This article is by Gary Stone.

Bloomberg can help its clients comply with the new rules with greater accuracy, reduced operational risk and minimal impact to their current voice workflows. Firms may be able to leverage one of three Bloomberg workflow solutions to capture data across the voice and sales-to-trader workflows by using a new feature added to Instant Bloomberg (IB) that we call an “Inquiry Pill”.

1. What is Bloomberg IB?

All Bloomberg users have access to IB, the instant messaging tool that enables users to enhance real-time text-based conversations with data, analytics and charts. It also helps counterparties negotiate prices, and can be linked to off-venue trading and reporting workflows.

2. What is the Pill?

Voice and chat functionality provides color and context. Once parties are ready for formal price negotiations, the Bloomberg Pill allows the unstructured voice data to be carried to a structured workflow. In technical terms, the Pill is an object that refers to the instrument being negotiated. The Pill, or object, acts as a mechanism that integrates with other workflows.

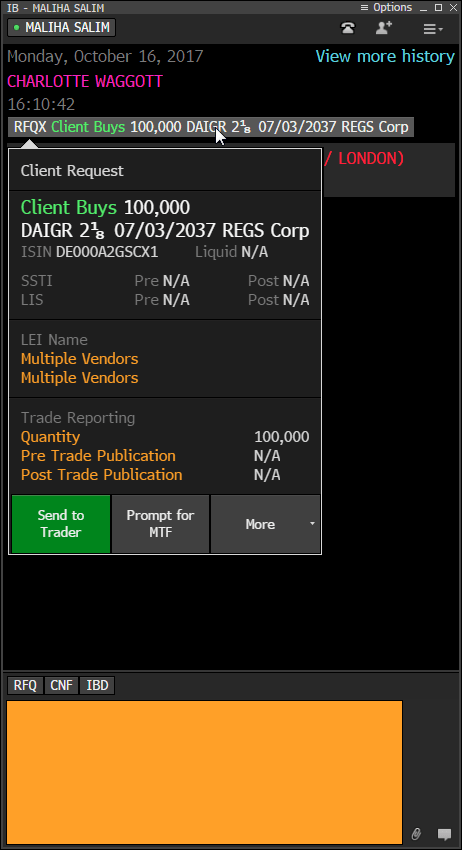

A client can send a free form Bloomberg IB chat to their salesperson to ask for a quote in a particular bond. The salesperson can create the Inquiry Pill by clicking the RFQX option from the Chat Actions menu located in the corner of their IB manager. In this example, the instrument or object is the bond Daimler 2’s of 37. The customer is requesting a market on 1MM. The RFQX button transforms the text description into a Pill on both the customer’s and salesperson’s IB chat. The Pill can also be created via specific workflows within the Terminal that allow a user to connect directly with IB and initiate conversations from some of Bloomberg’s other screens.

Hover over the Pill and a card containing descriptive information will appear. This includes the specific ISIN number of the instrument and other MiFID II information such as an instrument’s liquidity profile, eligibility for a pre-trade price transparency waiver and the trade size threshold for a post-trade transparency deferral.

3. What are the three ways firms can leverage IB and the Pill?

The Inquiry Pill workflow can be integrated with third party systems through either an IB Chat API or Bloomberg’s Trading Network Protocol (TNP) a FIX-based messaging protocol which includes counterparty validation and firm mappings for IB chat-based sales-trader workflows. This pill and form of data capture is also seamlessly integrated with Bloomberg’s Trade Order Management System (TOMS) sales-to-trader workflow (STW).

Due to varying factors such as an instrument’s liquidity, or how customers prefer to execute, Bloomberg solutions are used in different ways by the sell-side to create unique sales-customer experiences. In some cases, the interaction may be predominantly over IB chat. Firms that are adept at scraping and mapping may prefer to use the IB API service to capture and send key inquiry information directly to their internal systems, along with relevant metadata, and to send prices from those systems back into the chat.

However, for those looking to benefit from the pill as well as the other workflows it integrates with, based on their ability and preference to implement the TNP or leverage our OMS capabilities, there is no shortage of options. Furthermore, given a rapidly approaching deadline and the common challenges and uncertainty surrounding voice communication in a post-MiFID II world, Bloomberg endeavors to continue providing flexible solutions to meet the demands of its clients.

More information and demonstrations of all these solutions is available here.