their use of data to better inform decisions, support their activity, and increase levels of automation. They are looking at new ways to incorporate live liquidity into portfolio re-balancing and at trade generation tools in real-time. Additionally, investors are looking for ways to synthesize large amounts of data to identify reliable sources of liquidity such as axes, find the best dealers for execution, and spot trends and opportunities.

An axe is an indication that a market participant has a particular interest in buying or selling a bond. Consolidating and aggregating these indications of pricing and liquidity provides transparency into where liquidity lies, helping investors to spot high-level liquidity trends, and providing support to an investment strategy.

Bloomberg’s fixed income liquidity tool and buy-side axe discovery workflows, including IMGR, QMGR and ALLQ functionality, help fixed income analysts, portfolio managers and traders to aggregate liquidity in real-time. Using the Bloomberg Query Language (BQL), clients can now also access live and actionable axe data, enabling them to add an executable liquidity component to the security selection and execution process.

BQL is an API based on normalized, curated, point-in-time data. Using BQL, Bloomberg clients can perform custom calculations directly in the cloud. Analyses that previously required users to download thousands of data points and perform complicated manipulation now require only a single formula. Bloomberg Terminal users can simply specify the data needed and the required calculation – – to synthesize large amounts of data and extract the exact information needed.

By incorporating axe data into their investment analytics via BQL, buy-side portfolio managers and traders can filter the data to analyze executable liquidity in real-time, incorporate insights on liquidity into their pre-trade workflows, and develop more informed approaches to investment and execution.

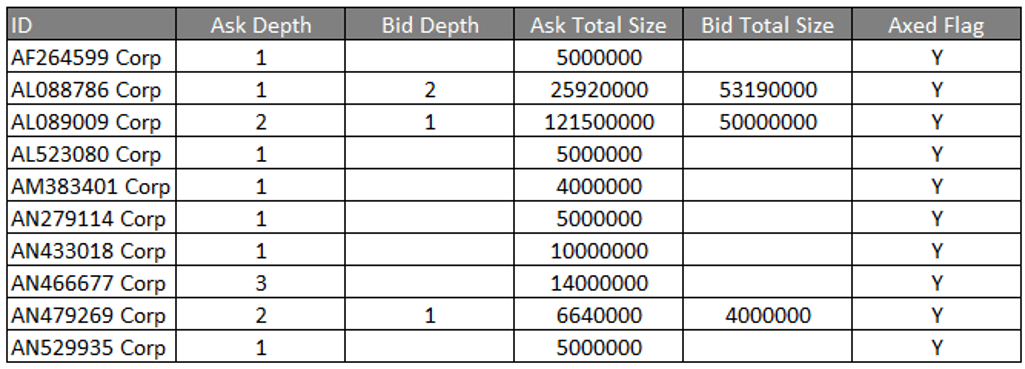

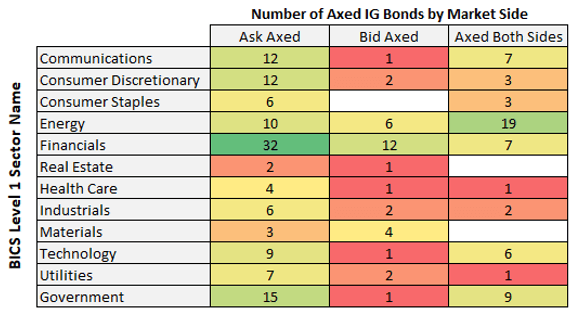

For example, a trader or buy-side portfolio manager looking for executable liquidity for her portfolio can now highlight where liquidity exists for specific bonds. Axe data in BQL allows clients to quickly identify axed securities for a given portfolio or watchlist in one single query.

Additionally, if a buy-side portfolio manager is seeking to access executable liquidity for her portfolio, with the availability of axe data via BQL, they can now highlight where liquidity sits across different sectors or issuers. The ability to filter and sort this dataset allows buy-side traders to quickly and easily identify which dealer has liquidity and the best price.

Access to this type of data and analytics are increasingly helping traders and portfolio managers make better informed decisions about their trade execution. On Bloomberg, Clients can use the data available on IMGR AXE <GO> and QMGR AXE<GO> to augment their pre-trade analysis, aggregate information on pricing and liquidity for a specified universe, discover liquidity trends, and use the findings to refine their investment strategies.

For further information on BQL and Axes Data, visit:

- BQLX<GO> > BQL For Fixed Income > Axes Data in BQL

- BQNT FI<GO> > New in 2022 > Axes Data

- On the Bloomberg Terminal, axe data is available via IMGR AXE <GO> and QMGR AXE <GO>.

For a spreadsheet tutorial on Axes and more information on BQL, visit BQLX <GO> on the Bloomberg Terminal.