Bloomberg Intelligence’s beverage survey reveals durable preferences amid disruption

This analysis is by Bloomberg Intelligence Senior Analyst Kenneth Shea and Bloomberg Intelligence Associate Analyst Stephen Strackhouse. It appeared first on the Bloomberg Terminal.

As pandemic restrictions have eased over the past year, consumers have shifted where they drink along with some of their beverage choices, though their preferences have remained steadfast with brands, product benefits and new offerings, based on a Bloomberg Intelligence beverage survey. Coca-Cola, PepsiCo, Monster Beverage and Constellation Brands are among the companies best positioned to capitalize on key beverage trends.

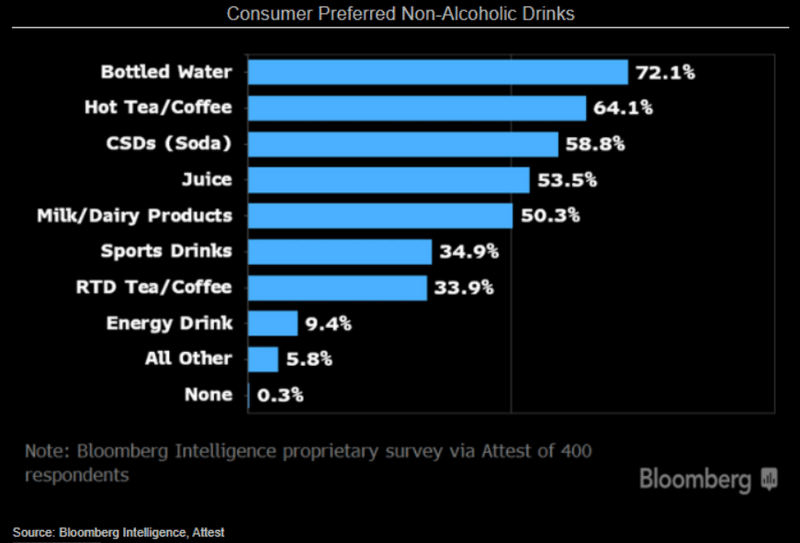

Bottled water most popular, yet soda still pops

Bottled water, hot tea/coffee and carbonated beverages (soda) ranked as the most popular U.S. non-alcoholic drinks among respondents to BI’s consumer survey, which we ascribe to their relative maturity and widespread availability. We expect energy and sports-drinks categories to grow faster in the near term, though, if consumer mobility increases as pandemic-related restrictions on travel and the foodservice channel ease further.

Companies Impacted: Coca-Cola held a market leading 39.1% value share of the $43.2 billion U.S. off-trade carbonated beverage market in 2020, followed by PepsiCo (22.9%), based on Euromonitor data. Coca-Cola also held a 10.1% value share of the U.S. off-trade bottled-water market.

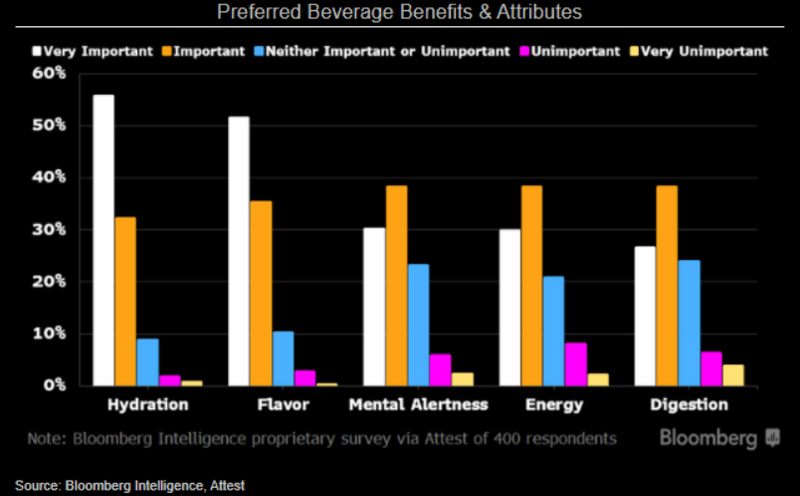

Beverage consumers seek hydration, flavor, energy

Product benefits and attributes including hydration, flavor, mental alertness and energy ranked the highest among beverage consumers surveyed, findings that are consistent with the types of beverages cited (water and hot coffee/tea) as the most popular. Without the current lingering restrictions on consumer mobility, we believe sports and energy drinks would have ranked higher, given high consumer affinity for hydration and energy benefits.

Companies Impacted: Coca-Cola, PepsiCo, Starbucks, Monster Beverage, Red Bull and Keurig Dr Pepper are among the companies we view as heavily exposed to soft drink beverage benefits and attributes most sought.

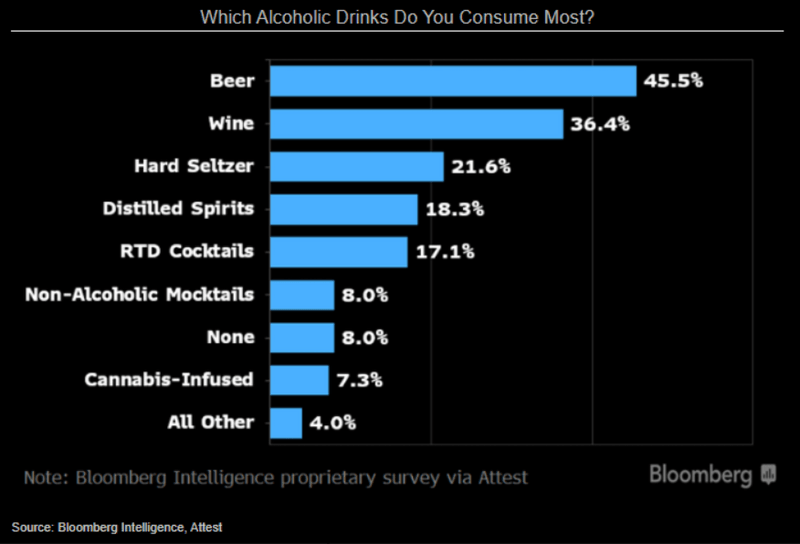

AB InBev, E&J Gallo big beneficiaries of lockdowns

Though the survey finding that beer and wine are consumed the most among alcoholic drinks by respondents was expected, the level of the consumption vs. other alcoholic segments appears to be wide to us. This may stem from lingering pandemic-based restrictions on consumer mobility, as beer and wine consumption tends to occur more at home than that for distilled spirits.

Companies Impacted: Anheuser-Busch InBev held a market-leading 36.7% value share of the $88 billion U.S. beer market in 2020, followed by Molson Coors (20%) and Constellation Brands (14.6%), based on Euromonitor data. E&J Gallo held a leading 25% value share of the $38 billion U.S. wine market, followed by Wine Group (10.7%) and Constellation Brands (10.5%).

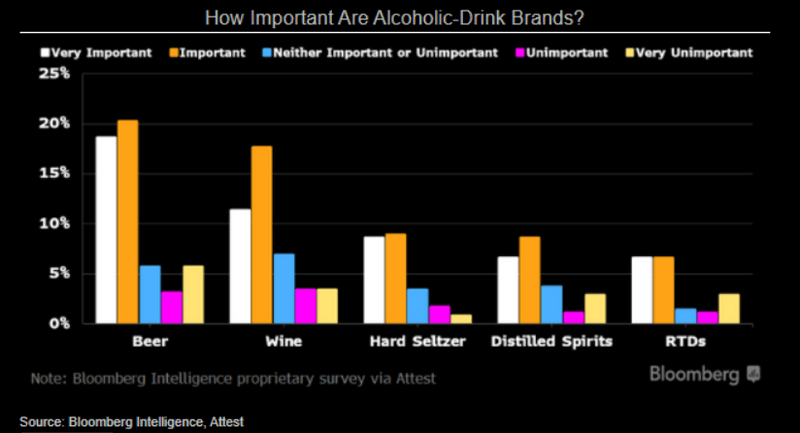

Brewer and vintner product brand loyalty is high

Consumer brand loyalty is the highest for beer and wine among the main alcoholic-beverage segments, based on BI’s survey, implying to us that leading producers have a higher level of pricing power compared with other segments. We view this as especially favorable to Constellation Brands, producer of Mexican import brands Corona Extra and Modelo Especial. These brands command the highest unit prices of leading brews, based on IRI data. Heineken’s namesake beers and AB InBev’s Michelob Ultra brand also have high unit prices. Popular wine brands that hold high unit prices include La Marca, Kendall Jackson and Josh Cellars.

We expect leading U.S. alcoholic beverage producers across all segments to continue to emphasize premium-priced brands.

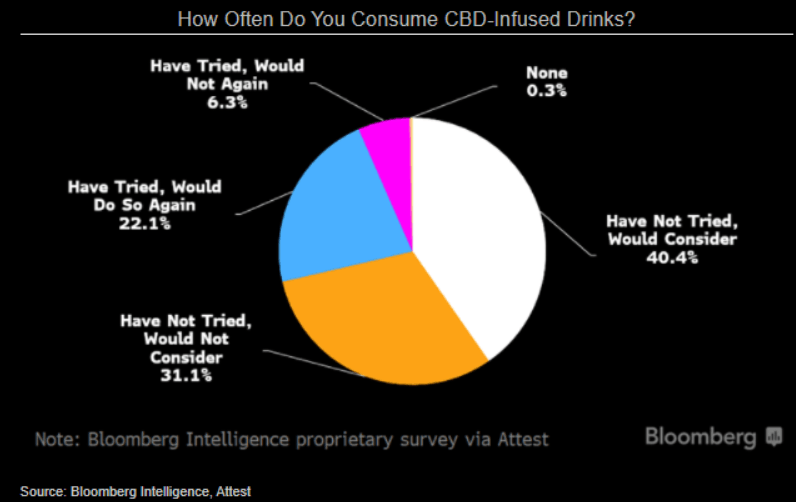

CBD-infused beverage demand holds promise

Beverages infused with cannabidiol (CBD), a non-intoxicating cannabis compound, have promising market potential, based on findings from BI’s survey. About 22% of respondents said they’ve tried the concoction and would do so again. Of note, 17% of respondents cited trying beverages infused with tetrahydrocannabinol (THC), the psycho-active ingredient in marijuana. The CBD and THC-infused beverage markets in the U.S. are fragmented among small producers, as large beverage and cannabis companies await clarity from the FDA regarding regulations.

Cannabis market tracker BDSA forecasts CBD-infused beverage sales in the U.S. to account for about 9% of a total CBD-product market of $21.6 billion in 2026, up from about 3% of the $4.1 billion total CBD-product market in 2020.