EDF, RWE, Uniper outlooks could brighten on EU green-label shift

This analysis is by Bloomberg Intelligence Industry Analyst Patricio Alvarez. It appeared first on the Bloomberg Terminal.

The potential inclusion of gas and nuclear in the EU’s sustainable investment taxonomy may improve funding conditions for utilities exposed to atomic and gas-fired generation, such as EDF, RWE and Uniper. We believe the move could help advance climate-neutrality goals by adding resilience to the bloc’s power grid as renewables expand over time.

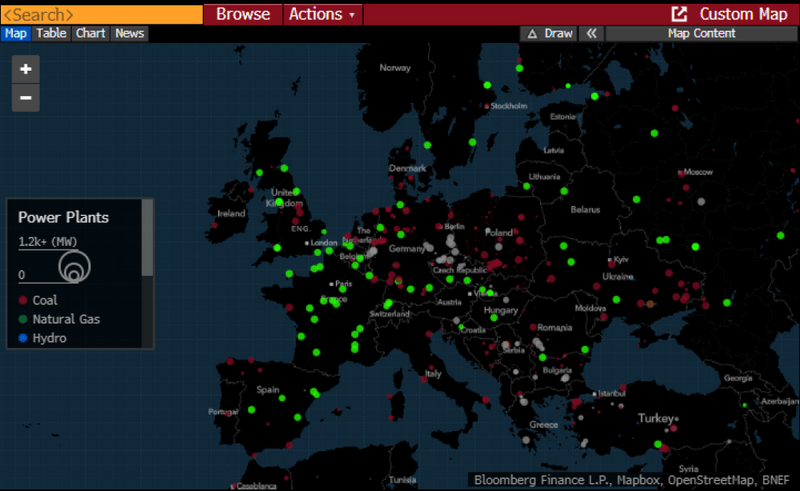

Greening of gas should ease, not derail, transition

The inclusion of certain gas activities in the EU’s green taxonomy could boost midterm investment fundamentals for natural gas-fired generation and storage in Europe, aiding the prospects of utilities with significant exposure — such as Fortum’s Uniper, RWE, Naturgy and Snam — while easing their longer-term transition to renewable sources. A renewed focus on gas may also provide greater flexibility and help accelerate the phaseout of coal.

Under the current proposal, new natural-gas-fired power plants will be deemed “green” if they: have an emission profile below 270 grams of CO2 equivalent per kilowatt-hour; replace a more polluting fossil-fuel plant; are permitted for construction before 2030; plan to switch to green gases by the end of 2035.

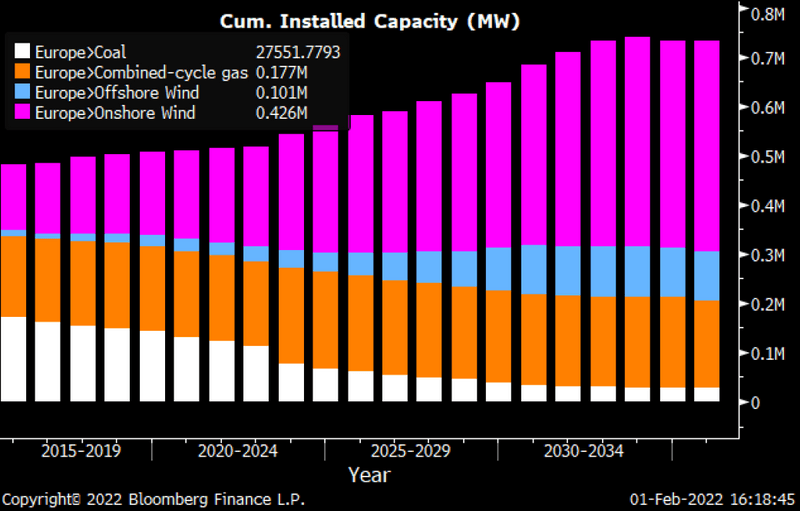

EU gas-fired capacity vs. Wind generation (MW)

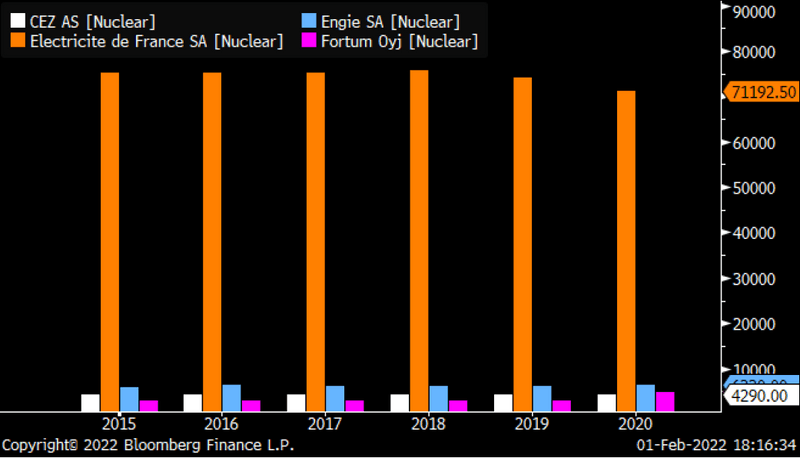

Taxonomy shift may do little to revive nuclear

By classifying certain nuclear plants as “green,” the EU taxonomy should incentivize companies to invest in renewing Europe’s atomic fleet, yet construction delays and cost overruns on existing projects highlight the associated economic and operational hurdles. Atomic plants generate reliable baseload electricity that could help offset wind and solar’s intermittency issues while also reducing exposure to fossil fuels and their price volatility. Europe’s largest nuclear generator — EDF — plans to manufacture small modular reactors by 2030, which could help shorten project lead times.

Under the proposal, a new nuclear-power project is deemed green if it can secure funding, find a site to safely dispose of radioactive waste and is permitted before 2045. Existing plants are seen as being “temporarily sustainable” until 2040.

Europe’s largest nuclear generators (MW)

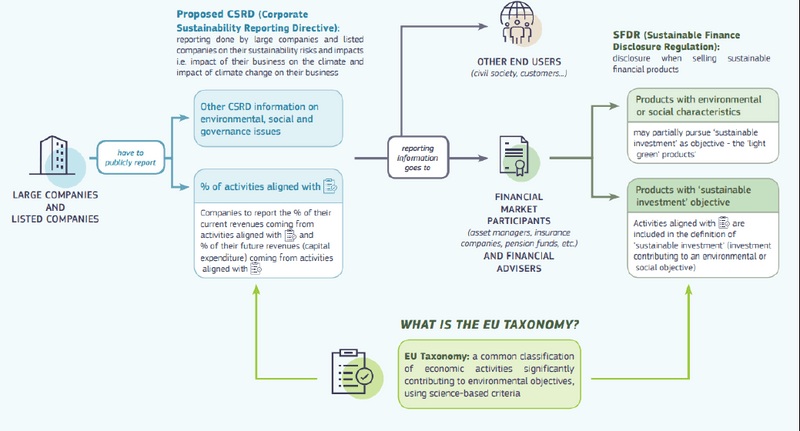

EU green taxonomy steers sustainable investment

Despite facing opposition from activists and some bloc members, the EU’s proposal to classify certain natural gas and nuclear activities as being sustainable under its green taxonomy could enter into force through midyear, we believe. Though EU states are unlikely to reject the proposal — given this would require 20 vetoes out of 27 — a win in the European Parliament is still uncertain. Germany supports the inclusion of gas, as it will need more capacity to bridge the gap left by its early retirement of nuclear power. France, meanwhile, is pursuing an energy plan that has atomic generation at its core.

The EU taxonomy for sustainable activities was introduced in 2020 as a system to clarify which investments are environmentally sustainable in the context of the European Green Deal.

EU sustainable finance taxonomy framework

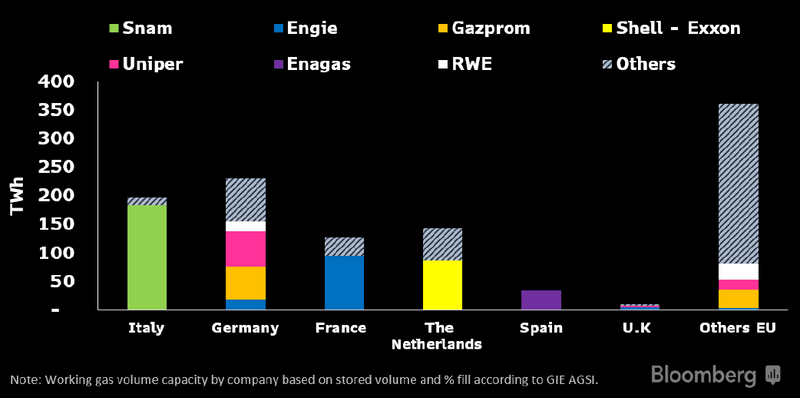

Strategic gas reserves as a possible buffer

Implementing strategic natural-gas reserves in Europe and the U.K., similar to the U.S. Strategic Petroleum Reserve, could help avoid market volatility, we believe. Abnormally low storage levels are the key reason for the price surge unfolding since early September. Setting minimum gas inventories at an European level may provide a buffer against external supply-demand shocks by improving domestic-reserve stability. With the exception of France and Italy, where regulation mandates baseline balances, there’s no EU policy on strategic gas reserves, which means most members rely on market dynamics to manage inventories.

Setting up a strategic gas reserve in Europe may provide a supportive readacross for utilities involved in gas infrastructure such as Snam, Engie, Enagas and Gazprom.

Major gas storage companies EU & U.K.

Nuclear comeback may be too little, too late

Expanding nuclear power could help Europe and the U.K. become less reliant on fossil fuels, yet we believe its long development lead times (5-10 years) make it incompatible with the region’s decarbonization goals. Delaying nuclear phaseouts or increasing capacity through the end of the decade may help the continent’s energy mix, providing a source of reliable carbon-free power that helps abate wind and solar’s intermittency issues. A revamp in atomic spending may benefit Europe’s largest nuclear generators; EDF, Engie, Fortum and CEZ.

Germany leads Europe’s nuclear exit with its 2023 goal, while France continues its push to include nuclear under the EU’s green-finance taxonomy and deploy additional smaller-scale reactors, aligning with its plan to reduce nuclear’s share of the generation mix from 70% to 50% by 2035.

Nuclear power plants in Europe/U.K.