Confidence in Bitcoin grows as it passes a liquidity stress test

This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

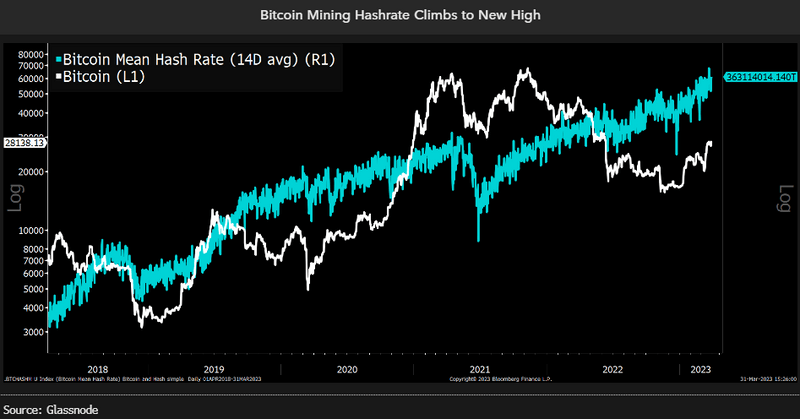

Although the rates narrative has dramatically shifted, Bitcoin continues to be the signal in the noise as its Q1 performance marks a significant milestone in its potential ascendancy as a global reserve asset. Even as the market prices in deflation and US authorities ramp up hostilities against the industry, confidence in the network based on the hashrate is hitting an all-time high.

Shift in market narrative

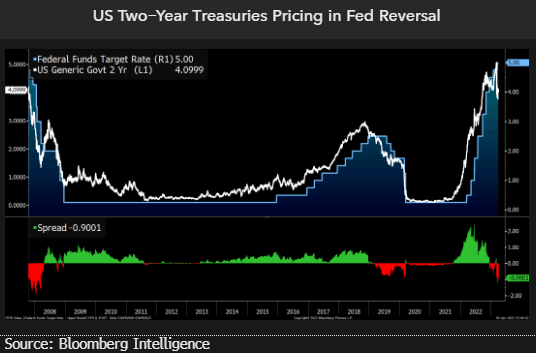

With backward-looking inflation prints remaining high, 2023 started with a consensus rates narrative of “high for longer”. Bitcoin’s outperformance of global assets had started in November and continued through the first two months of 2023, when the market narrative suddenly changed; a liquidity crisis in US banks was prompted by the Fed’s record-setting rate rises and the subsequent depositor exodus.

The spread between the two-year treasury and the Fed funds rate, which went negative in January, has collapsed further into negative territory. This is the most negative the spread has been since the 2008 Global Financial Crisis, indicating that the market is pricing in a severe downturn and deflation.

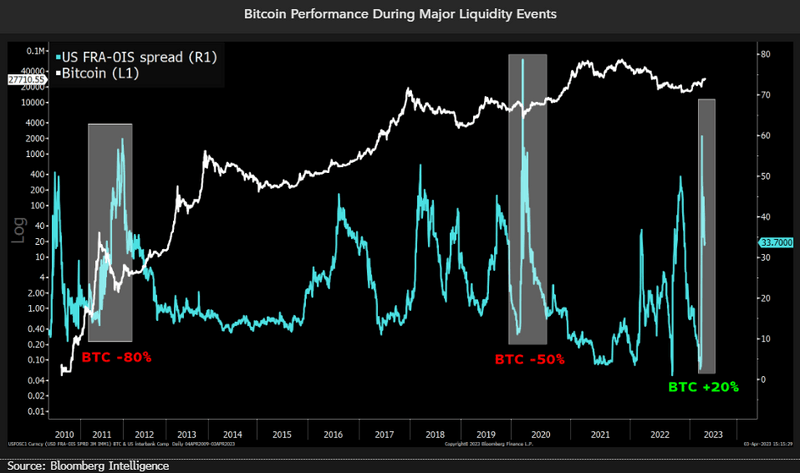

Bitcoin passes its first major liquidity event test

The world’s youngest asset has many tests to pass if it is to become a global reserve asset, including liquidity crises. In 2020, disappointed proponents believed Bitcoin’s unique monetary properties would provide shelter, even in a pandemic. When the interbank borrowing rate, the US FRA-OIS spread, spiked to 78bps in February and March, Bitcoin fell 50% in a month. A decade earlier during the EU sovereign debt crisis in 2010, it didn’t fare well; when the rate rose to 60bps over five months, Bitcoin lost 80%.

As the rate climbed to 60bps, the third-highest since the GFC, Bitcoin rallied more than 20%. In the event of another global crisis such as a pandemic or cyber attack, Bitcoin is unlikely to be spared. Yet, as a hedge against the inherently unstable fractional reserve banking system, Bitcoin has passed a crucial test.

Second-best 1Q despite US crackdown

Despite the fact that the US crypto climate has entered a new and more hostile phase, Bitcoin has recorded its second-best 1Q performance in a decade, signaling what could be another significant shift for the network. Strong 1Q performances in previous years have also resulted invariably in a higher year-end price.

Although prior regulatory determinations protect the network from Securities Act-driven enforcement, it appears that the Fed, regulators, the White House and industry are making an effort to choke off-ramps into the asset. Other actions targeting miners are not out of the question. The US could be misjudging the game theory that’s at play, as other jurisdictions make overtures to the industry, with the EU, Singapore, Canada, the Middle East and Hong Kong seen as the front runners for businesses fleeing the US.

The network has never been more secure

Although a new directed attack on miners by US authorities remains a significant risk, the remarkable 25% year-to-date growth in hashrate indicates that confidence in the network is at an all-time high. Hashrate refers to the network’s computational power, which is used to process and validate transactions on the Bitcoin blockchain. The greater the hashrate, the more difficult it is for any single entity to control the network or manipulate transaction history.

As central banks and regulators attempt to shore up confidence in the fractional reserve banking system, Bitcoin’s armor of decentralized and distributed nodes, miners and users grows organically thicker. The doubling of hashrate during the 2022 bear market compounded by the exceptional start this year is indeed impressive.