E-commerce surge can add $1 trillion to US retail sales by 2027

This article was written by Bloomberg Intelligence Senior Industry Analyst Poonam Goyal. This article appeared first on the Bloomberg Terminal.

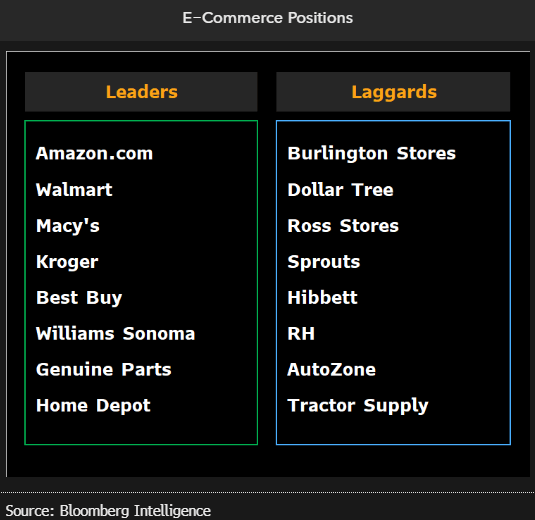

Digital sales could jump to 33% of US retail revenue by 2027 from 25% last year, based on our scenario analysis, as new sales channels like social, voice and video compound a boost provided by pandemic lockdowns. E-commerce natives such as Amazon and brick-and-mortar giants like Walmart will be central to adding around $1 trillion to online sales, with natives making up more than half. AI, e-wallets, augmented reality and cloud-based software that assist smaller merchants may also speed the transition. Macy’s, Kroger, Best Buy and Home Depot are well positioned among traditional retailers.

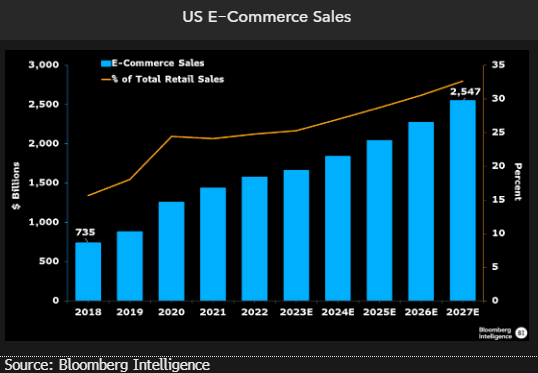

US E-commerce heads to $2.55 trillion as Amazon gets company

E-commerce is poised to hit $2.55 trillion by 2027, making up 33% of US retail sales from 25% today, according to our analysis. Adoption of generative AI, low barriers to entry and growing use of online marketplaces are key catalysts. Though Amazon leads the market, brick-and-mortar stores are gaining quickly after investing heavily in omnichannel capabilities.

Amazon, Walmart, Macy’s help lead digital wave

US retailers could add almost $1 trillion in e-commerce sales through 2027, according to our scenario analysis, driven by sharp increases at digital natives and non-natives alike. Investments in payments, fulfillment, marketplaces and new technologies like generative AI will fuel growth as consumers demand more convenience. Though Amazon.com will continue to lead the gains, Macy’s, Kroger and Best Buy are also making strides. Walmart has focused on quickly bolstering its marketplace, expanding its assortment and launching its own fulfillment service to compete with the e-tail behemoth.

Amazon is the market-share leader, with its first- and third-party offerings catering to over 160 million Prime members in the US. But niche digital natives are expanding fast and chipping away at brick-and-mortar.

Solid sales growth to build on pandemic’s pop

Though US digital sales gains have normalized since the pandemic’s surge, e-commerce could still grow at a 10% compound annual rate to $2.55 trillion (excluding gas) in 2027 from $1.57 trillion last year, based on our scenario analysis. Almost 60% of the increase may be driven by digitally native retailers. Traditional brick-and-mortar stores might add more than $330 billion in online sales, reaching about $1.06 trillion in 2027 as they expand their omnichannel capabilities and invest in generative AI, social commerce and fulfillment. Though e-commerce should remain at 25% of total retail this year, growth could start accelerating in 2024, taking penetration to 33% in 2027.

Click on the exhibit to see our interactive scenario analysis and its methodology.

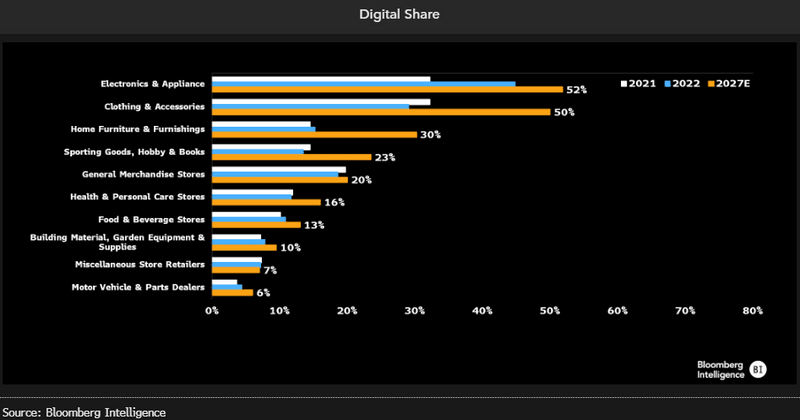

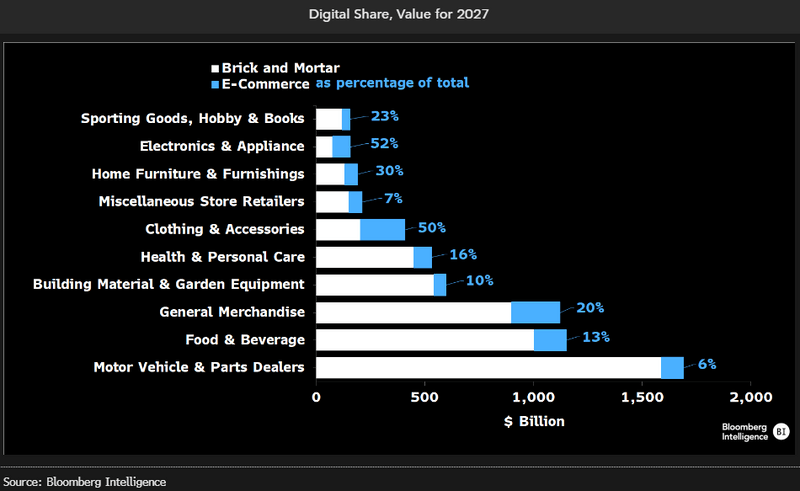

Online share has room to rise across sectors

Digital natives will likely drive most e-commerce gains, but brick-and-mortar companies could increase their share as the pandemic-induced shift is cemented. Mass merchants like Walmart, Target and Costco may make the greatest contribution to online sales as they ramp up digital efforts. E-commerce penetration for apparel and electronics could reach equilibrium in the next several years, but automotive’s digital share might continue to lag behind as most new- and used-vehicle sales, repair and maintenance are conducted in person.

The automotive industry’s resistance may keep digital below 50% of overall US sales as the sector accounts for 22% of retail’s total.

E-commerce penetration to expand through 2027