China could base housing model on Singapore instead of Hong Kong

This analysis is by Bloomberg Intelligence Senior Industry Analyst Kristy Hung and Bloomberg Intelligence Associate Analyst Lisa Zhou. It appeared first on the Bloomberg Terminal.

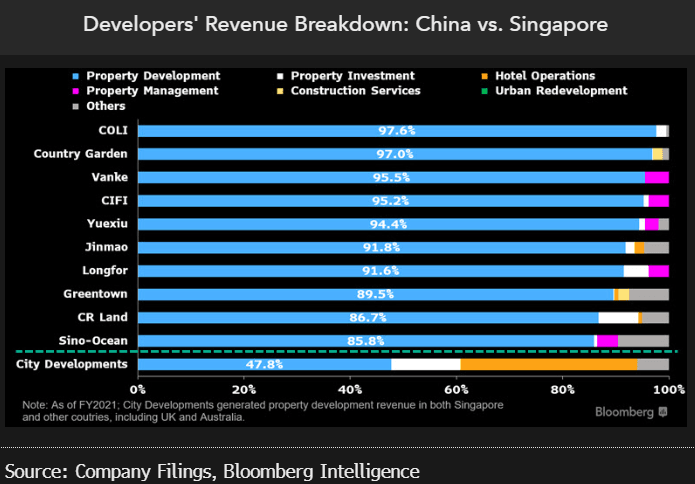

China’s move toward public housing at the expense of private homes — as the country potentially models its housing supply structure on Singapore’s — could further dim developers’ long-term home-sales outlook. Developers with larger exposure to retail leasing, like CR Land and Longfor, could be better placed in the shift, as will firms like Greentown that have a construction business.

Co-owned public homes could expand to more cities

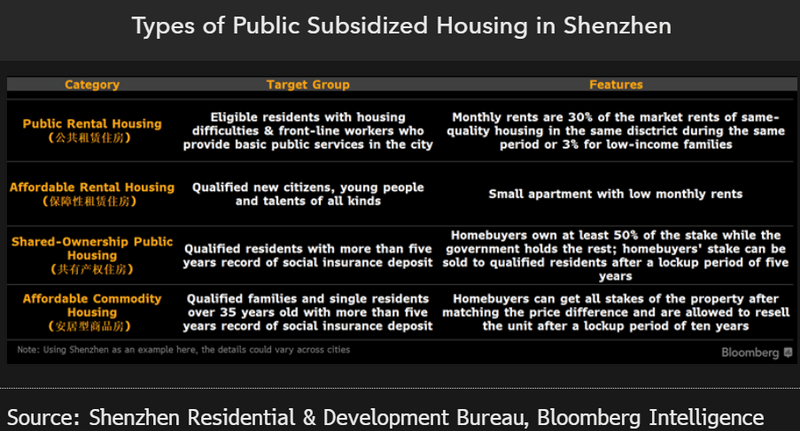

The introduction of shared-ownership public housing in Shenzhen in January, which allows qualified residents to buy half of a property unit, could see the concept spread to more cities as China seeks to build a more comprehensive and affordable housing system in the long run. The pilot program allows homeowners to sell their stake after a lockup period of five years to only qualified groups, with the rest constantly held by the government.

The city’s halt to offering new land plots for affordable commodity housing appears to answer the country’s call to build homes for living and not “speculating”, as an owner of the so-called affordable commodity housing could keep all the gains from an increase in valuation during the lockup period of ten years after selling the unit to the public.

China’s potential shift to Singapore’s housing model

Shared-ownership public housing could account for a higher proportion of home supply in mainland China over the longer term, as it seeks to avoid the affordability problem with Hong Kong’s private homes even as 31% of the city’s households are living in public rental apartments. This could bring challenges to Chinese developers’ sales expansion in major cities where land slated for private apartments might be used instead for public housing.

Singapore could be a role model for mainland China, given its steady track record on home prices, which have risen 24% in the past ten years, thanks to the sizable supply of public residential units provided by the Housing and Development Board (HDB), home for 71% of the country’s households, according to Singapore Department of Statistics.

Developers face pressure to deliver growth

Chinese developers could struggle to expand home sales in the medium term, as they face a dual challenge of a potential shrinkage in land supply for private homes in stronger cities and lukewarm housing demand in smaller ones. This makes the need to find another driver of long-term revenue growth more urgent. CR Land could be better positioned for delivering resilient top-line growth in the longer term, thanks its peer-leading exposure to property investment at 8% of its total revenue. Longfor’s exposure is also high at 5%.

Greentown’s lion’s share in the construction management industry brings it growth opportunities as China’s housing structure shifts, considering government entities’ limited capacity in building public housing.

Rental housing to remain a focus till 2025

China is set to increase the supply of public rental housing in major cities where private homes are less affordable in the coming years. The average new-home prices in tier-1 cities in 2022 were nearly triple those in 2012, according to China Real Estate Information Corp. data. Guangzhou will lead with a plan to offer 630,000 units by 2025, which matches the city’s new supply of 650,000 private residential properties, according to the local government’s five-year plan for 2021-2025.

The acceleration in China’s development of public rental housing could partly offset the slump in private-housing construction. Property and related sectors account for 13-14% of the country’s GDP, according to the National Bureau of Statistics.

Developers’ rental-business expansion a rocky path

Some Chinese developers could face hurdles in expanding their apartment-rental business when more public residential units are available in the rental market, as these are usually 70% cheaper than a similar private unit nearby, according to government filings. To secure occupancy, developers may need to focus on brand differentiation and provide value-added services, offer flexible rental terms and target different customer groups.

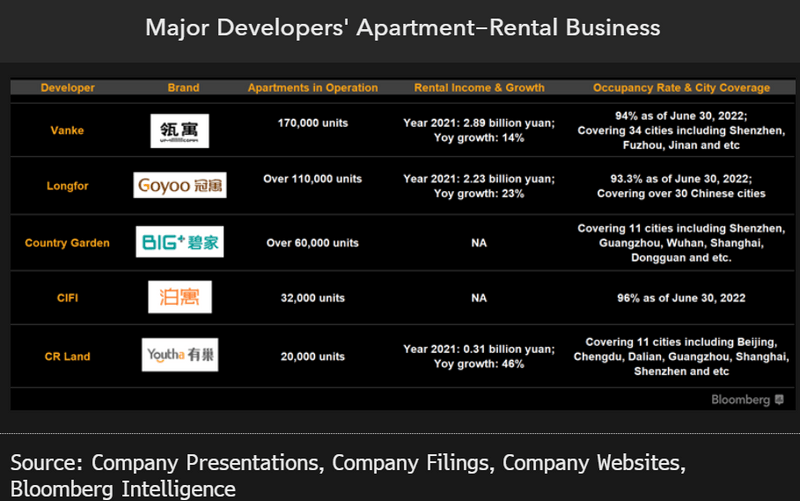

Vanke’s Lingyu has 170,000 units of rental apartments in operation, according to company disclosure, sitting atop a list of major developers we cover, followed by Longfor’s 110,000 units and Country Garden’s 60,000 units.