This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Sean Savage. It appeared first on the Bloomberg Terminal.

The Treasury Department’s focus in its quarterly refunding on dealer-to-customer (D2C) activity in Treasuries marks the latest salvo in the official sector’s efforts to improve market transparency and liquidity. Various measures are being considered, including increased central clearing of cash Treasuries, but we expect regulators to move with caution, given the systemic importance of the market.

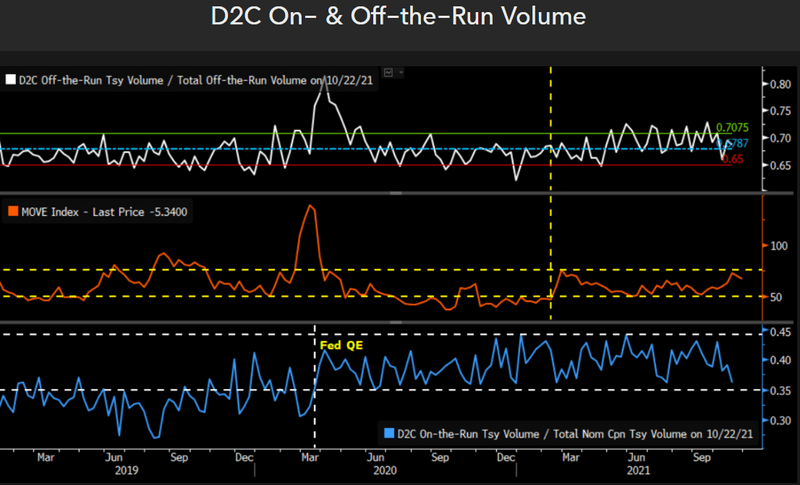

D2C share of off-, on-the-runs larger, but different catalysts

Dealer-to-customer Treasury market activity has always included substantial off-the-run trading. Though this remains closely tied to the auction cycle, the segment has seen its share of off-the-run volume expand from about two-thirds through 2019 and much of 2020, excluding the severe market stress in March-May 2020 (top panel). The ramp-up in D2C’s share of late has occurred as rate volatility settled into a range above that seen in 2H20-1Q (middle panel).

By contrast, the increase in the D2C share of on-the-run volume coincided with the Federal Reserve’s quantitative easing program, where dealers are the key intermediaries between the central bank and investors (bottom panel).

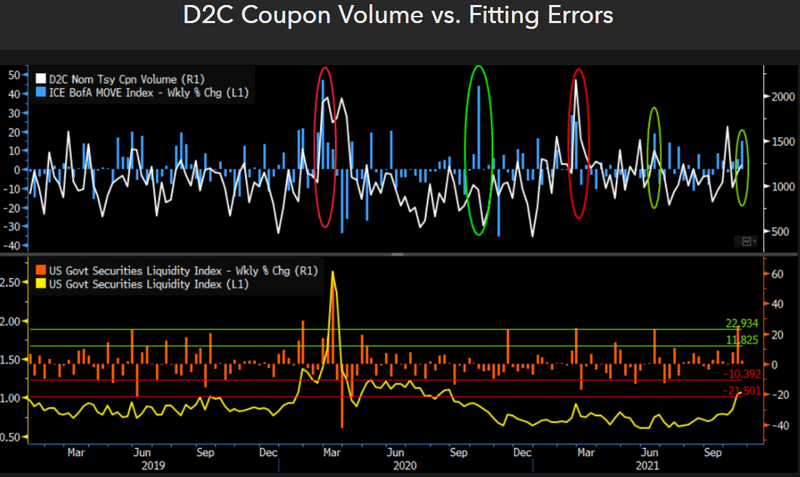

D2C linked to liquidity deterioration amid volatility

In recent years, volatility spikes coincided with sharp increases in D2C trading volume. March 2020 and February market turmoil (top panel, red ovals) led to large fitting errors on nominal coupons, an indicator of worsening liquidity (bottom panel). However, there have also been volatility spikes without a big balance sheet “flex” by dealers associated with higher fitting errors (top panel, green ovals).

The similarity in outcomes despite different dealer-reaction functions reflects that dealer capital hasn’t scaled with the size of the Treasury market. The meager spread dealers earn on Treasury cash and repo trades, capital constraints and shifts in risk management across volatility backdrops all contribute to this.

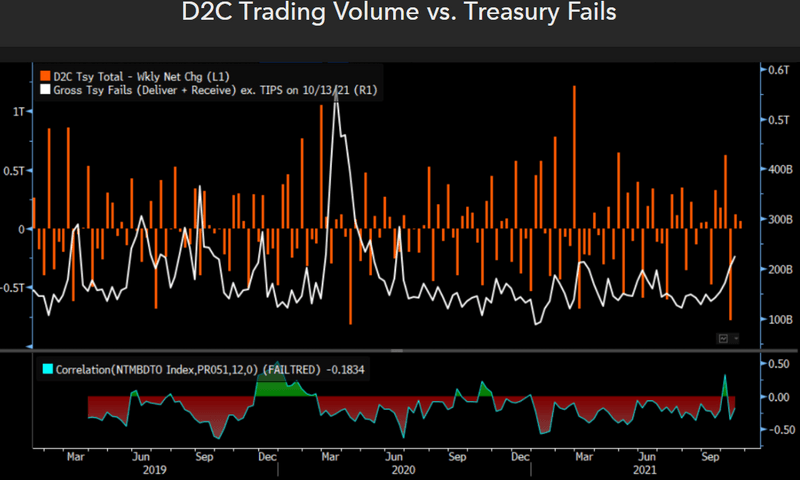

Bilateral D2C settlement obscures central clearing benefit

Dealer-to-customer trades settle bilaterally, though regulators continue to discuss the merits of central clearing. Such a move would provide balance sheet relief to dealers via netting of exposures — though not as much as central clearing of Treasury repo trades — and mitigate counterparty risk in D2C trades. This should increase dealers’ willingness and ability to intermediate in Treasuries. Central clearing would also provide benefits in periods of market stress by reducing the knock-on effects of settlement fails. That said, large one-sided flows, like in March 2020, could pose a challenge even with central clearing.

Treasury trading in the D2C segment is usually negatively correlated with settlement fails, as dealer intermediation on behalf of customers declines amid rising fails.

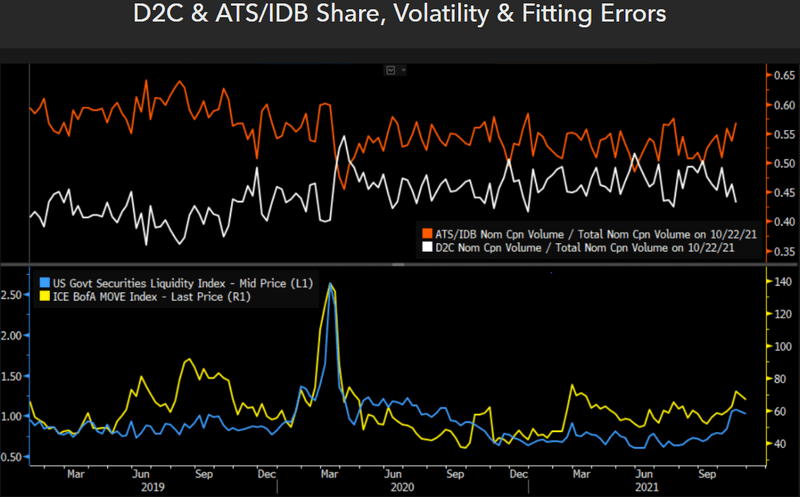

Shifts in liquidity reflect source of stress, segmentation

Distinct stress points are reflected in Treasury-coupon shifts in liquidity provisions, most notably amid March 2020 and February volatility. The D2C share rose in March, given widespread liquidation of off-the-runs, while alternative trading systems and interdealer brokers’ share of total activity increased in February with on-the-run selling. This historical segmentation between the D2C and wholesale sectors is reflected in trading protocols, with the former characterized by request-for-quote, voice trading and streams, and the latter using central limit order books (e.g., BrokerTec).

There are operational and technological hurdles to integrating the two models, but buy-side demand for more tools to source liquidity while streamlining workflow will continue to spur innovation in both.