This article was written by Katharine Furber. It appeared first on the Bloomberg Terminal.

Bloomberg Bridge is a new anonymous intermediated all-to-all trading service for corporate and emerging-market bonds. It expands the intermediation services that Bloomberg has supported through CastleOak Securities’ DirectPool offering since 2017.

Although all-to-all trading isn’t new, adoption has increased in the past few years. Recent research from Coalition Greenwich found that all-to-all trading accounted for 12% of US corporate bond volume in 2020, up from about 5% in 2017. This type of trading enables participants to expand their liquidity network, potentially achieve price improvements, and find trading opportunities for less-liquid bonds.

All-to-all trading lets users engage anonymously with existing counterparties or with alternative liquidity providers by trading via an intermediary that connects participants to the intermediary’s respondent pool. Bloomberg Bridge trades are intermediated and settled by Goldman Sachs’s intermediation service.

Bloomberg Bridge currently supports anonymous all-to-all trading in the UK and Europe, and launches are coming in the US and Asia-Pacific. For more information on enrolling as a price taker and/or price maker, go to {BBN <GO>}.

How does it work?

Submit a request for quote (RFQ) anonymously to the Bloomberg Bridge network. Participants on Bloomberg’s multilateral trading facilities (MTFs) who also have a trading relationship with Goldman Sachs can select Bloomberg Bridge as a source of liquidity. The onboarding process is simple and uses existing settlement instructions.

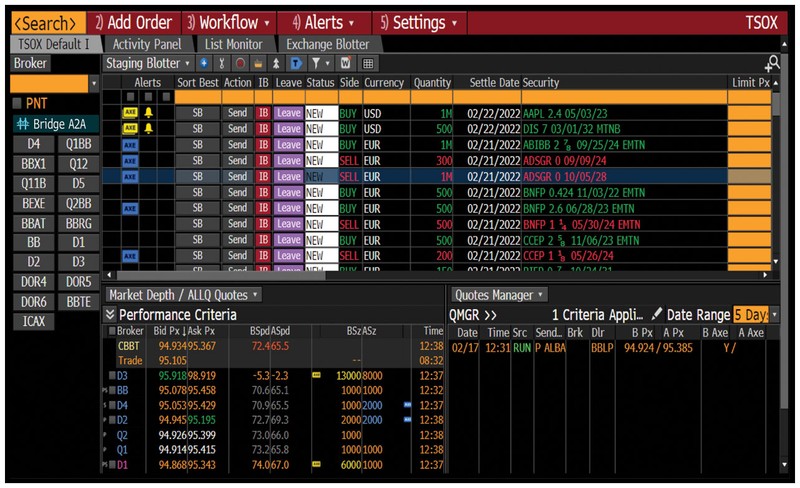

The service is fully integrated into existing trading workflows. You can send an inquiry to Bloomberg Bridge—or include Bloomberg Bridge in an RFQ you’re sending to existing liquidity providers—whether you’re trading a single security or a list, manually or via automation.

Bloomberg Bridge will be designed to harness much of Bloomberg’s global network of institutional investors and dealer firms, currently numbering more than 3,700. Once a participant sends out an RFQ, the Goldman Sachs intermediation desk sends the inquiry to its on-boarded users. This growing network comprises all investor types—from traditional sell-side firms to asset managers, hedge funds, insurance companies, pension funds, and alternative liquidity providers.

Responding to inquiries from the all-to-all network is easy via the Bloomberg terminal or by using existing application programming interface (API) connections.

To help optimize the trading process, you can customize the inquiries and opportunities you’re alerted to based on your trading strategies. You can use the data and analytics on Bloomberg to establish a watchlist, which could be based on your positions held in the Bloomberg Asset and Investment Manager (AIM) system or trade orders staged on Bloomberg’s Fixed Income Execution Management (TSOX) system.

BLOOMBERG BRIDGE CAPITALIZES on the benefits of the Bloomberg terminal’s functionality and connectivity, which enables you to streamline workflows and realize greater execution efficiency with automated trading tools. Use trade automation to help select liquidity providers and set rules to manage low-touch trades so you can focus on higher-touch trades. Bloomberg’s Sort Best tool allows you to define a blend of criteria to automate dealer selection on an electronic trade with a single click. Similarly, Rule Builder (RBLD) lets you predefine routing, broker selection, and execution criteria logic so trades can be completely automated when market conditions allow. Both tools now support Bloomberg Bridge as part of their liquidity provider selection. That means you can automatically include Bloomberg Bridge on electronic RFQs with a single click, or even no click.

Bloomberg Bridge is integrated into established pretrade price discovery workflow as well. Bloomberg’s Inventory & Pricing (IMGR), a robust source of market intelligence, lets you view real-time information gathered from your sell-side feeds, MSG, RUNZ, and IB, and also provides searching and alerting tools. You can use existing IMGR views, searches, and alerts to see Bloomberg Bridge activity. To respond to a live Bloomberg Bridge inquiry, right-click on it and select Respond to Inquiry.

Another benefit for Bloomberg Bridge users is their existing connectivity. Bloomberg delivers full and automated straight-through-processing (STP) without requiring any additional integration efforts from participants. That includes, for example, an asset manager who requires a trade to automatically drop into her firm’s order management system (OMS) post-execution (regardless of whether the firm is liquidity taker or maker on a trade). It also includes a sell-side firm wishing to use the same connectivity channels and tools for disclosed RFQs.

WHAT’S NEXT FOR Bloomberg Bridge? The number of onboarded users available via Goldman Sachs intermediation is growing and gaining momentum. Price responsiveness is outperforming averages observed on other Bloomberg venues and negotiation systems. With the addition of services in the US and Asia-Pacific and integration for traditional buy-side players to act as liquidity providers via the Bloomberg terminal, the future looks promising for this all-to-all trading service.

For more about electronic trading on Bloomberg, go to bloomberg.com/professional/blog/category/electronic-trading.